Financial Experts Discuss Recent Updates in Retirement Guidance. Here’s What You Should Be Aware Of

Financial Advisors Rethink Retirement Strategies Amid Market Uncertainty

Recent shifts in the economy and unpredictable market conditions have prompted a significant number of financial advisors to update their retirement guidance for clients.

Image credit: Luis Alvarez/Getty Images

Main Insights

- According to new research from the Alliance for Lifetime Income, about two-thirds of financial advisors are revising their retirement investment recommendations in response to economic volatility and market instability.

- These changes are largely driven by concerns over inflation, uncertainties surrounding Social Security and Medicare, and the rising cost of living.

- Advisors are urging clients to review their withdrawal plans and consider assets that may not have previously been part of their portfolios.

With the current economic landscape in flux, financial professionals are adapting their approaches to better support clients making retirement decisions. The Alliance for Lifetime Income, in collaboration with LIMRA, found that a majority of advisors are modifying their advice to address these new challenges.

Certified financial planner Nathan Sebesta explains, “The surge in inflation, unpredictable changes to Social Security and Medicare, and ongoing concerns about living expenses have led us to rethink both our conversations and the strategies we suggest to clients.”

Advisors now recommend that retirees carefully evaluate their withdrawal methods and consider ways to cushion against market swings. Sebesta has even suggested that some clients explore phased retirement or part-time work to help maintain financial stability during uncertain times.

“For many, we’re helping to completely reimagine what retirement could look like,” Sebesta adds.

Addressing Sequence Risk in Retirement Planning

Sebesta also notes an increased focus on building cash reserves and reassessing investment allocations to help minimize sequence risk—the risk that the order and timing of withdrawals can negatively affect overall returns. When retirees begin drawing down their savings, especially during market downturns, the lack of new gains can amplify losses.

While sequence risk often comes down to timing and luck, advisors stress the importance of being mindful of this factor when planning for retirement. Those who rely solely on their investment portfolios may be especially vulnerable during bear markets, which could force them to reconsider their retirement plans.

Given the unpredictable nature of retirement savings, certified financial planner Scott Bishop emphasizes that there is no universal solution. He advises clients to clarify two key figures: how much they need to spend and how much they want to spend in retirement. Without this clarity, setting a fixed withdrawal rate is not effective.

Using Diverse Assets to Manage Market Fluctuations

Bishop works with clients to establish “safe buckets”—accounts holding one to three years’ worth of income in cash or highly liquid assets, such as savings accounts or certificates of deposit. This approach helps shield retirees from market volatility.

Sebesta has observed a growing interest in guaranteed income products like annuities, as well as strategies to improve tax efficiency, such as utilizing tax-deferred accounts. Flexible spending accounts (FSAs) are also gaining popularity for covering healthcare expenses with pre-tax dollars.

Bishop is also exploring additional options to better align with his clients’ retirement goals. “I’m considering alternatives like private credit to boost yields beyond what traditional bonds offer, and incorporating private real estate and private equity for greater diversification and potential for higher returns and income compared to stocks,” he says.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

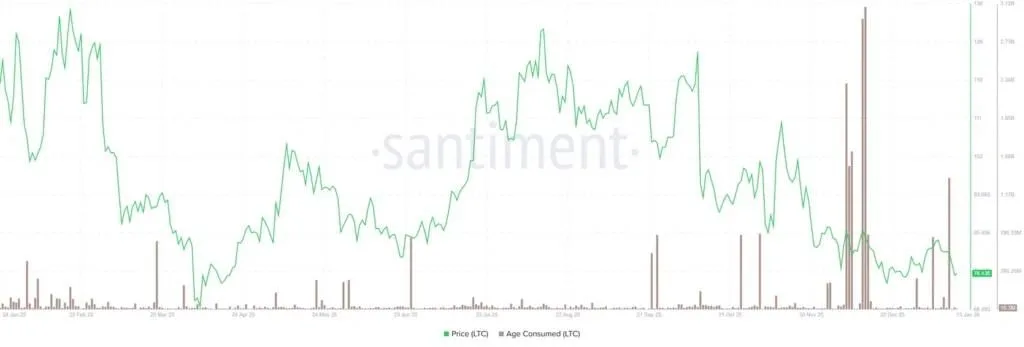

Litecoin Price Prediction: Will LTC Hold Key $72 Support?

Analysts Bullish On BlockDAG Hitting $1 in 2026 – Why It’s The Best Crypto To Buy Before Launch

FAA de EEUU advierte a aerolíneas sobre posibles acciones militares en Centroamérica y Sudamérica

Trump administration urges tech firms to purchase $15 billion in power plants they might never operate