How Do Gen Z's 401(k) Savings Measure Up Against Other Age Groups

Gen Z Leads the Way in Early Retirement Planning

Members of Generation Z are beginning to set aside money for retirement at a much younger age than those who came before them—a move that could greatly benefit their financial futures.

Main Insights

-

The average 401(k) balance for Gen Z employees stands at $13,500. Their personal contributions average 7.2%, which rises to 10.9% when employer matches are factored in.

-

Gen Z individuals typically begin working with financial advisors at age 23, making them the earliest generation to do so.

-

Although their retirement savings are currently the smallest, 63% of Gen Z workers feel confident about their ability to retire comfortably—a higher percentage than any other age group.

Older generations have often criticized the youth for being careless with money or lacking a strong work ethic. However, Gen Z (who will be between 13 and 28 years old in 2025) is breaking these stereotypes by prioritizing retirement savings earlier and seeking professional financial guidance sooner than their predecessors.

Research from Northwestern Mutual reveals that Gen Zers who consult financial advisors start at an average age of 23—over 20 years before most baby boomers begin similar planning.

While Gen Z's average 401(k) balance is currently the lowest among all generations, this is largely due to their age and limited time in the workforce, not a lack of motivation. Many are just starting their professional journeys and have only recently begun saving for retirement.

Early Action, Even with Modest Savings

Gen Z’s average 401(k) balance of $13,500 includes everyone from students to young professionals. According to Vanguard, those under 25 have an average of $6,899 in their accounts, with a median balance of $1,948. Meanwhile, Gen Zers with middle-class incomes have a median retirement savings of $43,000, as reported by the Transamerica Center for Retirement Studies.

If your savings are similar to these numbers, there's no need to worry. Many in Gen Z are still in school, working part-time, or just starting their first full-time jobs. The important thing is that you’re beginning to save for retirement earlier than previous generations.

The Power of Starting Early

Time is a powerful ally for those who begin saving young. For example, investing $300 per month at age 20 with a 7% annual return could grow to over $1 million by age 65. Delaying until age 30 means you’d need to contribute about $620 monthly to reach the same goal, and waiting until 40 would require around $1,360 per month. The sooner you start, the easier it is to reach your targets.

Despite recent economic challenges, many Gen Zers are making saving for retirement a priority.

Noteworthy Fact

Northwestern Mutual reports that Gen Zers who work with financial planners typically begin at age 23.

If you’re a Gen Zer without a 401(k), don’t worry. If your employer doesn’t provide one, you can open an IRA and set up automatic monthly contributions—even small amounts count. What matters most is developing the habit of saving, not the initial amount.

Maximize Your Opportunities

If you have access to a workplace retirement plan, aim to take full advantage of your employer’s matching contributions—this is essentially free money. If you’re dealing with high-interest debt, focus on paying it down while still contributing enough to get the employer match. The key isn’t perfection, but rather building momentum early as you embark on your retirement savings journey.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

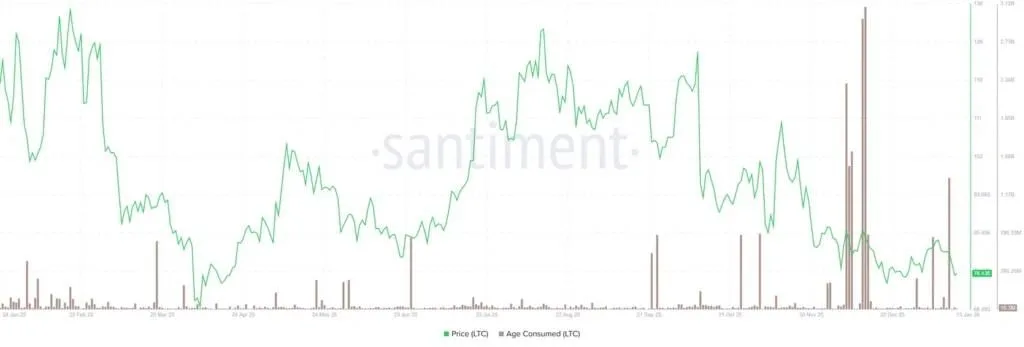

Litecoin Price Prediction: Will LTC Hold Key $72 Support?

Analysts Bullish On BlockDAG Hitting $1 in 2026 – Why It’s The Best Crypto To Buy Before Launch

FAA de EEUU advierte a aerolíneas sobre posibles acciones militares en Centroamérica y Sudamérica

Trump administration urges tech firms to purchase $15 billion in power plants they might never operate