Gold pulls back from all-time peak; upward trend remains due to global tensions and Fed uncertainty

Gold Surges to New Heights Amid Global Uncertainty

Gold (XAU/USD) extended its rally for a third consecutive session on Monday, reaching a new all-time high near $4,600 during Asian trading. This marks the fifth positive session in the last six, as investors continue to seek refuge in safe-haven assets. Ongoing geopolitical tensions—including US involvement in Venezuela, President Donald Trump's threats of military intervention in Iran, the ongoing conflict between Russia and Ukraine, disputes between China and Japan, and the US administration’s interest in Greenland—have all contributed to heightened market anxiety. These factors have collectively dampened risk appetite and fueled increased demand for gold.

At the same time, doubts regarding the independence of the US Federal Reserve have weighed on the US Dollar, pulling it back from its highest level since early December. This shift has further supported gold, which does not yield interest. However, Friday’s US employment figures have tempered expectations for aggressive monetary easing in 2026, limiting gold’s ability to build on its recent momentum. Many traders are choosing to remain cautious and avoid new bullish positions in XAU/USD ahead of this week’s US inflation data.

Key Drivers in the Gold Market

- Earlier this month, following a strike in Venezuela, President Trump announced that the US would temporarily oversee Venezuela’s government to manage a transition. He even referred to himself as Venezuela’s acting president on Truth Social.

- The Wall Street Journal, citing anonymous US officials, reported that Trump is considering punitive measures against Iran in response to its crackdown on mass protests, which has resulted in over 500 deaths. These developments, along with the escalating Russia-Ukraine conflict, continue to stoke geopolitical risks.

- Over the weekend, a Ukrainian drone attack caused a fire at an oil facility in Russia’s Volgograd region. In retaliation, Russia launched a hypersonic Oreshnik missile at the Lviv region, close to EU and NATO borders.

- Separately, China has intensified its dispute with Japan by restricting exports of rare earths and related products, following recent comments from Japan’s Prime Minister regarding Taiwan. This move has further boosted gold to record levels during Monday’s Asian session.

- Federal Reserve Chair Jerome Powell stated that the threat of criminal charges against him stems from the central bank’s commitment to setting interest rates based on what is best for the public, rather than presidential preferences.

- Powell also noted that the outcome of the ongoing investigation will influence future decisions by the central bank. After Friday’s jobs report showed the US unemployment rate dropped to 4.4% in December from 4.6%, traders have scaled back expectations for further rate cuts this year.

- Meanwhile, the latest Non-Farm Payrolls (NFP) report indicated that 50,000 jobs were added last month, falling short of the 60,000 expected and November’s revised figure of 56,000. This data has done little to strengthen the US Dollar, especially amid growing concerns over the Fed’s independence.

- Looking ahead, there are no major US economic releases scheduled for Monday, leaving gold and the dollar susceptible to comments from key Federal Open Market Committee (FOMC) members. The market’s attention remains firmly on this week’s inflation numbers.

Technical Outlook: Gold’s Uptrend Remains Strong Despite Overbought Signals

Technically, gold has been climbing within an upward-sloping channel over the past month, signaling a robust short-term uptrend that favors bullish traders. The price remains above the rising 200-period Simple Moving Average (SMA), reinforcing the positive outlook and offering dynamic support in the $4,325–$4,320 range. The MACD indicator continues to show bullish momentum, with the MACD line above the Signal line and a widening histogram.

The Relative Strength Index (RSI) currently stands at 71.82, indicating overbought conditions that could prompt a period of consolidation near the channel’s upper boundary. Any pullback is likely to find support around $4,365, with the ascending 200 SMA maintaining the broader bullish trend. As long as gold holds above these key support levels, the upward trajectory is expected to persist. A decisive move above channel resistance could pave the way for further gains.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Chevron Gives Green Light to Expand Leviathan Gas Project in the Eastern Mediterranean

Bitcoin Momentum Recovery: The Critical Juncture That Could Spark a Dramatic Rally

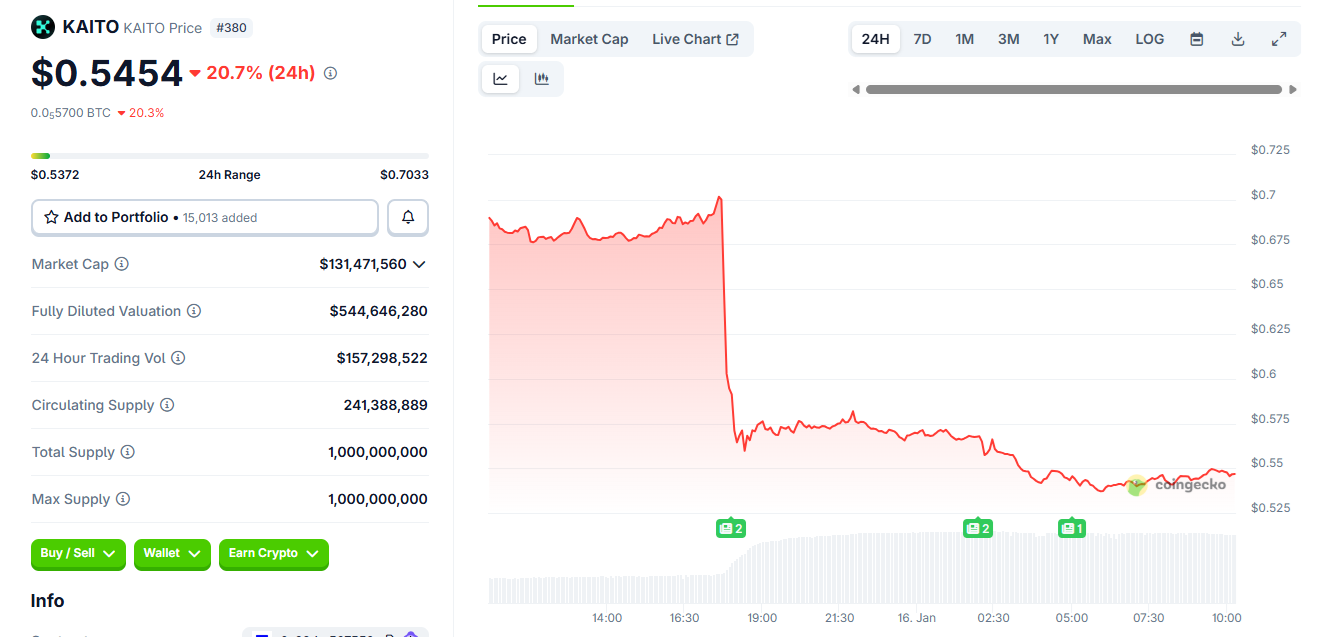

Kaito retires Yaps as token falls near all-time lows

The US Treasury market is experiencing a level of stagnation that is approaching record highs