Gen Z is pushing back against economic challenges through 'disillusionomics,' addressing nearly six-figure debts by transforming their lives into an extensive array of income sources

Gen Z Faces a New Economic Reality

What are the consequences when an entire generation grows up expecting financial stability that never arrives? Generation Z might look to millennials for answers, as the aftermath of the 2008 financial crisis and the slow recovery that followed left many with changed lives and unfulfilled ambitions.

Now, as the oldest members of Gen Z near their thirties, their financial behaviors are diverging sharply from those of millennials, who came of age during the crisis. Born into a period of economic transformation, Gen Z is forging its own path.

The Rise of the "Doom Spender"

Gen Z has earned the nickname “doom spenders” for their willingness to spend large sums on experiences like concerts and travel, fueling the “YOLO economy” that took off in 2021. On average, Gen Z carries $94,101 in personal debt—far surpassing the debt loads of millennials and Gen X.

While some might dismiss this as youthful financial recklessness, Gen Z’s approach to money reflects both a rejection of traditional advice and a deep internalization of the idea that everything can be commodified. Economist and author Alice Lassman, herself a member of Gen Z, has described her generation’s mindset as “disillusionomics”—a way to cope with an unpredictable economic future after her own experiences with rescinded job offers and shifting opportunities.

Understanding "Disillusionomics"

Lassman introduced her concept in an article for the Guardian, explaining that she coined the term to capture the common thread linking Gen Z’s varied economic behaviors. She believes that much of how society perceives Gen Z is rooted in this underlying sense of economic disillusionment.

Unlike millennials, whose outlook was shaped by entering adulthood during a recession, Gen Z’s skepticism runs deeper. Many are still in school, and research from the Harvard Kennedy School’s Institute of Politics shows that they are even more doubtful about their financial prospects than previous generations.

Lassman notes that the economic system their parents describe simply doesn’t align with Gen Z’s lived reality. Having witnessed constant financial instability since childhood, Gen Z has absorbed the disconnect between economic promises and outcomes more profoundly than is often recognized.

Fading Confidence in Traditional Milestones

For Gen Z, traditional markers of security—owning a home, starting a family, retiring comfortably—seem increasingly out of reach. The unemployment rate for those aged 16 to 24 reached 10.8% last year, compared to a national average of 4.3%. A third of Gen Z believes they may never own a home, and many are reconsidering having children. This widespread disillusionment helps explain their growing distrust of institutions like government, media, and business.

Adapting to a Commoditized World

Lassman’s theory overlaps with the concept of “economic nihilism,” popularized by entrepreneur Demetri Kofinas and writer Kyla Scanlon. She observes that Gen Z has fully embraced the commodification of everything, from “house hacking” (renting out extra rooms for income) to viewing content creation as a source of passive revenue. With traditional paths to prosperity narrowing, Gen Z is constantly seeking new ways to diversify their income, even if it means taking on greater risks.

As Scanlon wrote in the Wall Street Journal, “When people start treating the economy like a game, it’s a sign that the traditional ways of winning no longer feel real.”

Spending Habits and Value Consciousness

Gen Z is more likely to use buy-now-pay-later services than traditional credit cards, allowing them greater flexibility as they navigate a commodified world. Despite this, they are generally spending less and making different purchasing choices compared to older generations.

Kelly Pedersen, PwC’s global retail leader, noted that Gen Z’s spending actually dropped by 10% to 12% during the recent holiday season—a surprising trend given their rising incomes. This generation is highly value-driven, often opting for affordable “dupes” over luxury brands and prioritizing sustainability and durability in their purchases.

Challenges and Coping Strategies

Lassman points out that Gen Z’s frustration sometimes manifests in rebellious behaviors, such as increased shoplifting—both in stores and online—justified by a belief that large corporations can absorb the losses. Others adopt a zero-sum mentality, viewing resources and job opportunities as increasingly scarce.

Many in Gen Z also struggle with feelings of inadequacy and “money dysmorphia,” always feeling behind financially. Short-lived trends and coping mechanisms, like “treat culture” and quick-return investments, serve as both material and psychological strategies for surviving in a world where affordability is a constant concern.

“There’s a sense that time has been lost, and anxiety about the future is widespread,” Lassman explains, noting the political, social, and economic volatility that shapes Gen Z’s worldview.

