Why Reducing Interest Rates Might Not Achieve the Housing Affordability Washington Seeks

CBO Forecasts on Interest Rates and Treasury Yields

According to a recent report from the Congressional Budget Office, the Federal Reserve’s benchmark interest rate is anticipated to decrease to 3.4% by year’s end and remain at that level throughout President Trump’s term, lasting until 2028. This marks a decline from the projected 3.9% rate in the final quarter of 2025.

However, future developments may not always align with expectations. Even as the Fed lowers rates, the CBO estimates that the yield on 10-year Treasury notes—which directly affects borrowing costs for mortgages, car loans, and credit cards—will gradually increase. The yield is expected to move from 4.1% in the last quarter of 2025 to 4.3% over time.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

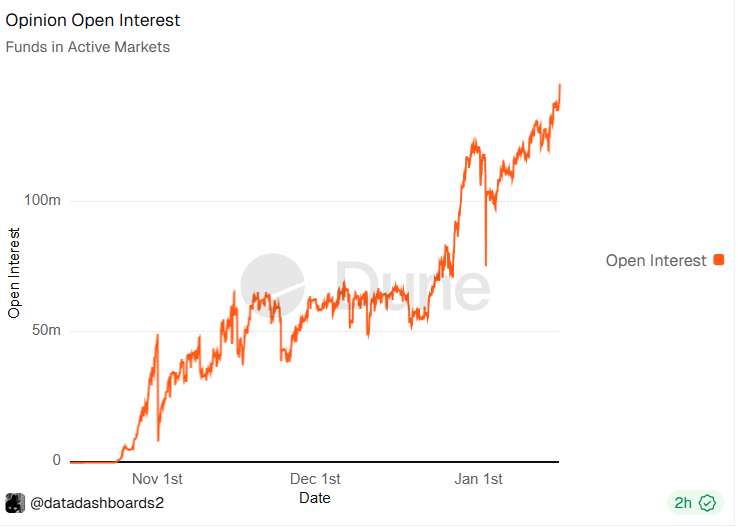

Opinion prediction platform reaches record open interest

Swiss Franc gains slightly while the US Dollar takes a breather following a surge fueled by economic data

As major technology companies become increasingly involved in the energy sector, they face greater risks

BDT & MSD Appoints Centerview Banker Adam Beshara to Senior Leadership Role