Gold and Silver Both Break Historical Records! Has the "Currency Depreciation Trade" Gone Completely Crazy?

After U.S. prosecutors launched a criminal investigation into Federal Reserve Chairman Powell, concerns over the Fed's independence have arisen, and gold continues to hit new historical highs.

During the U.S. session on Monday, gold surged over 2%, pushing its record high above $4,620, while silver spiked by more than 7% at one point. As of press time, both have retraced somewhat.

Kevin Thozet, a member of the investment committee at asset management firm Carmignac, stated that the risk lies in the possibility that, in the coming quarters, the White House and the Federal Reserve may “no longer hold back.” Last Sunday, Powell said the Fed had received a grand jury subpoena and threats of criminal prosecution from the Department of Justice, related to his congressional testimony about the $2.5 billion renovation project for the central bank's headquarters.

Investors noted that the movements in the U.S. dollar and gold reflect a risk that, due to political pressure, U.S. policy rates could be suppressed to levels lower than they should be, potentially leading to higher long-term inflation and increased monetary policy uncertainty.

Mike Riddell, a fund manager at Fidelity International, said: “We have seen this before—political pressure on the Fed means a weaker dollar, higher long-term U.S. Treasury yields, and rising inflation expectations.”

However, the scale of market volatility has been relatively minor, and many investors are still betting that policymakers will maintain their independence. Jan Hatzius, chief economist at Goldman Sachs, said at a conference in London: “My expectation remains that the committee will continue to make decisions based on its mandate and economic data.”

Gold and silver have been swept up in what is known as the “currency debasement trade,” as investors fear that pressure to lower rates will ultimately lead to the devaluation of U.S. dollar assets. These concerns, along with the pursuit of safe haven assets, have fueled record-breaking rallies in precious metals. John Woods, Chief Investment Officer for Asia at Lombard Odier, said: “Gold is the premier geopolitical risk asset—more so than any other.” “There are currently too many geopolitical risks present in the market.”

Just over a week after U.S. forces took control of Venezuelan leader Maduro, U.S. President Trump stated that, given the Iranian regime’s crackdown on nationwide protests, he is considering military action against Iran.

The Department of Justice’s investigation into Powell came after the Trump administration launched a campaign aimed at forcing the Fed to cut rates more aggressively, despite ongoing concerns about reigniting inflation. The latest tussle between the White House and the Fed is taking place against the backdrop of long-term government bonds already facing challenges globally.

Last week, the gap between the 30-year and 2-year U.S. Treasury yields reached 1.4 percentage points, the widest in four years, further exacerbating global concerns over government borrowing. Thozet from Carmignac noted that as the likelihood of a “MAGA” (Make America Great Again) figure being appointed as Fed Chair increases, inflation expectations may “creep higher.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

DTCC emphasizes interoperability over closed networks in tokenization

WeLab’s $220M Raise Shows Institutional Bet on Asia Fintech

Ethereum Faces Challenges: Market Trends and Investor Insights

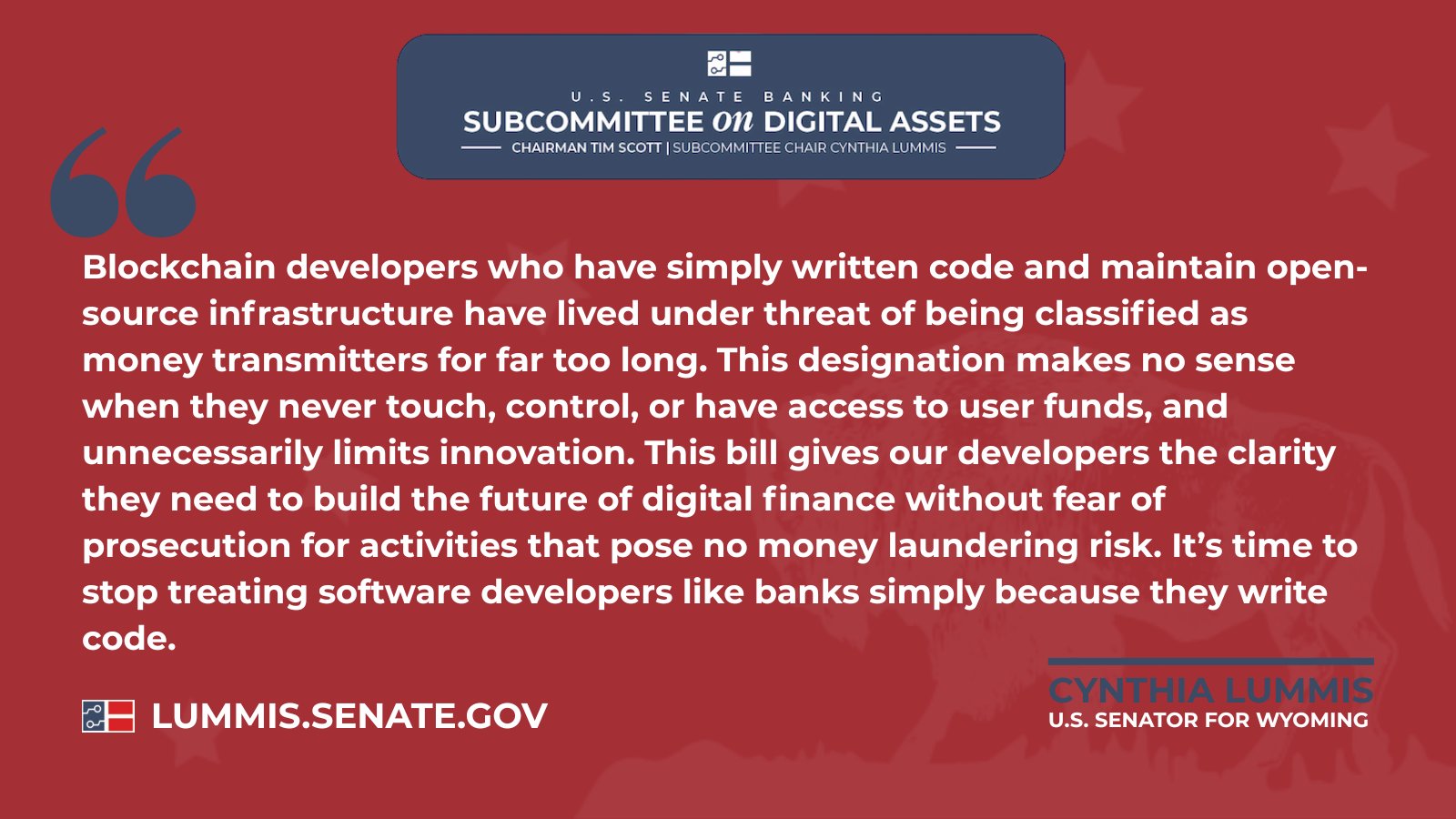

Senate Judiciary flags DeFi oversight ‘gaps’ in U.S. crypto bill