-

Ethereum price continues to compress above the $3,000 mark, showing tight consolidation.

-

On-chain and derivatives data hint at positioning buildup, favoring upside ahead.

Ethereum price showed a daily uptick of over 2%, reclaimed the $3100 zone during the intraday session, but the volatility remains unusually compressed. For the past few sessions, ETH has traded sideways, absorbing supply while refusing to lose its $3000 support level.

The current price action points to a coiling phase rather than exhaustion. The short-term range of $2900-$3400 is a critical area of focus for sharp directional moves ahead.

Ethereum Price Chart Forms Inverted Head and Shoulders Pattern: What Does It Mean

On the daily chart, Ethereum (ETH) remained sideways around $3000, while facing immediate resistance around $3200. However, the chart structure leans bullish, suggesting a massive upside toward $4800 in the coming sessions.

Looking at the key indicators, the RSI line is holding above the neutral 50 level, while the MACD indicator is flat near equilibrium, reflecting a balance rather than weakness.

The weekly chart adds more weight on the bullish thesis. According to the analyst’s post, he cited that ETH appears to be forming an inverse head-and-shoulders pattern, with price consolidating near the upper volume shelf.

This pattern typically signals a transition toward a bullish phase once confirmed. A decisive weekly close above $3400 could validate the structure and significantly push ETH even higher.

However, a drop below $2900 would invalidate the bullish thesis and expose ETH to deeper correction ahead.

On-Chain & Market Data: Valuation Gap Meets Rising Liquidation Pressure

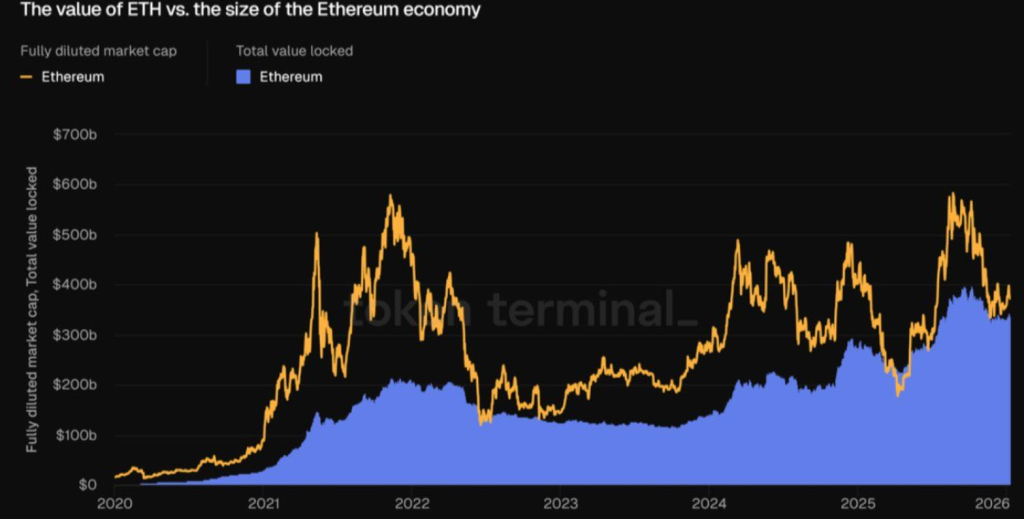

From a validation perspective, ETH’s market value continues to lag the growth of the Ethereum economy. The metrics comparing fully diluted valuation against on-chain activity and TVL show a widening gap, suggesting price has yet to fully reflect the network’s economic throughput.

This divergence strengthens the case that ETH’s current consolidation is occurring amid structural undervaluation rather than weakening fundamentals.

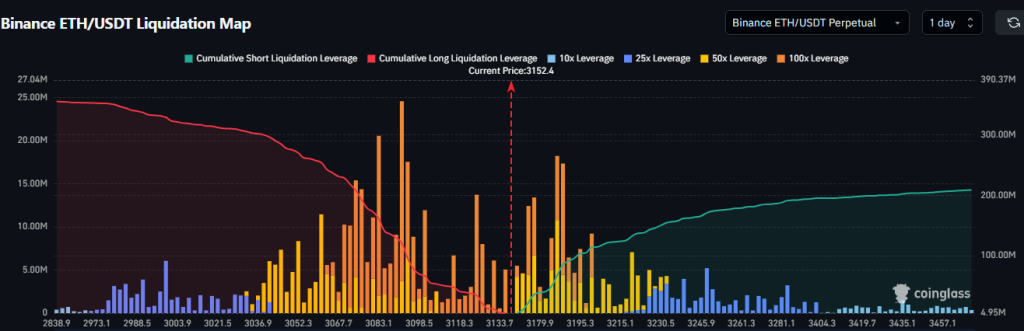

At the same time, liquidation map data reveals a dense cluster of short-side leverage positioned above the current price level of $3,100. It means that a relatively modest upside of around 10-12% would be enough to trap billions of short positions to unwind, potentially accelerating bullish momentum.

From a network perspective, ETH’s active addresses and transaction activity have stabilized, reinforcing the view that Ethereum’s underlying usage remains intact.

Final Thoughts

Ethereum price is coiling above the $3000 mark, with price compression, rising liquidation pressure, and on-chain undervaluation, pointing toward a potential volatility expansion.

Amidst the bullish chart setup, a clean break above $3400 would strengthen the bullish case, while a dip below $2900 may activate selling pressure ahead.