Cosmos price today trades near $2.60 as the network approaches a January 15 deadline for tokenomics reform proposals that could fundamentally reshape ATOM’s value accrual model. The token has gained 18.13 percent over the past week, dramatically outperforming the broader market as traders position ahead of governance votes expected shortly after the deadline.

Cosmos Labs issued a Request for Proposals to redesign ATOM’s economic model, targeting inflation rates currently running between 7 and 20 percent. The initiative represents the most significant structural change since the Inter-Blockchain Communication protocol launch.

Research firms are racing to submit frameworks that could cut ATOM’s effective inflation by up to 60 percent. The proposed shift would transition from dilutive staking rewards toward fee capture from major chains including dYdX and Cronos that rely on Cosmos infrastructure.

Institutional observers are watching closely. Delphi Digital maintains a $4.50 price target over the next six months, contingent on successful implementation. The firm argues that aligning ATOM’s tokenomics with SDK adoption rather than staking yield would address chronic value-accrual challenges that have plagued the token since its 2022 peak.

The market cap currently sits at $1.26 billion with 24-hour volume reaching $96.31 million. Trading activity has accelerated as the deadline approaches, with participants betting that governance approval could trigger a rerating of ATOM’s fundamental valuation.

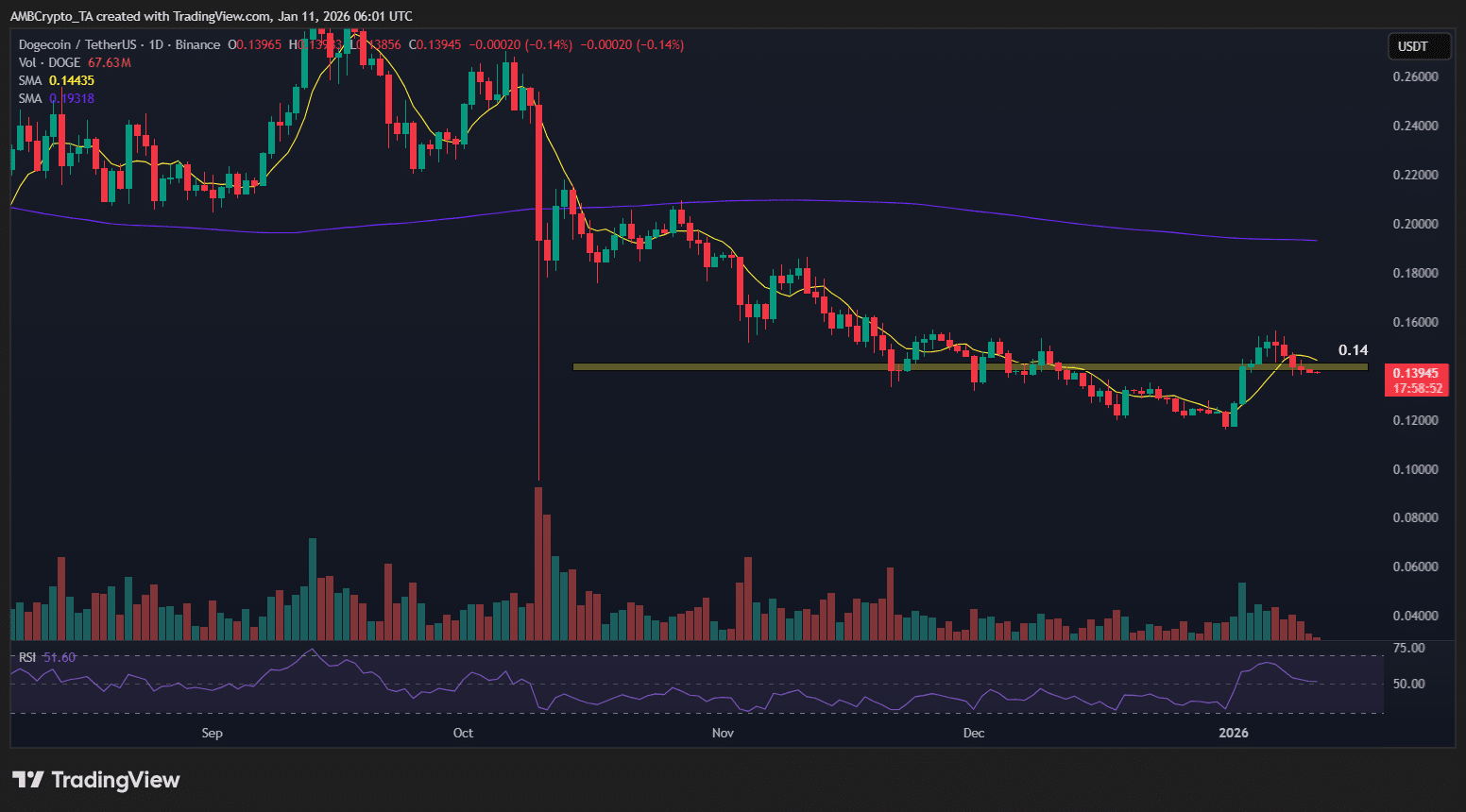

ATOM Price Action (Source: TradingView)

ATOM Price Action (Source: TradingView)

Cosmos price today trades above both the Supertrend indicator at $2.206 and Parabolic SAR at $2.200, confirming a shift in momentum after testing support near $1.90 in late December. The rally marks the strongest weekly performance since October, when the token briefly tested resistance above $5.00.

The daily chart shows ATOM breaking above a consolidation range that compressed volatility throughout December. Price now approaches the descending trendline that has capped rallies since August highs around $5.00. The trendline currently sits near $2.80, marking the first major resistance test.

Key levels show a bullish structure forming:

- Immediate support: $2.40-$2.50

