As U.S. debt exceeds $38 trillion, the increasing volume of corporate bonds poses an escalating risk to Treasury issuance

Rising Corporate Bond Issuance May Push Interest Rates Higher

As the U.S. Treasury seeks to maintain investor demand for its growing debt offerings, increased competition from corporations issuing their own bonds could lead to higher interest rates, according to Torsten Slok, Chief Economist at Apollo.

In a recent analysis, Slok highlighted that Wall Street projects investment-grade bond issuance could reach up to $2.25 trillion this year.

This surge is fueled in part by the rapid expansion of artificial intelligence, prompting major tech companies and related businesses to seek funding for large-scale investments in data centers and infrastructure through the bond market.

“The notable uptick in bond sales by hyperscalers raises the question of who will step in as the next buyer of investment-grade securities,” Slok noted. “Will these purchases come at the expense of Treasuries, thereby driving up rates? Or could they reduce demand for mortgage-backed securities, resulting in wider mortgage spreads?”

With the national debt now exceeding $38 trillion, the federal government has already borrowed $601 billion in the first quarter of the 2026 fiscal year, which began in October 2025, according to the latest Congressional Budget Office data.

This figure is $110 billion lower than the deficit recorded during the same period last year, as increased tariff revenues have temporarily outpaced government spending. However, the Supreme Court may soon overturn former President Donald Trump’s global tariffs, and the upcoming tax season is expected to bring a wave of refunds due to new tax reductions under the One Big Beautiful Bill Act.

Additionally, Trump has pledged to raise annual defense spending to $1.5 trillion from the current $1 trillion, which could further widen the federal deficit.

Despite a series of interest rate cuts by the Federal Reserve last fall, Treasury yields have remained near their early September levels, indicating that the government is unlikely to see much relief from the high cost of servicing its debt, a key factor in the growing deficit.

“Ultimately, the large volume of fixed-income securities entering the market this year is expected to exert upward pressure on both interest rates and credit spreads as we move through 2026,” Slok concluded.

Ensuring Investor Demand and the Risk of Fiscal Dominance

To maintain robust demand from bond buyers, Treasury yields must remain competitive compared to other investment options. If the government fails to attract sufficient investors, it risks entering a situation known as fiscal dominance, where the central bank is compelled to finance expanding deficits.

This scenario was recently highlighted by former Treasury Secretary Janet Yellen during a panel discussion hosted by the American Economic Association.

“The conditions for fiscal dominance are clearly intensifying,” Yellen remarked, pointing out that the national debt is projected to climb toward 150% of GDP over the next thirty years.

Shifting Ownership of U.S. Debt

Over the past decade, the makeup of U.S. debt holders has changed dramatically, with a growing share now held by profit-driven private investors rather than foreign governments, according to Geng Ngarmboonanant, a managing director at JPMorgan and former deputy chief of staff to Yellen at the Treasury.

Ngarmboonanant explained in a recent op-ed that foreign governments once held over 40% of Treasury bonds in the early 2010s, a significant increase from just above 10% in the mid-1990s. This stable investor base allowed the U.S. to borrow at unusually low rates.

“Those days of easy borrowing are behind us,” he cautioned. “Foreign governments now account for less than 15% of the Treasury market.”

This article was first published on Fortune.com.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

