As 2026 approaches, Bitcoin is facing challenges in finding a clear direction. There’s a significant division of opinions among influential global fund managers, crypto companies, and on-chain analysis platforms. While some foresee new records on the horizon, others believe that the bear market hasn’t concluded yet. Bitcoin’s decline at the end of 2025 has led to reconsideration of the classic four-year cycle narratives. This complex scenario heightens the sensitivities surrounding investor expectations for 2026.

Bitcoin Navigates Uncertain Terrain as 2026 Approaches

Institutional Optimism: Are New Highs on the Horizon?

In the bull camp, prominent names like VanEck, Bitwise, Grayscale, Bernstein, and Coinbase stand firm. They suggest that Bitcoin might witness a strong recovery in 2026, potentially soaring to new all-time highs around $150,000. Despite Bitcoin concluding 2025 in red, Bitwise and VanEck emphasize the possibility that the four-year cycle theory may no longer hold relevance.

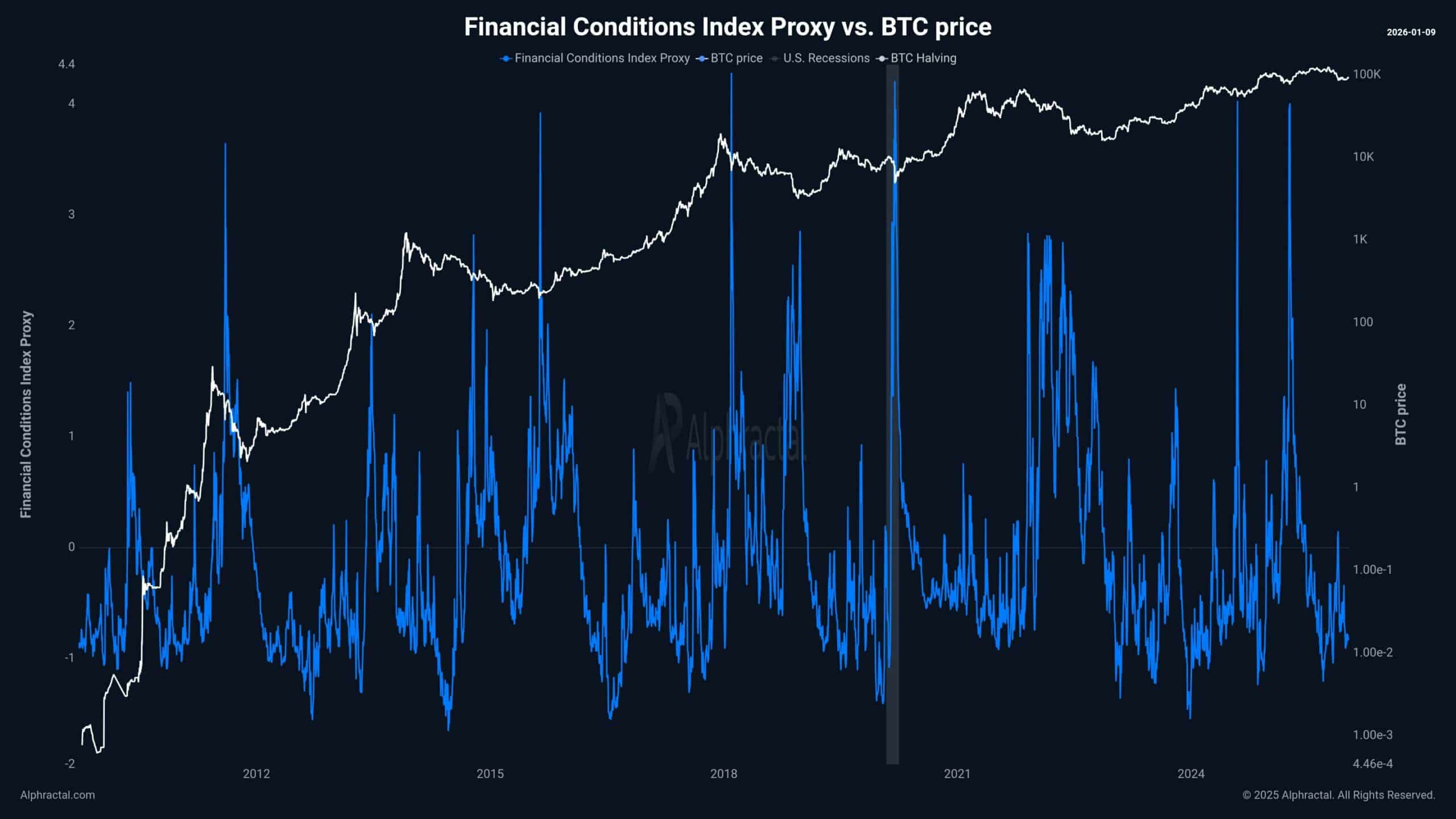

This perspective suggests that Bitcoin may now move more in sync with the US stock markets. Particularly, a positive trend in tech stocks could elevate BTC prices. In such a scenario, a traditional severe bear market may not occur, or its impact could be limited. Matthew Sigel, Head of Digital Asset Research at VanEck, argues that the Relative Unrealized Profit (RUP) indicator is not yet at dangerous levels and the market cycle hasn’t peaked.

The Bear Camp and On-Chain s

However, not everyone shares this optimism. Jurrien Timmer, Director of Global Macro at Fidelity, is cautious about the idea that bear markets have ended. According to Timmer, a critical threshold for Bitcoin is the $65,000 level, with a risk of retreating to $45,000 if this level is breached. He suggests Bitcoin might trade sideways for a year, gaining strength for another upward attempt.

On-chain data also supports this cautious stance. According to CryptoQuant data, Bitcoin dipped below its one-year moving average in November 2025, entering a bear market. Ki Young Ju, the firm’s founder, highlights that the slowdown in the Realized Market Value (Realized Cap) indicator is reminiscent of past bear periods. This is seen as a potential risk that could weaken optimistic predictions for 2026.

Additionally, the slowing inflow into spot Bitcoin ETFs in the US further complicates market uncertainty. The recent decrease in net inflows in ETFs suggests that institutional demand remains cautious in the short term, which can pressure prices.

In conclusion, Bitcoin’s journey into 2026 seems more dependent on macroeconomic conditions and institutional behaviors than classic cycles. On one side are strong players believing in new highs, while on-chain data warns of caution. This setup indicates that high volatility may be inevitable in the coming period, and investors shouldn’t rely on a single scenario.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin – Spot inflows hit 6-week low, but is there good news next?

As Meta Postpones Launch of New Ray-Ban Smart Glasses, Is It Time to Buy, Sell, or Hold META Shares?

SpaceX receives authorization from the FCC to deploy an additional 7,500 Starlink satellites

Ranger ICO Pulls $86M on Solana, Far Exceeding $6M Target