Warren Buffett is a household name, but Greg Abel remains largely unfamiliar to most people. Here’s what Berkshire’s incoming CEO has revealed about his background.

Meet Greg Abel: Berkshire Hathaway’s New Leader

-

Warren Buffett is a household name, but his successor at Berkshire Hathaway, Greg Abel, remains largely unfamiliar to the public.

-

Business Insider has examined Abel’s previous statements to shed light on his character and leadership style.

-

Abel is an avid reader, actively coaches youth sports, and closely follows Buffett’s investment philosophy.

Warren Buffett is celebrated worldwide for his investment acumen, down-to-earth advice, immense wealth, modest lifestyle, and even his fondness for fast food.

In contrast, Greg Abel, who assumed the role of CEO at Berkshire Hathaway on January 1, is virtually unknown outside financial circles. While Buffett has mingled with celebrities and appeared on television, Abel’s name is rarely recognized beyond Wall Street.

Abel has kept a low profile, typically reserving his remarks for Berkshire’s annual shareholder gatherings. Business Insider analyzed these sessions to better understand Abel’s approach, revealing a private individual deeply committed to Buffett’s principles and unlikely to make drastic changes.

Collaborative Leadership

Abel became part of Berkshire in 2000 after Buffett acquired MidAmerican Energy. He advanced from leading that subsidiary to being named vice-chairman of Berkshire’s non-insurance operations in 2018, and began sharing the stage with Buffett starting in 2020.

Before last year, Abel primarily focused on discussing Berkshire’s subsidiaries, such as Berkshire Hathaway Energy and BNSF Railway, and addressed major issues like the transition to clean energy.

He often echoes Buffett’s sentiments, praises his team, upholds Berkshire’s unique corporate culture, and highlights the company’s strengths.

Abel has described Berkshire as an extraordinary organization, emphasizing its partnership with shareholders and the owner-like mindset of its business managers, insisting that this approach will remain unchanged.

Continuing Buffett’s Legacy

Abel has pledged to follow Buffett’s investment strategies, focusing on areas where he has expertise, viewing every stock purchase as a long-term business investment, assessing companies based on their future value and risks, and maintaining patience and discipline.

At the 2024 annual meeting, Abel reassured shareholders that Berkshire’s capital allocation principles would remain intact.

Like Buffett, Abel has stressed the importance of being prepared to act during turbulent times, noting that significant effort goes into staying ready for opportunities and that patience is key to success.

Abel, much like Buffett who has called himself Berkshire’s “chief risk officer,” has emphasized his commitment to safeguarding the company’s reputation, responsibly managing shareholders’ assets, and maintaining a strong balance sheet to ensure resilience in any environment.

Following the example of Buffett and his late partner Charlie Munger, Abel has acknowledged and learned from mistakes, such as BNSF’s overuse of tribal lands and PacifiCorp’s wildfire response strategy.

Abel has noted that, compared to Buffett’s famously hands-off approach, his own management style is more involved, but he hopes this will be a positive difference.

Personal Insights

Greg Abel’s new role comes with a $25 million annual salary.

Abel has revealed little about his private life. However, he did share last year that he hopes to be remembered as both a devoted father and a coach.

He elaborated that this applies not only to his family and friends, but also to the young athletes he mentors in sports like hockey and baseball.

Abel has discussed his daily habits, which include extensive reading about Berkshire’s businesses, their industries, competitors, risks, and potential disruptions.

He also emphasizes the importance of hard work, stating that a strong work ethic and a desire to contribute are key ingredients for success.

Berkshire Hathaway’s Future

Abel is acutely aware of the weight of leading a company valued at $1 trillion.

He expressed deep gratitude and humility at the opportunity to succeed Buffett as CEO and to have worked with him and other Berkshire leaders for a quarter-century.

Reflecting Buffett’s famous remark that he “tap dances to work” out of sheer enjoyment, Abel said that finding something as special as Berkshire makes every day fulfilling.

Abel has positioned himself as the ideal successor to carry on the legacy of Buffett and Munger, ensuring Berkshire’s continued prosperity.

While Abel has so far allowed Buffett to remain at center stage, he now steps into the spotlight himself, and all attention is now on him. Shareholders may soon get a closer look at the man guiding Berkshire’s next era.

