Activist investor Ancora establishes a unique position within the transportation industry

Ancora Alternatives: Transforming the Transportation Sector Through Activist Investing

Driving improvements in shareholder value is at the heart of investor activism, and Ancora Alternatives has established itself as a significant force within the transportation industry. The firm has made its mark by orchestrating board restructurings, executive leadership changes, and overhauling ineffective capital allocation strategies.

In recent years, Ancora has engaged with several prominent companies in the sector. These include logistics giant C.H. Robinson (NASDAQ: CHRW), expedited trucking provider Forward Air (NASDAQ: FWRD), and both major Eastern railroads—CSX (NASDAQ: CSX) and Norfolk Southern (NYSE: NSC). The firm’s latest collaboration was finalized last month with Americold (NASDAQ: COLD), a leader in temperature-controlled warehousing.

“We focus on companies that have strong fundamentals and were once industry leaders, but have since encountered challenges,” explained Conor Sweeney, director and portfolio manager at Ancora Alternatives, in a conversation with FreightWaves.

Ancora Alternatives operates as the activist investing division of Ancora Holdings Group, a diversified wealth management firm overseeing approximately $11 billion in assets. The company’s activist approach began in 2014 with the arrival of Jim Chadwick as president.

The firm seeks opportunities in traditional industries such as manufacturing, packaging, chemicals, and transportation. Before initiating engagement, Ancora evaluates factors like valuation, industry cycles, margin and cash flow stability, and the potential for operational improvements.

Case Studies in Activism

Forward Air (2021 & 2025)

Ancora has twice spearheaded efforts to revamp Forward Air’s board of directors. In 2021, the firm successfully replaced five board members and prompted the chief financial officer’s departure, aiming to refocus the company on its core airport-to-airport, less-than-truckload operations. Ancora attributed the company’s declining valuation to investments outside its primary business, which diluted shareholder value.

In 2025, Ancora again succeeded in removing three long-standing directors, including the chairman, following controversy over the acquisition of Omni Logistics. The deal, which bypassed shareholder approval, increased the company’s debt and unsettled both customers and investors. As a result, Forward Air is now considering strategic alternatives, including a possible sale, due to Ancora’s influence.

Building an Edge in Transportation

Sweeney noted that Ancora has developed a unique advantage in the transportation sector by cultivating a broad network of industry experts, potential board members, and executive candidates to support its campaigns.

“Our ability to bring the right talent to each situation gives us confidence that we can achieve the outcomes we and other shareholders seek,” Sweeney said.

This network often includes former executives and directors from both the target companies and their competitors. For instance, Andy Clarke, who previously served as CFO at both Forward Air and C.H. Robinson, has played a key role in several of Ancora’s initiatives.

“Identifying the right individuals to help shape our investment thesis greatly enhances the quality of our analysis and increases the likelihood of success, especially if a proxy contest becomes necessary,” Sweeney added.

C.H. Robinson (2022)

In 2022, Ancora reached an agreement with C.H. Robinson that resulted in two new board seats, the creation of a capital allocation committee, and ultimately the exit of CEO Bob Biesterfeld. The company has since implemented cost-saving measures, revised its incentive programs, and introduced other initiatives to boost profitability.

Targeting Underperforming but Promising Businesses

Ancora targets companies with strong potential that have lost their way, especially where issues like poor management, weak cost controls, inefficient capital use, or the need to divest non-core assets can be addressed.

“There are many ways to unlock value, and each situation requires a tailored approach to identify the root problems and the best path forward,” Sweeney said. “Bringing in the right expertise is crucial to making meaningful changes.”

Norfolk Southern (2024)

After citing lagging share performance, operational setbacks, and the 2023 East Palestine, Ohio derailment, Ancora secured three board seats at Norfolk Southern’s 2024 annual meeting, resulting in the removal of the board chair and two committee heads. The firm’s involvement also led to the dismissal of CEO Alan Shaw following an internal investigation.

Later that year, Ancora negotiated for a fourth board seat. The board, including Ancora’s appointees, unanimously endorsed an $85 billion merger with Union Pacific (NYSE: UNP).

CSX (2025)

In 2025, Ancora pressured CSX to remove CEO Joe Hinrichs, criticizing his leadership as detrimental to shareholder value. The firm also encouraged CSX to consider mergers and acquisitions to expand transcontinental services.

Although Berkshire Hathaway (NYSE: BRK-B), parent of BNSF, has stated it is not interested in rail mergers, Ancora’s actions have brought major railroads closer together, leading to new intermodal partnerships.

Investment Strategy and Market Dynamics

Sweeney observed that transportation stocks are often underrepresented in institutional portfolios due to their cyclical nature, particularly in the fragmented truckload segment. This lack of active ownership creates opportunities for firms like Ancora to step in.

Ancora typically acquires stakes ranging from 0.5% to 10%, preferring to stay below the 5% threshold to avoid SEC disclosure requirements. This approach allows the firm to remain agile and avoid influencing stock prices through public filings.

“We don’t need to hold a large percentage of shares to drive meaningful change, as our track record demonstrates,” Sweeney said.

The firm also avoids companies dominated by passive index funds, as these investors generally support existing management. For example, despite proxy advisors endorsing most of Ancora’s proposed board slate at Norfolk Southern, only one candidate received support from the three largest passive shareholders.

Americold (2025)

In December, Ancora’s agreement with Americold secured two board seats and led to the creation of a finance committee tasked with reviewing the company’s assets and recommending potential sales or divestitures.

Looking Ahead

Sweeney remains optimistic about finding compelling opportunities in the transportation and logistics industry. “Ultimately, our objective isn’t activism for its own sake—it’s about generating returns for our investors. Activism is simply the means we use to achieve that goal.”

Further Reading from Todd Maiden at FreightWaves

- Susquehanna says TL recovery requires kick start from demand

- Estes to surpass 14,000 doors in 2026

- Transportation capacity index hits 4-year low in December

Read the original article: Activist investor Ancora carves out niche in transportation sector on FreightWaves.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

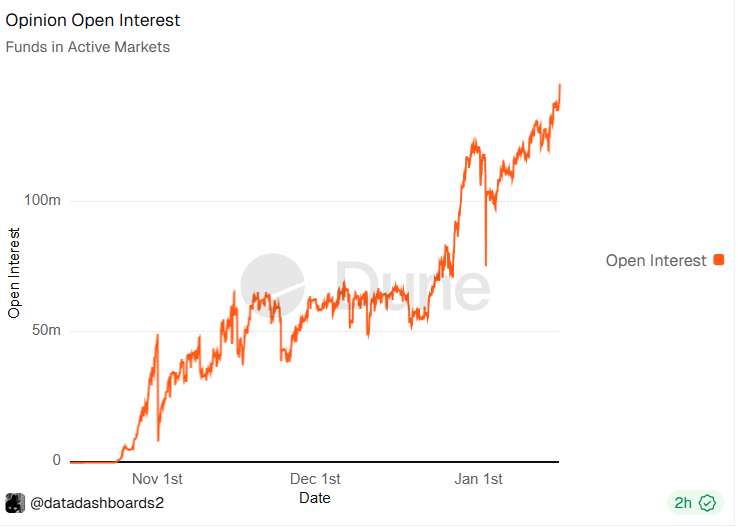

Opinion prediction platform reaches record open interest

Swiss Franc gains slightly while the US Dollar takes a breather following a surge fueled by economic data

As major technology companies become increasingly involved in the energy sector, they face greater risks

BDT & MSD Appoints Centerview Banker Adam Beshara to Senior Leadership Role