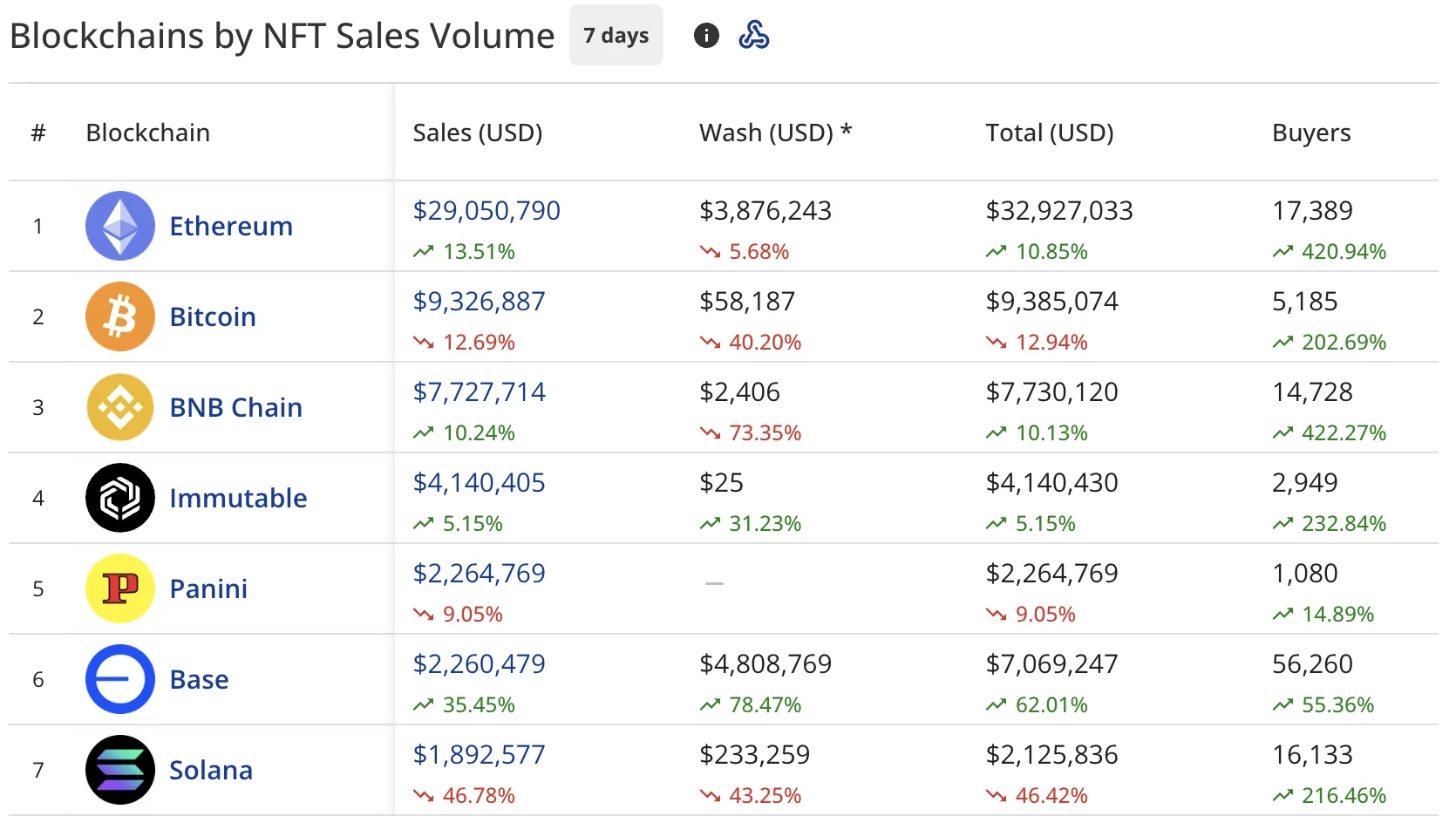

NFT buyers rise 120% despite sales staying flat at $61.5 million

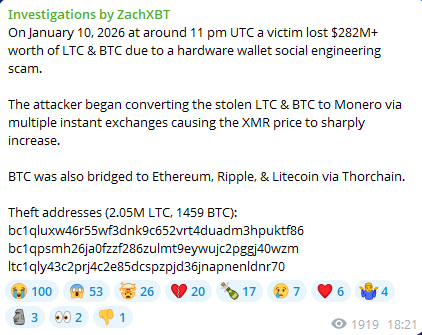

Was Monero’s (XMR) Surge Fueled by a $282M Theft Swap? Chart Says No!

Trump’s renewed attacks on the Fed evoke 1970s inflation fears and global market backlash

Bitcoin Flashes Near-Identical Fractal Before The 2021 Bull Run Started