What Should You Look For in Alphabet’s Q4 2025 Earnings Announcement

Alphabet Inc.: A Tech Giant at the Forefront

Headquartered in Mountain View, California, Alphabet Inc. (GOOGL) is a powerhouse in the digital world, with Google deeply woven into everyday online experiences. With a market capitalization nearing $4 trillion, Alphabet dominates global search and digital advertising, while also making significant strides in cloud services, artificial intelligence, hardware, and innovative healthcare solutions across major international markets.

Anticipation Builds for Q4 2025 Earnings

Investors are closely watching as Alphabet prepares to announce its fiscal fourth-quarter 2025 results on Wednesday, February 4, after the market closes. Analysts are forecasting diluted earnings per share (EPS) of $2.59, a 20.5% increase from $2.15 in the previous year. This projection highlights Alphabet’s consistent performance, as the company has exceeded EPS expectations for the past four quarters.

Strong Outlook for Future Earnings

For the full fiscal year 2025, Wall Street anticipates diluted EPS to reach $10.58, representing a 31.6% increase over the prior year. This positive momentum is expected to persist into fiscal 2026, with projected EPS climbing to $11.04, a further 4.4% year-over-year gain.

Image source: www.barchart.com

Share Performance Outpaces the Market

Alphabet’s stock has soared 69.4% over the past year and is up nearly 5% so far this year. These gains significantly outstrip the S&P 500 Index ($SPX), which posted increases of 17.7% and 1.8% over the same periods, respectively.

Sector Leadership Remains Unmatched

Alphabet’s dominance is even more pronounced within its industry. The State Street Communication Services Select Sector SPDR ETF (XLC) rose 21.2% in the past year but has shown only slight gains year-to-date, underscoring Alphabet’s continued outperformance.

Image source: www.barchart.com

Record-Breaking Q3 2025 Results

On October 29, 2025, Alphabet made headlines by surpassing $100 billion in quarterly revenue for the first time in fiscal Q3 2025. Revenue jumped 15.9% year-over-year to $102.35 billion, beating analyst expectations of $99.89 billion. EPS also surged 35.4% to $2.87, exceeding forecasts by $0.58.

Advertising and Cloud Fuel Growth

The company’s advertising segment remained a key driver, generating $74.2 billion. Google Search contributed $56.6 billion, up 14.5% from the previous year, while YouTube brought in $10.3 billion. Notably, Google Cloud stood out with $15.2 billion in revenue, marking a 33.5% year-over-year increase and highlighting rapid growth in enterprise services.

Following these impressive results, Alphabet’s shares rose about 2.7% on the day of the announcement and gained an additional 2.5% in the next trading session.

Analyst Sentiment and Price Targets

As the next earnings report approaches, analysts remain overwhelmingly positive on Alphabet, maintaining a “Strong Buy” consensus for the past three months. Out of 55 analysts, 45 recommend a “Strong Buy,” four suggest a “Moderate Buy,” and six rate the stock as a “Hold.”

The average price target for GOOGL stands at $334.23, indicating a potential upside of 1.7%. The highest target on the Street is $400, which would represent a 21.7% increase from current levels.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

