Gold Hits Record Highs, Dollar on a Rollercoaster: Who Is Quietly Downgrading America's "Credit Rating"?

Huitong Network, January 12——On Monday (January 12), the US Dollar Index traded around 98.75 during the European session. Previously, it had dipped to a low of 97.7479 before stabilizing and rebounding, then pulled back after hitting a high near 99.2679.

On Monday (January 12), the US Dollar Index traded around 98.75 during the European session. Previously, it had dipped to a low of 97.7479 before stabilizing and rebounding, then pulled back after hitting a high near 99.2679.

Overall, the current price is in a corrective rebound process, but the resistance above is obvious, and a unilateral upward trend has not yet formed. From a technical perspective, MACD’s DIFF is -0.0059, DEA is -0.1303, and the MACD bar has turned positive at 0.2489, indicating that the downward momentum is weakening and bullish forces are beginning to return. The RSI (14) is at 53.3049, residing in a neutral-to-strong range, suggesting that the market remains in a stalemate between bulls and bears and a one-sided trend is unlikely in the short term.

Against this backdrop, the key support at 98.2000 becomes the main focus. If subsequent pullbacks do not break this level, the rebound structure may continue; once it is lost, further downside could open up. It is noteworthy that this oscillatory trend is not driven solely by technical factors, but reflects deeper fundamental disagreements—the market’s pricing logic is shifting from “economic data-driven” to “concerns over institutional stability.”

A Financial Earthquake Triggered by a Subpoena: The Fed’s Independence Faces a Challenge

The real driver of recent forex market sentiment is not a particular economic data point, but a sudden political event: Fed Chair Powell disclosed that the Justice Department has issued a grand jury subpoena to the Federal Reserve, relating to his testimony before the Senate Banking Committee in June last year. The focus centers on a historic renovation project at the Fed’s headquarters costing about $2.5 billion, but Powell made it clear that the core issue is not the project itself or its budget details, but rather attempts by outsiders to use legal means to interfere with the central bank’s ability to set interest rate policy based on economic evidence.

This statement quickly ignited market concerns over the independence of monetary policy. The US Dollar Index dropped in response, US long-term Treasury futures and equity index futures simultaneously weakened, and gold prices soared to record highs. This rare combination of “the dollar and risk assets falling together while safe-haven assets surge” typically only occurs during systemic confidence crises. It means that capital is no longer just evaluating inflation and employment, but is recalculating the premium for institutional stability.

However, US Treasury futures stabilized after a brief fluctuation, suggesting that traders have not fully priced in the extreme scenario of the Fed completely losing its independence. The market appears to be waiting for further developments, which also explains why the dollar was able to technically recover after a sharp drop. In other words, the first wave of selling was panic-driven, but whether it persists depends on whether more substantive shocks follow.

The Tug of War Between Data and Narrative: The Dollar Swings Between Two Forces

Just as institutional risks were intensifying, some economic data showed resilience, giving the dollar a brief respite. Last week’s data showed the US unemployment rate fell to 4.4%, below the previous value of 4.6% and the expected 4.5%; average hourly wage growth year-on-year reached 3.8%, higher than expected and up from 3.6% previously. These numbers signal that the labor market remains tight, implying that the path of disinflation may be stickier, thus limiting the Fed’s room for aggressive rate cuts in the short term.

Meanwhile, another set of data painted a different picture: after excluding non-cyclical sectors such as healthcare and social assistance, December’s private non-farm employment actually decreased by 1,500, and over the past three months, the monthly average decreased by 19,400. This indicates that new jobs are increasingly dependent on a handful of counter-cyclical industries, and the overall foundation for economic expansion is weakening. If this trend continues, pressure on rate-sensitive sectors will gradually emerge, and expectations for further rate cuts will intensify.

This tug of war between the two forces is the core reason for the dollar’s recent choppy movement. On one hand, wage growth and an improving unemployment rate support high interest rates, which is positive for the dollar; on the other hand, institutional uncertainty pushes up risk premiums, suppressing dollar valuations. Therefore, although the data is somewhat strong in the short term, the market has not chased the dollar higher aggressively; the rebound is more of a technical correction than a trend reversal.

Inflation Becomes the Decisive Factor, the Dollar’s Future Remains Uncertain

Next, the market’s focus will be on the upcoming release of the US Consumer Price Index (CPI) for December. Economists expect core CPI year-over-year to rise to 2.7%, slightly above the previous value of 2.6%; the headline CPI is also expected to be 2.7%. If the actual data meets or exceeds expectations, it will reinforce the narrative of “stubborn inflation and delayed rate cuts,” potentially providing the dollar with short-term support; conversely, if inflation unexpectedly cools and concerns over employment structure resurface, bets on easing will return, limiting the dollar’s rebound.

More importantly, with the “Fed independence under threat” narrative lingering, even data favorable to the dollar may see the market react more cautiously. For example, even if inflation is stronger, traders may choose to sell into strength rather than chase the rally, resulting in limited upside for the dollar.

The current scenario of gold hitting record highs while the dollar declines indicates that the market currently tends to believe the latter—that institutional risk is eroding the dollar’s credit foundation. Therefore, the 98.2000 level is not just technical support, but also a confidence floor. If subsequent events continue to ferment and long-end yields steepen significantly (reflecting fiscal funding pressure or declining policy credibility), the dollar may face a deeper pullback; conversely, if the situation stabilizes, the bond market remains steady, and inflation data holds firm, the dollar may have a chance to continue its recovery at the current level and retest the 99.2679 resistance.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

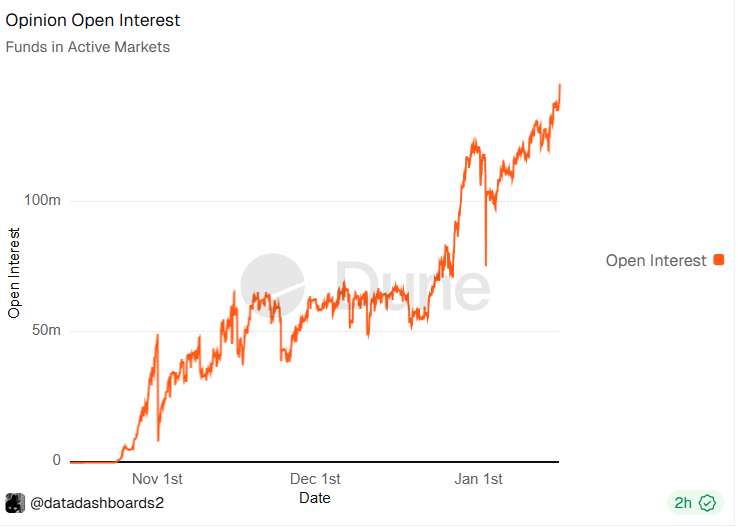

Opinion prediction platform reaches record open interest

Swiss Franc gains slightly while the US Dollar takes a breather following a surge fueled by economic data

As major technology companies become increasingly involved in the energy sector, they face greater risks

BDT & MSD Appoints Centerview Banker Adam Beshara to Senior Leadership Role