The ongoing market cycle is raising some important questions around L1s.

On a fundamental level, developers have become a key asset for chains, as “scalability” is no longer optional. Put simply, as blockchains move towards real-world utility, prioritizing network security is just as critical.

Looking at Ethereum’s [ETH] 2026 roadmap, it’s clear developers are heading in this direction, from the Fusaka upgrade to the recent BPO fork. Notably, on-chain usage is already starting to reflect the impact.

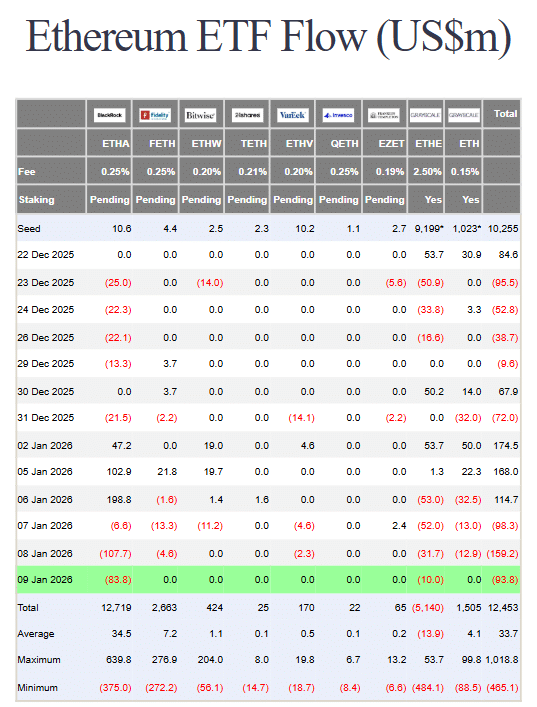

That being said, institutions aren’t fully buying into the story just yet though.

Less than two weeks into 2026, BlackRock’s ETHA ETF has seen $200 million in net outflows. Over the same period, Ethereum’s Coinbase Premium Index (CPI) has pulled back sharply into negative territory.

Notably, this disconnect between improving on-chain activity and soft demand now raises a key question – Is this setup another undervaluation opportunity, or is ETH’s “fundamentals-driven narrative” being overstated?

As conditions hold, Ethereum looks like it’s about to find an answer.