- Supertrend/SAR floor: $2.20

- Critical support: $2.00

- First resistance: $2.80 (trendline)

- Major resistance: $3.20-$3.40

The break above $2.20 flipped both the Supertrend and SAR indicators bullish, typically a signal that momentum has shifted from sellers to buyers. Volume during the rally has been consistent, showing participation rather than a thin breakout that could reverse quickly.

ATOM 30-Min Chart (Source: TradingView)

ATOM 30-Min Chart (Source: TradingView)

Shorter timeframes show ATOM consolidating inside a rising channel between $2.55 and $2.70. The RSI reads 51.28, neutral after reaching overbought levels above 70 during the initial breakout. The MACD shows slight bearish divergence at negative 0.003, suggesting momentum is pausing rather than extending immediately.

The 30-minute chart reveals price testing the upper boundary of the channel near $2.65. A breakout above this level with volume would confirm continuation toward the daily trendline resistance at $2.80. Failure to hold the channel would expose $2.50 support, where buyers have stepped in consistently over the past two sessions.

THORChain’s public beta enabled direct ATOM swaps with Bitcoin, Ethereum, and other assets via IBC, processing $42.7 million in volume during its first 24 hours. The integration bypasses wrapped assets, exposing ATOM to THORChain’s broader liquidity network.

Developers are finalizing IBC connections to Solana and Ethereum Layer 2 networks, with completion targeted for Q1 2026. The utility expansion provides a fundamental narrative beyond tokenomics reform, showing that Cosmos infrastructure continues to gain adoption despite ATOM’s 95.8 percent decline from its $44.45 all-time high.

The next 10 days are decisive. If tokenomics proposals meet community expectations and governance votes signal approval, ATOM could rally toward Delphi Digital’s $4.50 target. Reclaiming $2.80 and breaking the descending trendline would open a path toward $3.20, with further upside to $3.80 if momentum sustains.

If proposals disappoint or governance stalls, the rally becomes a sell-the-news event. Losing $2.20 would invalidate the bullish structure and expose $2.00 support. A breakdown below that level targets $1.80-$1.70.

Breaking $2.80 confirms the trend shift. Losing $2.20 invalidates the breakout.