Credit card shares tumble as Trump suggests 10% limit on fees: 'Yikes'

Credit Card Lenders See Stock Declines After Trump Proposes Interest Rate Cap

Leading credit card companies experienced significant drops in their share prices early Monday, following former President Trump's announcement late Friday of a proposed 10% ceiling on credit card interest rates.

Capital One (COF) and Synchrony Financial (SYF) both saw their stocks fall by up to 9% during premarket trading. American Express (AXP) and Citigroup (C) each declined around 4%, while shares of JPMorgan Chase (JPM) and Bank of America (BAC) slipped by nearly 2%.

Trump's Proposal and Its Uncertain Path

On Friday night, Trump posted on Truth Social that, if elected, he would implement a one-year 10% cap on credit card interest rates starting January 20, 2026. However, the method for enacting such a cap remains unclear, as it would likely require Congressional approval. Trump reiterated his commitment to the proposal while speaking to reporters aboard Air Force One on Sunday, insisting that lenders would be breaking the law if they failed to comply by the deadline, according to a Bloomberg report.

Without new legislation, it is uncertain how card issuers could be held legally accountable for not reducing their rates.

Market Reaction and Analyst Insights

Wells Fargo analyst Mike Mayo simply remarked, "Yikes," in a note to clients on Monday. He estimated that a temporary 10% cap could reduce pre-tax earnings for major banks by 5% to 18%. For companies that primarily focus on credit cards, such as Capital One and Synchrony Financial, the impact could be severe enough to eliminate profits entirely.

Further reading: How to find the best credit card interest rates

The Capital One logo outside a Capital One Cafe in Santa Monica, California, on February 21, 2024. (PATRICK T. FALLON/AFP via Getty Images)

Rising Interest Rates and Political Support

Credit card interest rates have surged in recent years, far outpacing other consumer loan rates. According to the latest Federal Reserve data, the average credit card rate reached 22.30%, up from 16.28% in 2020.

Lawmakers from both parties, including Senators Bernie Sanders and Josh Hawley, have previously advocated for limits on high credit card fees. Trump made the 10% cap a part of his 2024 campaign platform.

Industry Pushback and Regulatory Concerns

The proposal arrives at a time when the financial sector was enjoying its most favorable regulatory climate in decades. Within hours of Trump's announcement, five major banking trade associations, such as the American Bankers Association and the Bank Policy Institute, issued a statement warning against the cap.

They argued that a 10% interest rate limit would restrict access to credit and could have devastating consequences for millions of American families and small businesses who depend on credit cards.

“If this cap is implemented, it could push consumers toward less regulated and potentially more expensive borrowing options,” the groups cautioned.

Further reading: Buy now, pay later vs. credit cards: Which should you use for your next purchase?

Potential Benefits for Fintech and Upcoming Bank Earnings

On the flip side, Mizuho analyst Dan Dolev suggested that the cap could greatly benefit fintech companies offering buy now, pay later services, such as Affirm (AFRM), whose shares climbed 4% early Monday.

The fourth quarter earnings season for major banks begins Tuesday, starting with JPMorgan's report. Recently, JPMorgan also agreed to acquire Goldman Sachs' Apple Card portfolio.

David Hollerith reports on the financial industry, covering everything from the largest national banks to regional lenders, private equity, and the cryptocurrency market.

- Explore comprehensive coverage of the latest stock market developments

- Stay updated with the newest financial and business headlines from Yahoo Finance

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

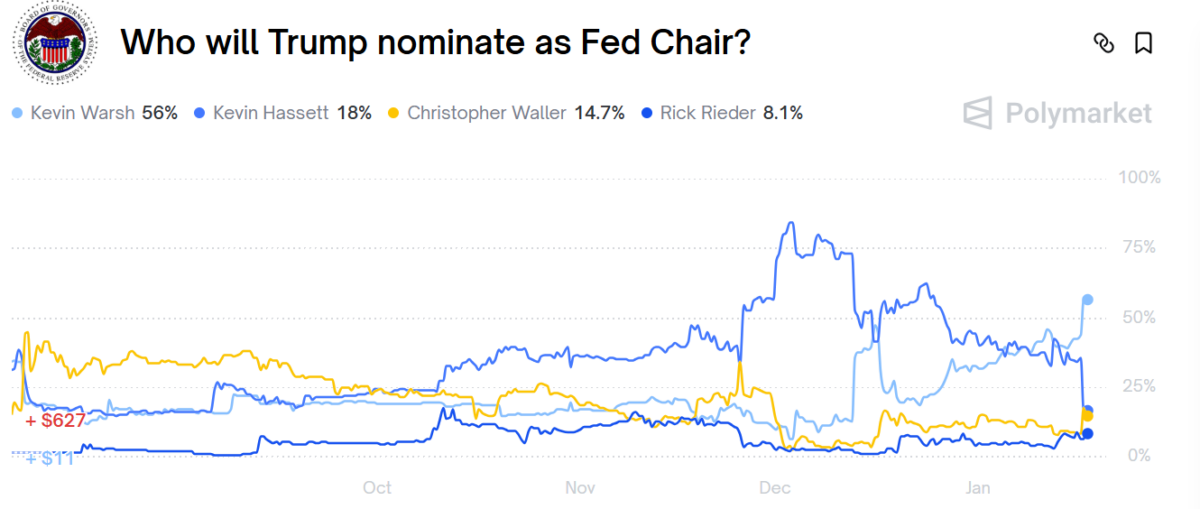

Kevin Hassett odds of replacing Powell at Fed Reserve on Polymarket tank, $11.4 million bets in trouble

A $280 Million Bitcoin Heist Leads to Monero Price Rally

3 Fastest-Growing and Trending Cryptos in 2026 — HBAR, SUI, and ENA