In their latest press release, Nasdaq and the CME Group announced the launch of the Nasdaq CME Crypto Index. This index focuses on top digital assets such as Bitcoin, Ethereum, and Chainlink.

For LINK, this update comes at a technically delicate time. And, it could affect the altcoin’s directional move in the near future.

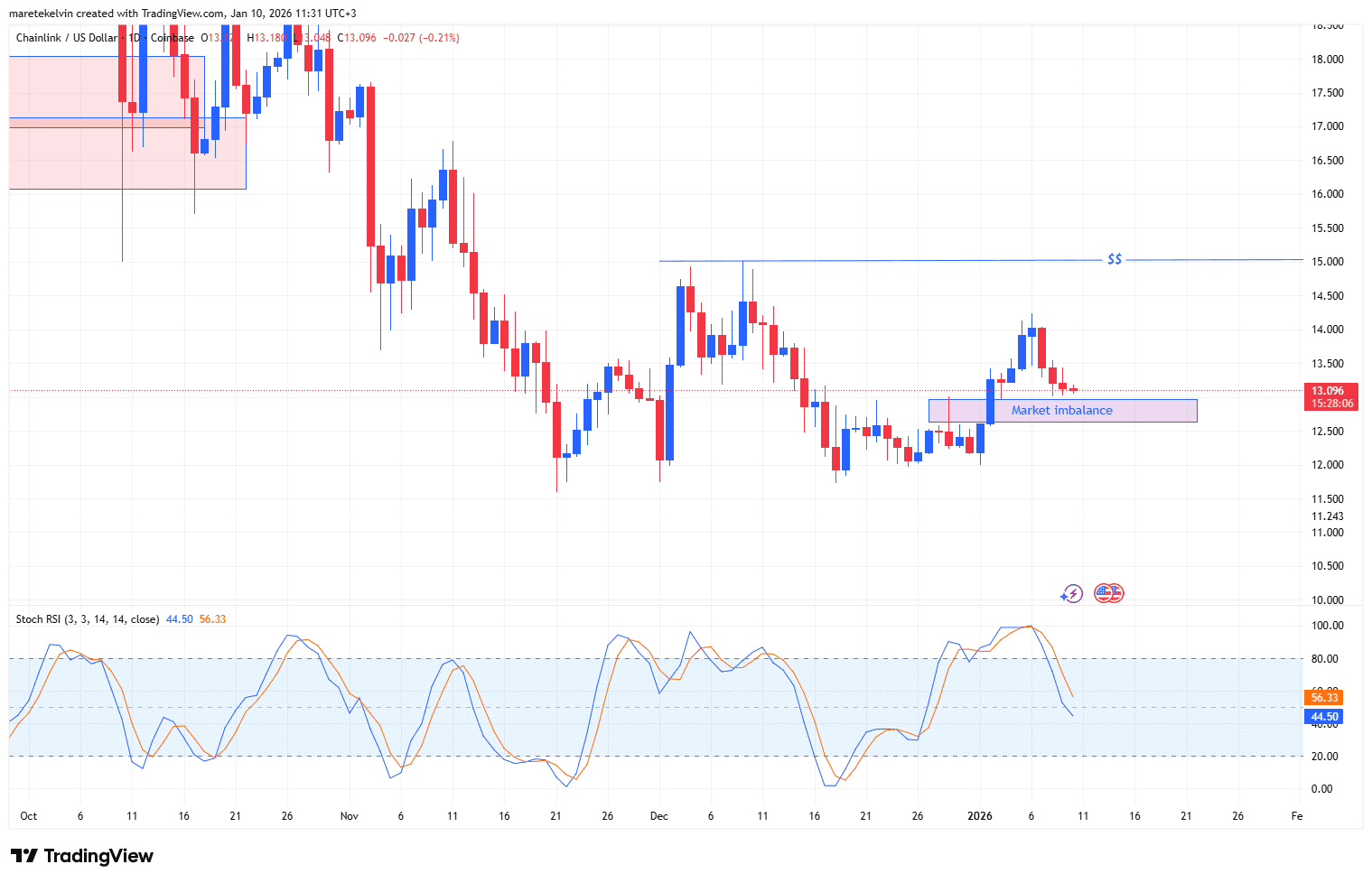

How to approach a key market gap

At the time of writing, the altcoin’s price was retracing into a key market imbalance zone around $13. This price level has acted as a launchpad during LINK’s previous rallies.

As the price returned to this zone, selling pressure began to show some exhaustion signs, presenting the market gap as a key imbalance zone for the anticipated reversal. In fact, buyers appeared to be testing the waters rather than rushing in.

That is not all either as momentum indicators seemed to strengthen that case as well. On the charts, the Stochastic RSI was drifting towards the oversold territory – A zone often associated with exhaustion from sellers.

