Microsoft Turns 50, But Its True Growth Cycle Is Just Beginning—Goldman Sachs Re-Initiates Coverage: AI Is a "Cross-50-Year" Business

On January 11, 2026, Goldman Sachs resumed coverage of Microsoft, giving it a Buy rating and a 12-month target price of $655, implying 37% upside potentialcompared to the current stock price.

In Goldman Sachs’ view, even in the context of Microsoft’s 50-year history, the current moment remains a“discovery value” point in time.

There’s only one reason:AI.

This is not a short-term earnings-driven report, but astudy of Microsoft’s “structural AI compounding” from a 5–10 year perspective.

1. The Market’s Biggest Misunderstanding: Treating Microsoft's AI as Just Azure

The current market debate about Microsoft focuses on two issues:

Huge Capex, but slowing Azure growth

Can AI investments really translate into profits, or are they just a “burn rate competition”?

Goldman Sachs’ view is clear:

You can’t understand Microsoft using the linear framework of “Capex → Azure growth.”

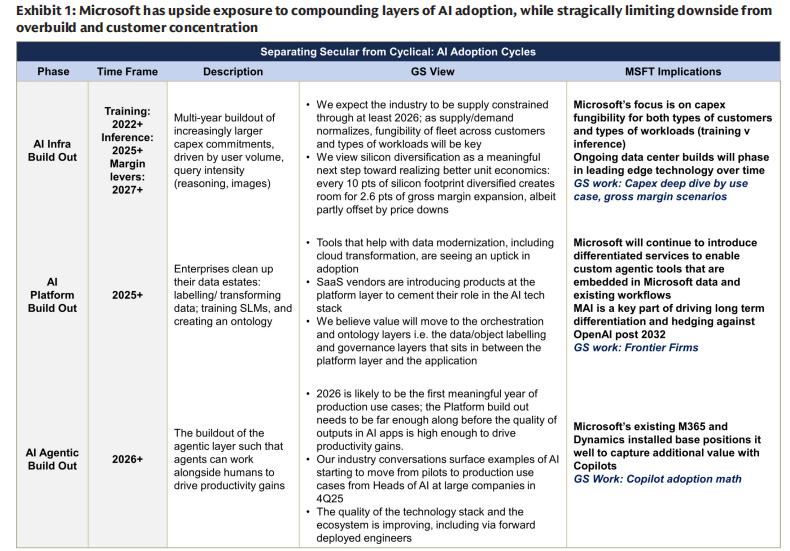

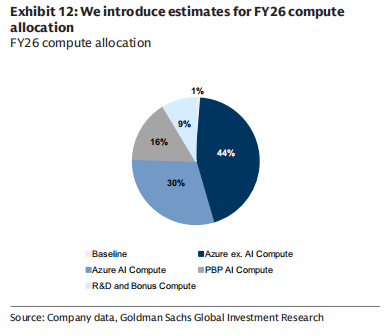

Microsoft’s AI investments are not a single-point bet, but aredistributed across four directions:

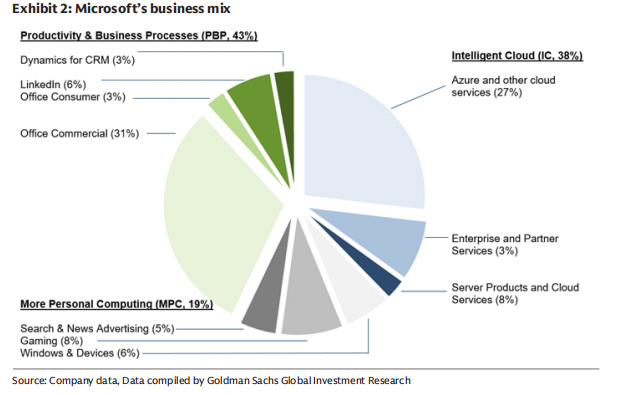

Azure AI (direct cloud monetization)

First-party applications (Copilot / 365)

Internal AI (Microsoft AI / MAI)

Maintenance computing power (legacy businesses)

What does this mean?

Between “short-term certainty” and “long-term moat,” Microsoft has proactively chosen the latter.