For the full story, read the original article on Business Insider.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

A $400,000 reward following Maduro's arrest is drawing attention to prediction markets

Rolls race: Germany’s plan to court the UK’s engineering icon

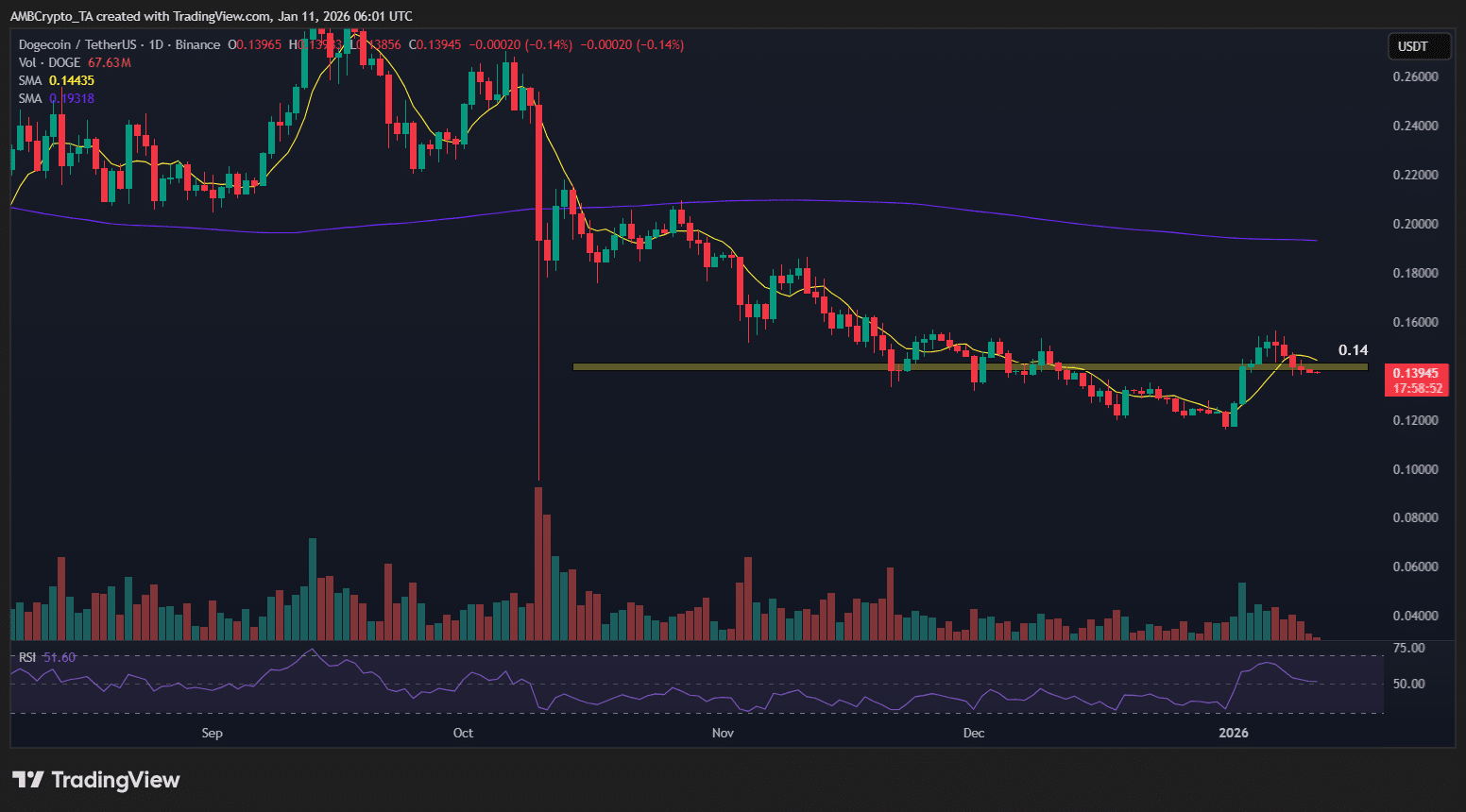

Dogecoin’s ETF buzz wears off – Should DOGE traders brace for $0.12?

Iran’s Covert Cryptocurrency Transfers Bypass Sanctions