In most cases, when the Stochastic RSI reaches such levels during broader market stability, reversals become increasingly likely.

On-chain metrics’ observations

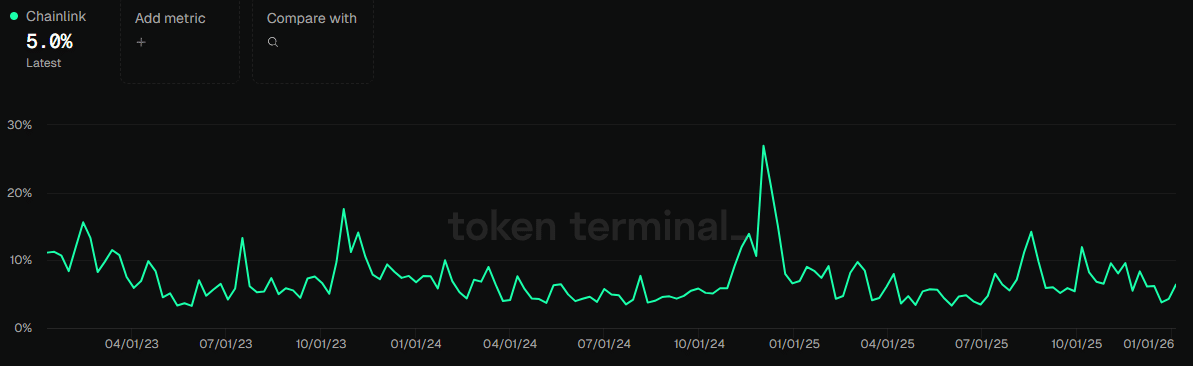

Meanwhile, on-chain activity added another layer to the story.

LINK’s circulating token turnover increased by roughly 5% over the last 24 hours. Usually, a hike in circulating turnover during a retracement phase is a sign of tactical positioning among investors, rather than panic selling.

In LINK’s case, the hike in activity suggested that participants may be preparing for a directional move.

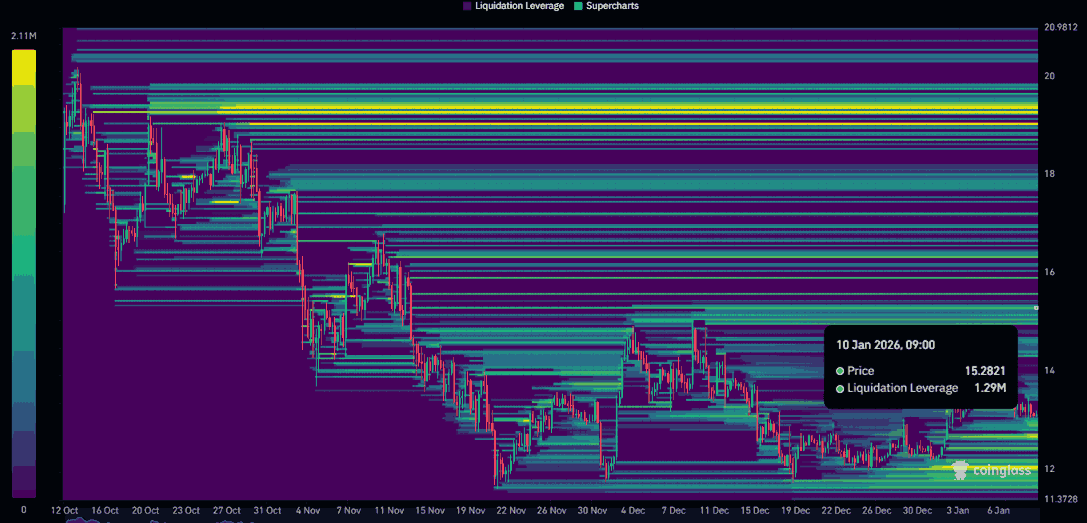

All about the liquidity cluster at $15

AMBCrypto’s analysis of the token’s liquidity data also pointed to a clear short-term target. LINK’s liquidity heatmaps data revealed a notable liquidity cluster worth approximately $1.32 million sitting near the $15-level.

Such clusters tend to act like price magnets. If momentum builds from the $13-zone, that liquidity zone could become the next objective.

Here, the institutional angle cannot be brushed aside either. Nasdaq teaming up with the CME for this index launch places Chainlink right at the heart of regulated finance.

More importantly, LINK sitting in the same basket as Bitcoin and Ethereum changes the narrative. It’s no longer just another experimental altcoin. Instead, it’s starting to look like part of crypto’s core infrastructure.

Even so, the price chart still has the final say. LINK needs to stay above the daily imbalance zone to keep the reversal anticipation alive.

Final Thoughts

- LINK has been stabilizing near $13 as institutional headlines arrived at a technically sensitive imbalance zone.

- Significant liquidity near $15 cements it a key target if momentum confirms a reversal.