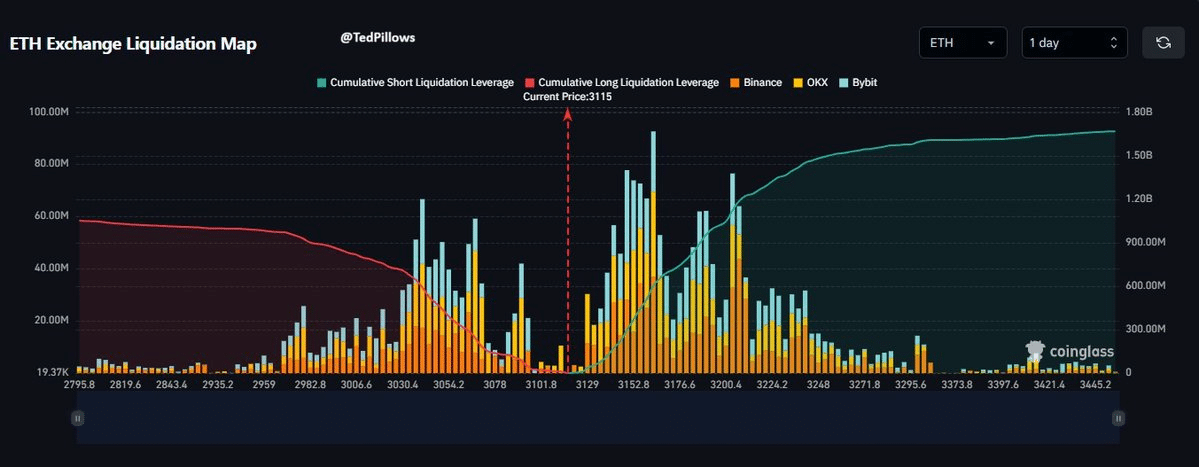

Ethereum faces massive liquidation wall on both sides

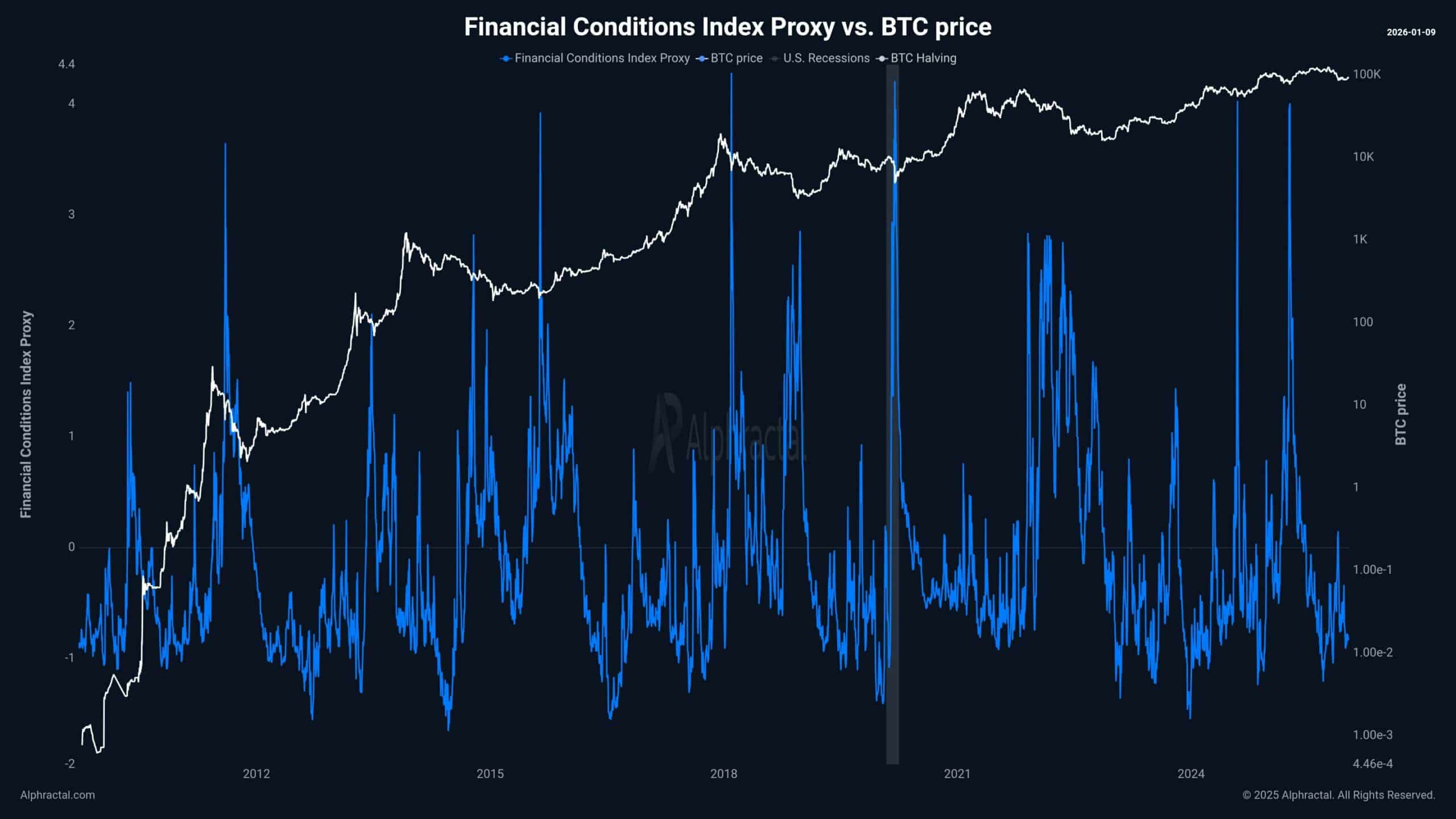

Risk assets are caught in a volatility loop.

Notably, Ethereum is no exception. From a technical standpoint, ETH has been trading in a tight range for around seven weeks – A setup that often creates a liquidity cluster as traders position for a directional move.

Against this backdrop, the question is whether Ethereum’s growing on-chain activity can trigger a breakout. If not, the $1.05 billion ETH wall holding longs stays exposed, keeping risk front and center for traders.

However, any breakdown will be more than just a routine pullback.

Instead, Ethereum’s inability to capture liquidity will highlight that until institutional bids return, a breakout will remain unlikely. However, the bigger question will become – Why won’t the institutional bid come back?

If this persists, Ethereum’s “fundamentals-driven” narrative will come under growing scrutiny, with any breakdown revealing “hype,” rather than a genuine undervaluation opportunity, despite strong on-chain activity.

Final Thoughts

- Ethereum’s market faces a $1 billion+ liquidation wall as on-chain growth meets weak institutional demand.

- This setup is likely testing whether its fundamentals story holds or hype dominates.