2. Microsoft’s True Core Advantage: Not the Model, But the “Three-in-One”

Goldman Sachs repeatedly emphasizes that Microsoft’s core competitiveness in the AI era is not “having the strongest model,” but rather:

Vertical integration of infrastructure (Infra) + platform (Platform) + application (App)

This advantage is further amplified in the AI era.

1️⃣ In the Infrastructure Layer (Infra)

Microsoft isone of the world’s largest AI infrastructure providers in terms of computing power

With AI demand, Azure is not just the cloud but aglobally distributed inference-first computing network

Microsoft intentionally reduces reliance on “training supercomputers,” shifting toward higher ROI inference workloads

2️⃣ In the Platform Layer

Foundry: allows enterprises to flexibly call upon different models such as OpenAI, Anthropic, and MAI on Azure

Essentially:the “control plane” for AI

Microsoft is not betting on a single model to win but isbetting on the long-term coexistence of multiple models.

3️⃣ In the Application Layer

More than 400 million Microsoft 365 users

Copilot is not just an add-on, it isa new work entry point

Every 10% Copilot penetrationcan bring about 10% incremental growthto the Productivity & Business Processes (PBP) segment

This is the most certain monetization path in AI commercialization.

3. Why is Microsoft’s AI Investment “Downside Risk Limited”?

This is a very key point in this report.

Goldman Sachs offers a very “financialized” explanation:

Microsoft is maximizing the “Sharpe Ratio” of its AI investments

What does this mean in practice?

Upside leverage

Holds about a 27% economic interest in OpenAI

Copilot, Azure, and Agent 365 all benefit simultaneously

Downside hedges

In-house development of MAI reduces dependence on a single model

Multi-GPU / multi-chip / in-house silicon

Data centers are highly “reusable”

This means even if the AI industry path deviates,

it ishard for Microsoft to become a loser.

4. Profit Margin Is the Biggest Variable in the Medium to Long Term

Another market concern is:

Will AI permanently drag down cloud computing profit margins?

Goldman Sachs’ answer is no.

Currently, Azure AI’s gross margin is about 30%, significantly lower than traditional Azure’s 60%+.

But Microsoft management’s goal is very clear:

Within 5–7 years, return AI cloud service gross margins to historical highs

The implementation path includes:

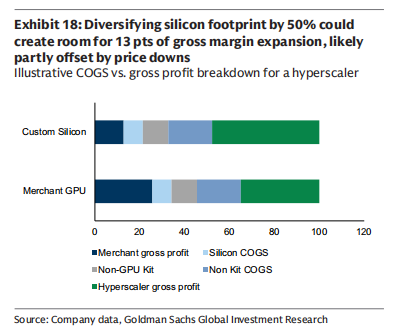

Increase in proportion of in-house chips (potentially >50%)

Continual improvement in inference efficiency

Maintaining GPU useful life at 6 years

Algorithmic efficiency improvements (not just unlimited scaling of computing power)

Goldman Sachs believes:

The gross margin curve for AI cloud is “down first, then up,” rather than structurally deteriorating.

5. The Financial Conclusion: Why Goldman Sachs Dares to Give $655

In Goldman Sachs’ optimistic scenario:

FY2030 EPS could exceed $35

Compared with the current trillion-dollar market cap companies, which havemedian single- to mid-teen growth rates

Microsoft can still maintain a20%+ long-term EPS compound growth rate

This is the core logic behind Goldman Sachs’ $655 target price.

My Understanding:

Goldman Sachs is not packaging Microsoft as “the next OpenAI,”

but instead repeatedly stresses its key characteristics:

Systematic

Patience

Cross-cycle

Microsoft is not in a hurry to “prove whether AI investment is worth it” in a particular year,

what it wants to do is—

make AI the underlying operating system for enterprise software for the next 50 years.

From this perspective,

this is not a stock that needs to be traded based on single-quarter Azure growth,

but rather aclassic asset that accumulates value over time.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Zuckerberg’s Threads starts 2026 ahead of Musk’s X in user count

Bitcoin Sees $1.65B Exodus From Exchanges as Holders Move to Cold Storage

Google Plans to Challenge US Court Decision Declaring Its Search Practices as an Illegal Monopoly