Last year, Trump scrutinized the Fed’s building renovation expenses in an attempt to remove Powell from his position. Unusually, he even visited the Fed, challenging Powell face-to-face. Recently, Powell shared a video stating, “I’m being threatened,” as Trump threatened to imprison him for not lowering interest rates.

Trump Rattles Markets by Threatening Fed Chair Powell

Powell: Seeking Support

It is uncommon for a central bank head to declare that they might face imprisonment if they don’t lower interest rates. Especially in the U.S., such scenarios seem outlandish but plausible under Trump’s volatile leadership. Known for destabilizing institutional governance, Trump continues to unsettle each organization he can.

Since last summer, Powell has been under investigation related to the Fed’s building renovation project. In his latest video, Powell mentioned he received a grand jury subpoena from the Department of Justice, indicating a potential criminal prosecution. Powell believes the investigation stems from ongoing pressure to lower interest rates, stating, “It concerns whether the Fed can continue to set interest rates based on evidence and economic conditions or if monetary policy will be dictated by political pressure or intimidation.”

This statement seemed like a plea to help preserve the institution’s independence. In response, Trump claimed ignorance of any pressure, asserting that Powell should only feel the weight of high interest rates.

“I would never consider doing such a thing. The only pressure he should feel is from the excessively high interest rates,” Trump remarked.

With Powell’s term ending on May 15, a decision on his successor will be made this month.

Impact on Cryptocurrencies

Krishna Guha from Evercore ISI expressed bewilderment over Powell’s remarks in a note to clients, noting Trump’s unpredictable nature. Concerns in Europe mirror this sentiment, highlighting NATO’s potential disintegration as a possibility. Since WWII, U.S.-led global institutions have either been discredited or abandoned by Trump. The arrest of Powell and the appointment of a new Fed chief could happen abruptly.

This situation could drastically affect cryptocurrencies, posing a risk to global markets. The devaluation of the Fed might bolster precious metals like gold and silver but could spell trouble for stocks and crypto.

Fidelitas Lex commented on the matter, stating, “Forget the trivialization and weak grasp reflections. These events are unexpected and historically rare for the U.S. A central bank head feels compelled to voice concerns due to pressures.”

Fox Business recently reported that Trump will meet Rieder regarding the Fed Chair position this week.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Future Contracts Tap into Altcoin Potential at CME Group

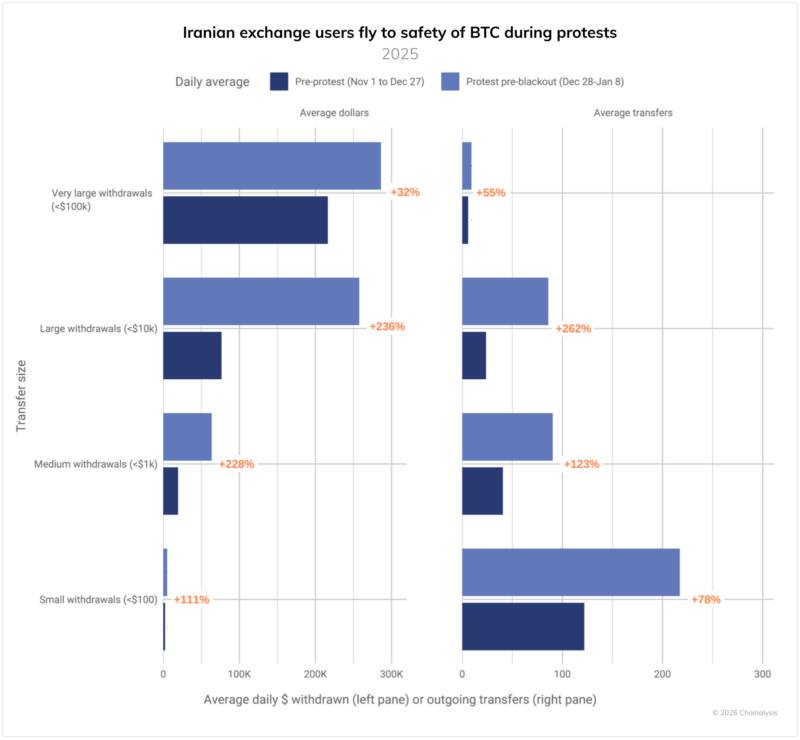

$7.8 Billion and Growing: What Iran’s Crypto Data Reveals About Crisis

Why is Sweetgreen's business struggling?