Morgan Stanley's View on the New Cycle: A Macro Framework for Interest Rates, AI, China, and the Global Revaluation of Assets

In this article, we interpret a report from

Morgan Stanley Investment Management

An annual macro framework report released at the beginning of 2026:

Big Picture: Key Themes for 2026

This is a typical "big framework report", which does not attempt to predict short-term market fluctuations, but instead provides Morgan Stanley’s overall assessment of the 2026 investment environment from five perspectives: interest rates, monetary system, AI, structural changes in China, and global asset allocation.

To summarize the report’s conclusion in one sentence:

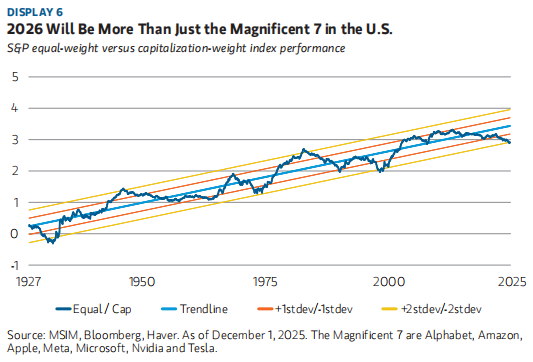

Global investment is moving from the “high concentration” of the past decade to a structural “broadening”.

This change does not stem from a single policy or event, but rather from several long-term forces changing direction at the same time.

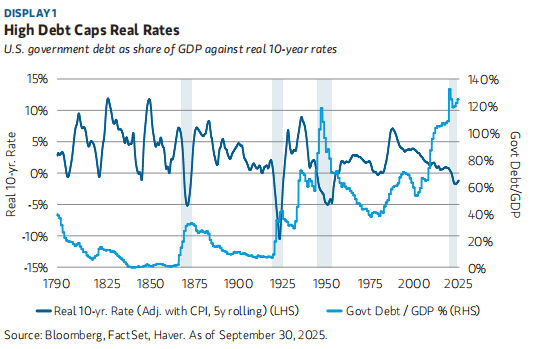

I. An Underestimated Premise: Real Interest Rates Have Been “Capped”

Morgan Stanley first presents a very important but easily overlooked macro constraint:

In a high debt world, real interest rates cannot remain restrictive for long.

Whether it is the US or other major global economies, the ratio of public debt to GDP is at a historically high level. Historical experience has repeatedly shown:

In high debt phases

it is inevitably accompanied by real interest rates close to zero or even negative

otherwise, the fiscal system cannot remain stable

This means:

even if monetary policy tightens on a cyclical level, structurally, the room for real interest rates to rise has already been sealed off.

This is the underlying logic for the pricing of almost all assets in 2026.

II. The World is Entering a “Multi-Currency Era”

The second judgment of the report is about a “de-monopolized” financial system:

The dollar is still the anchor

but it is no longer the only anchor

Several key changes have already occurred:

Over 30% of China’s trade is settled in RMB

Multiple emerging markets have started using local or non-dollar systems for cross-border payments

The proportion of gold in global reserves continues to rise

Morgan Stanley does not believe the dollar will collapse, but clearly points out:

The monetary system is becoming modular and multi-centered.

For investment, this means:

lower asset correlation and greater regional differentiation.

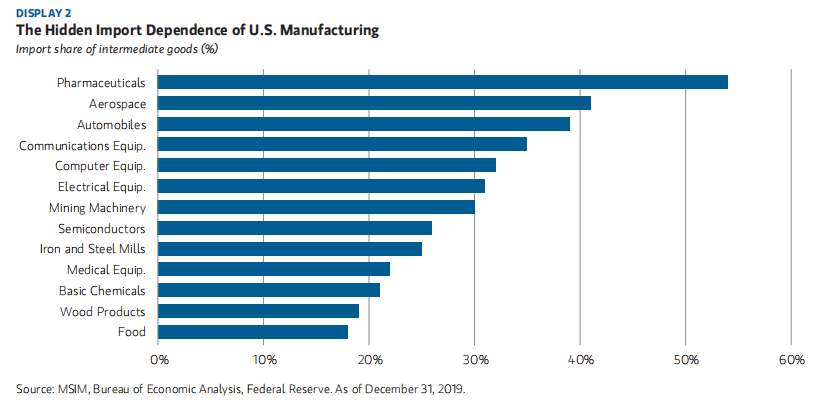

III. Tariffs Are More “Political Narrative” Than Economic Reality

The report’s judgment on tariffs is very straightforward:

The impact of tariffs has been systematically overestimated.

The reason is simple:

The global economy operates by industrial chain, not by national borders

The US imports a large amount of intermediate goods, not end-consumer goods

Taxing intermediate goods actually weakens domestic competitiveness

Especially in US-China relations, the reality is:

China exports more complex and harder-to-replace products

The US exports mainly bulk and primary products

Tariffs have not reshaped trade, only rearranged its paths.

IV. The Divergence Between “Old China” and “New China” is Key

Morgan Stanley’s analysis of China is very clearly divided into two lines:

Old China

Real estate

Traditional infrastructure

Weak domestic demand, heavy deflationary pressure

New China

High-end manufacturing

New energy, EV, batteries, robotics, AI

Global export competitiveness continues to rise

A key data point is:

China now accounts for 28% of global manufacturing output.

After the semiconductor blockade, China did not choose to retreat, but rather de-westernized its supply chain + pursued technological self-sufficiency.

Morgan Stanley’s conclusion is clear:

The core of the next stage of global competition is not real estate, but AI and manufacturing systems.

V. AI: Prosperity, Fractures, and Real Opportunities

The report’s assessment of AI is very “calm”:

User numbers are exploding

CapEx at an unprecedented scale

But monetization is still lagging

At the same time, some structural fractures have appeared:

Power bottlenecks

Unequal utilization of networks and data centers

Increasingly complex financing structures

But Morgan Stanley emphasizes:

Historically, overbuilding of infrastructure often precedes the next round of productivity improvements.

More importantly, the world is forming two sets of AI architectures:

United States: high cost, capital intensive, GPU heavy

China: low cost, high efficiency, supply chain coordination

This means:

AI is not a single track, but a highly differentiated long-term theme.

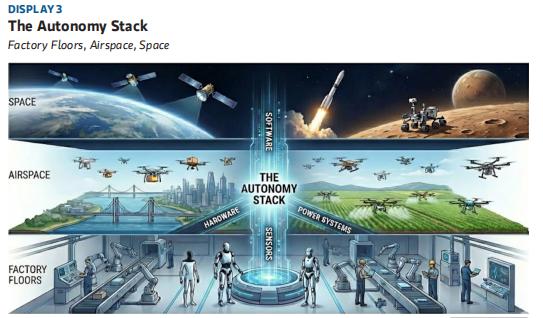

VI. From “Thinking” to “Acting”: Autonomous Systems are Taking Shape

Morgan Stanley introduces a very important concept:

Autonomy Stack

AI is evolving from:

analyzing the world

→ entering the physical world and beginning to “operate”

Including:

robots in factories

drones in the air

autonomous systems in space

To summarize in one sentence:

AI is evolving from software into a fundamental factor of production.

My Interpretation:

Essentially, this report describes achange of era:

Interest rates are no longer a single-direction variable

AI is no longer the domain of only the giants

China is no longer just about real estate

The world is no longer just about the United States

The key word for 2026 is not “higher”, but “broader”.

For investors, this means:

Indices will “de-sensitize”

Structure will become more “active”

Choosing the right direction is more important than timing

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

TheoriqAI Partners with OpenLedger to Build Accountable, Production-Ready DeFi AI Agents

Betting Shares Decline While NFL Prediction Wagers Rise on Gambling Platforms

Sui Blockchain’s Revolutionary Partnership with LINQ Transforms Crypto Access in Nigeria