VelaFi secures $20 million in Series B funding to grow its stablecoin payment network

VelaFi Secures $20 Million in Series B Funding

VelaFi, a provider of stablecoin-driven financial infrastructure and a subsidiary of Galactic Holdings, has announced the successful completion of a $20 million Series B funding round. The investment was led by XVC and Ikuyo, according to a statement released by the company on Monday.

Additional backing came from Alibaba Investment, Planetree, BAI Capital, and several other international investors. With this latest round, VelaFi’s total capital raised now exceeds $40 million.

Expansion and Platform Capabilities

Established in 2020, VelaFi began by developing payment solutions in Latin America and has since broadened its reach to the United States and Asia. The company’s platform integrates local banking systems, cross-border payment networks, and leading stablecoin protocols, enabling businesses to transfer funds between markets more efficiently and at reduced costs compared to conventional methods.

VelaFi’s suite of services includes on- and off-ramps, pay-in and pay-out solutions, international payments, multi-currency accounts, foreign exchange tools, and asset management. These offerings are accessible through both a direct platform and API integrations.

The Growing Role of Stablecoins

Stablecoins have become an essential component in global payments, providing blockchain-based digital assets that aim to maintain price stability and facilitate near-instant settlements.

While stablecoins were once primarily used within cryptocurrency trading, their adoption has expanded to enterprise applications such as international payments, treasury management, and liquidity solutions—especially in regions where traditional banking systems are slow or expensive.

This trend has attracted increased attention from regulators and financial institutions, positioning stablecoins as a possible link between traditional finance and blockchain-based settlement networks.

“We are creating a new era of global payment infrastructure—one that is immediate, transparent, and prioritizes regulatory compliance,” stated Maggie Wu, CEO and co-founder of VelaFi. “This funding will accelerate our expansion from Latin America into the U.S. and Asia.”

Industry Trends and Company Impact

Stablecoins are now widely used for international settlements, with industry analysts estimating annual transaction volumes in the tens of trillions of dollars. VelaFi anticipates that the need for faster, more interoperable payment systems among enterprises will continue to rise as the financial sector moves away from outdated, fragmented systems.

The company reports having supported hundreds of enterprise clients and processing billions of dollars in transactions to date.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

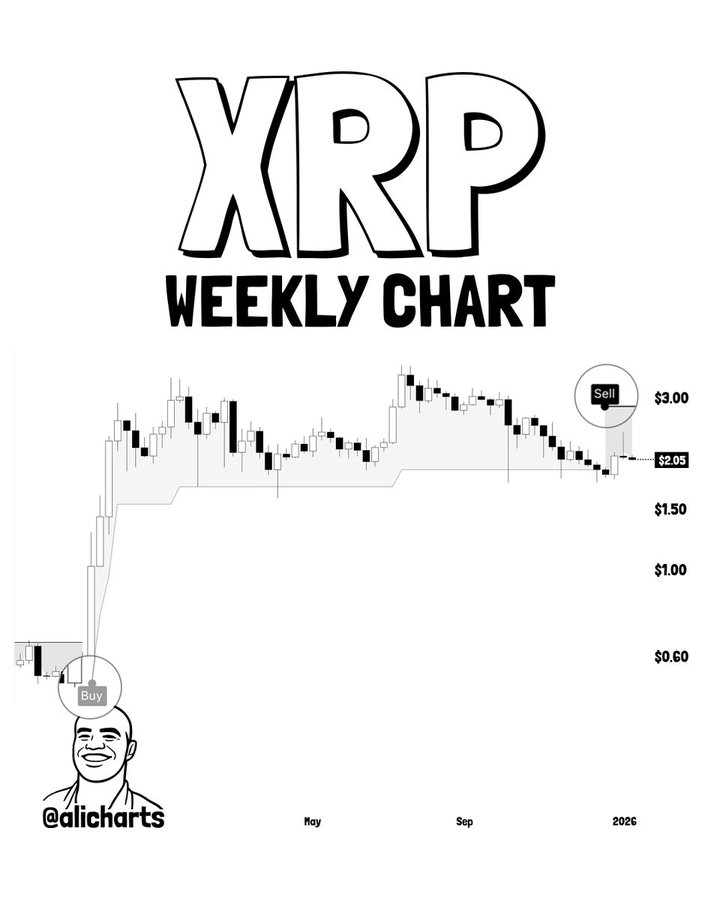

XRP In A ‘Super Cycle’? SuperTrend Suggests Another Story

President Trump Plans an “Emergency Power Auction”: What It Could Mean for Bitcoin Miners

German inflation expected to reach 2.2% in 2025