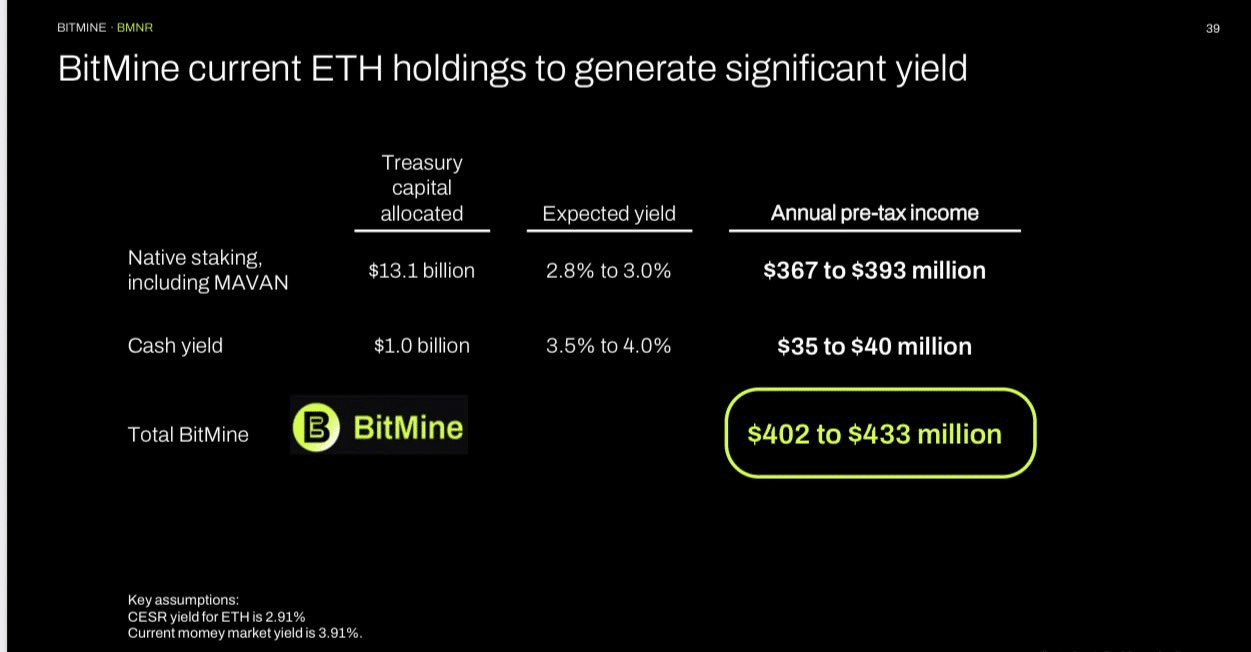

From $3.5K to $12K? Here’s why BMNR’s Ethereum forecast makes sense

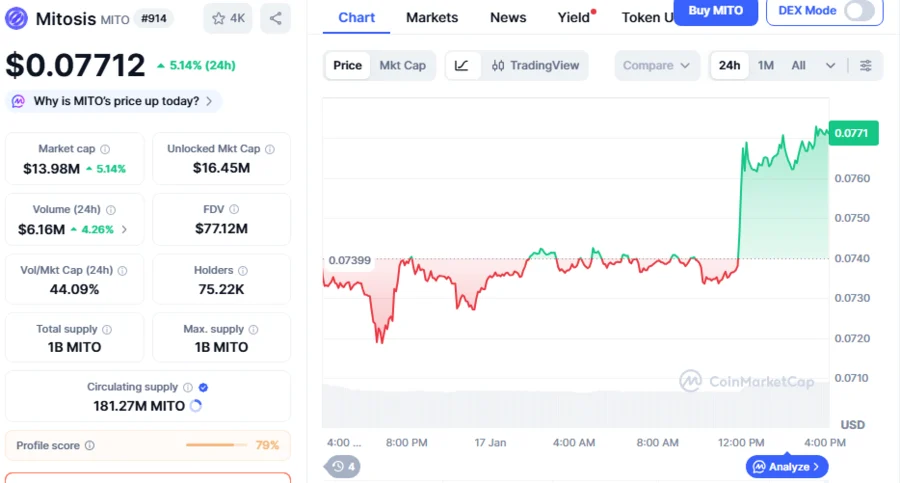

Mitosis Price Flashes a Massive Breakout Hope; Cup-And-Handle Pattern Signals MITO Targeting 50% Rally To $0.115305 Level

Recent financial moves by Trump spark renewed worries about possible conflicts of interest

Why Quant (QNT) Price Is Rising Today: Can It Hit $100 This Weekend?