Redefining Success in a Volatile Economy

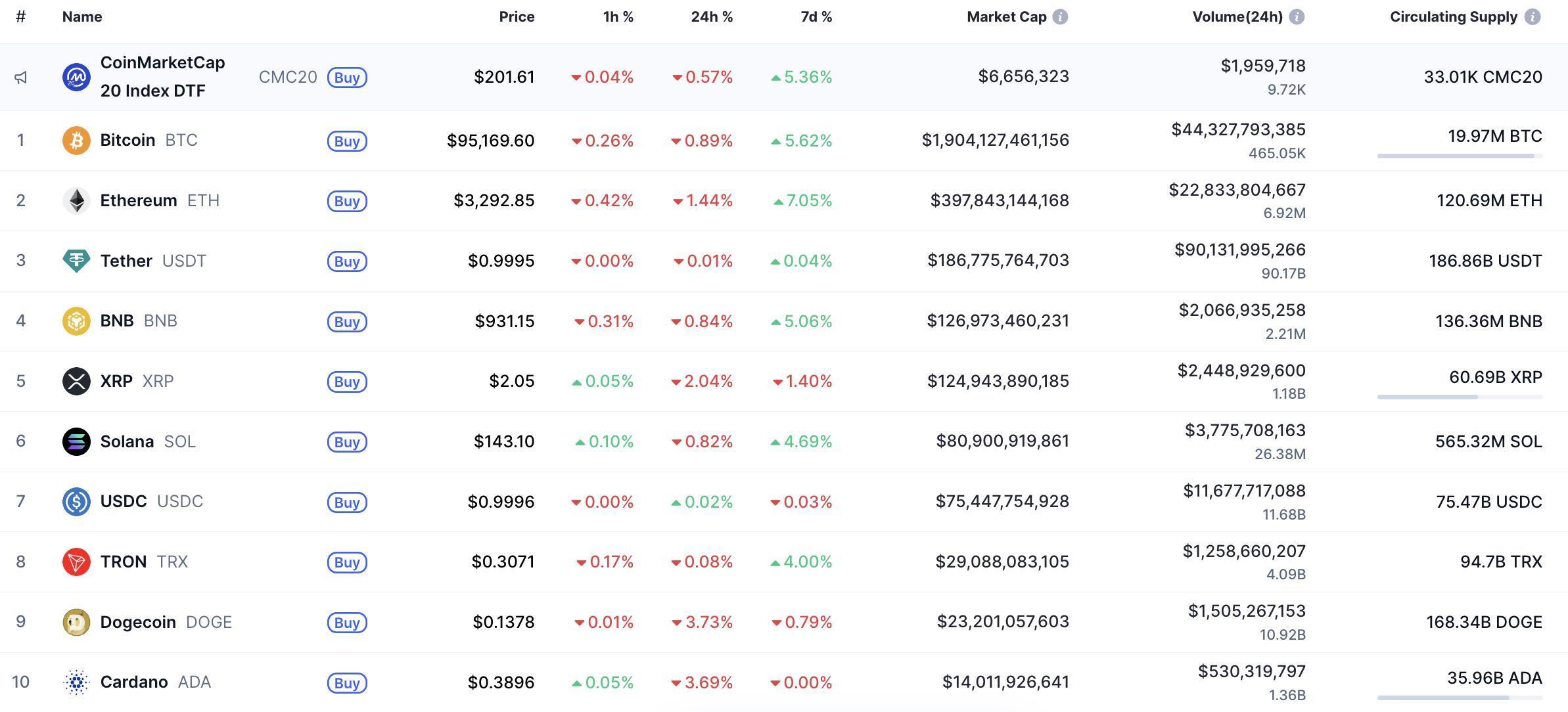

Some Gen Zers have responded to the unpredictability of the economy by embracing financial “games”—from prediction markets to sports betting and cryptocurrency—as alternative ways to build their futures. Lassman believes that much of Gen Z’s economic behavior is reactive rather than planned, as they carve out new income streams and redefine what financial success looks like.

This article was originally published on Fortune.com.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP Cyclical Pattern Points to Subsequent Price Expansion

Monero (XMR) Price Analysis for January 16

Cardano Rockets 5,310% in Futures Activity as Markets Await Next Move