EUR/GBP recovery stalls below 0.8700 despite upbeat Eurozone data

The Euro posts minor losses against the British Pound on Monday, trading at 0.8670 at the time of writing, after failing to break resistance at 0.8690 for the second time over the last few days. The bullish correction from four-month highs near 0.8640 remains in play, although technical indicators hint at a fading momentum.

The pair has shrugged off the upbeat Eurozone Sentix Economic Confidence Index, which improved to -1.8 in January from -6.2 in December. January’s is the best performance since July last year, and highlights a significant improvement in the institutional investors’ sentiment about the region’s economic outlook.

Geopolitical tensions keep Euro rallies limited

Euro bulls, however, remain in check amid the growing geopolitical tensions. In Iran, the harsh repression of the protests against the regime is reported to have caused hundreds of deaths over the weekend, and has boosted speculation about the involvement of the US or Israel.

In the UK, the Government has announced a $268 million investment for a potential deployment of UK troops to Ukraine. Russian President Vladimir Putin threatened that any Western forces would be considered a legitimate target.

The macroeconomic calendar in the UK is void today, but the market keeps an eye open for Tuesday’s employment report for further insight into the Bank of England’s (BoE) next monetary policy steps.

A recent report by the UK Recruitment & Employment Confederation and KPMG reveals that hiring plans among UK employers fell in December at their fastest rate since August, amid rising costs and the Labour Government’s tax-raising budget. In this context, the risk is on a weaker-than-expected employment report that might raise speculation about further BoE easing and add pressure on the GBP.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

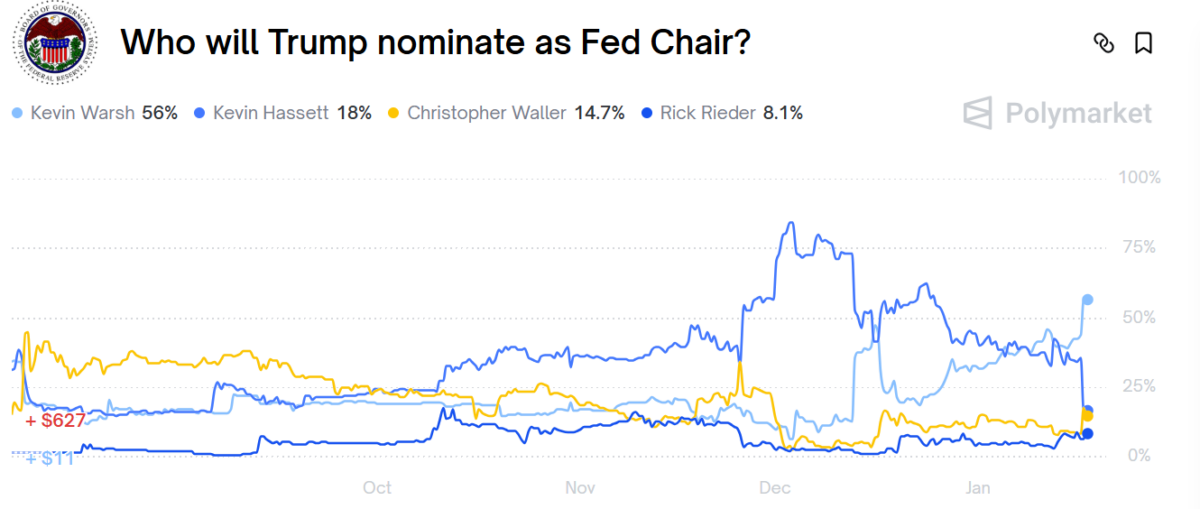

Kevin Hassett odds of replacing Powell at Fed Reserve on Polymarket tank, $11.4 million bets in trouble

A $280 Million Bitcoin Heist Leads to Monero Price Rally

3 Fastest-Growing and Trending Cryptos in 2026 — HBAR, SUI, and ENA