Paramount initiates legal action against Warner Bros. Discovery and warns of a potential proxy battle

Paramount Intensifies Efforts to Acquire Warner Bros. Discovery

Paramount has escalated its campaign to take over Warner Bros. Discovery (WBD), the parent company of CNN, by initiating legal action. On Monday, Paramount CEO David Ellison revealed that the company has filed a lawsuit in Delaware Chancery Court, a venue known for resolving corporate disputes, as part of its ongoing attempt at a hostile acquisition of the renowned media conglomerate.

Ellison criticized WBD for what he described as insufficient transparency regarding its preference for Netflix’s offer to purchase Warner Bros. and HBO. While WBD has not yet issued a public response, financial analysts had anticipated that the dispute could lead to litigation.

Despite months of efforts to acquire WBD, Ellison’s proposals have been consistently rejected. In response, he has put forward a $30 per share all-cash offer and is threatening a proxy battle. Paramount plans to nominate a slate of directors supportive of its bid at WBD’s 2026 annual meeting, aiming to gain control of the board.

Ellison stated that these new board members would use WBD’s rights under its agreement with Netflix to consider Paramount’s proposal and potentially negotiate a deal. The proxy fight serves as a contingency plan if not enough shareholders agree to sell their shares to Paramount in the near future.

The date for WBD’s next annual shareholder meeting has not yet been announced; last year’s meeting occurred in June.

Competing Bids and Ongoing Negotiations

WBD has already agreed to sell its Warner Bros. and HBO assets to Netflix for $27.75 per share, with $23.25 paid in cash and the remainder in Netflix stock. Netflix recently confirmed it is working with regulators in the United States and Europe to secure approval for the transaction.

However, Paramount’s aggressive acquisition attempt has cast uncertainty over the future of the media group. Ellison questioned WBD’s rationale for accepting a lower offer from Netflix, suggesting that the decision does not benefit shareholders as much as Paramount’s proposal would.

WBD’s board has expressed concerns about Paramount’s financing and the conditions attached to its bid. Additionally, the board has highlighted the potential value of its cable networks, such as CNN, which are not included in the Netflix deal. These channels are set to be spun off into a new publicly traded entity, Discovery Global, later this year.

Paramount, on the other hand, contends that these cable assets have limited value. The lawsuit in Delaware seeks greater transparency regarding the valuation of these channels, with Ellison emphasizing the need for WBD shareholders to have all relevant information before deciding whether to accept Paramount’s offer.

Shareholder Division and Political Involvement

WBD’s major shareholders remain divided, with some viewing Paramount’s bid as superior and others favoring the agreement with Netflix.

Adding another layer of complexity, former President Trump has indicated he will personally review any potential merger, raising speculation about the influence of his preferences on the outcome. Over the weekend, he shared an opinion article from One America News Network titled “Stop The Netflix Cultural Takeover,” which argued against the formation of a dominant media conglomerate.

Despite the ongoing dispute, Netflix remains optimistic that it will secure the necessary approvals and finalize the deal within the next twelve to eighteen months.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Hacker swipes $282 million in cryptocurrency through social engineering targeting hardware wallets

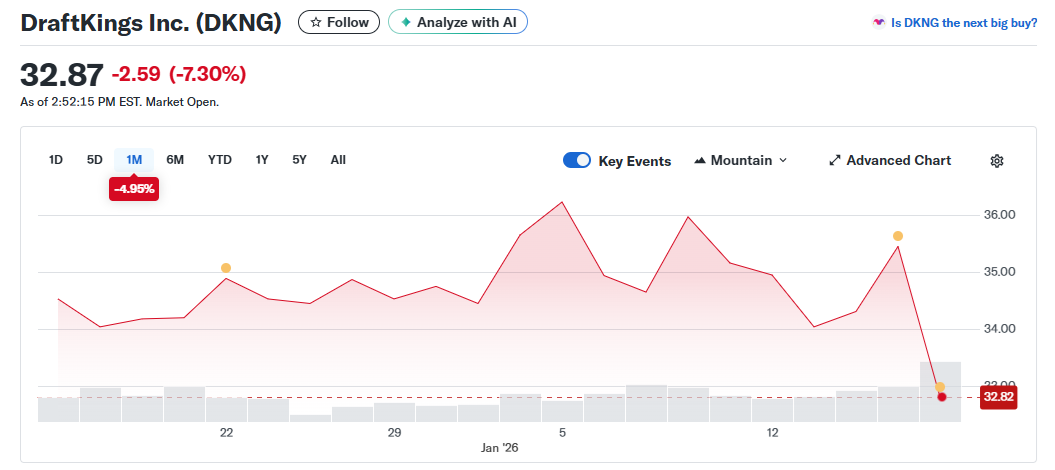

Gambling stocks tumble as platforms lose share to Kalshi and Polymarket

Clients Can Fund IBKR Accounts Via USDC

Barclays Upgrades This Leading AI Server Stock to 'Overweight,' Calling It 'Best in Class'