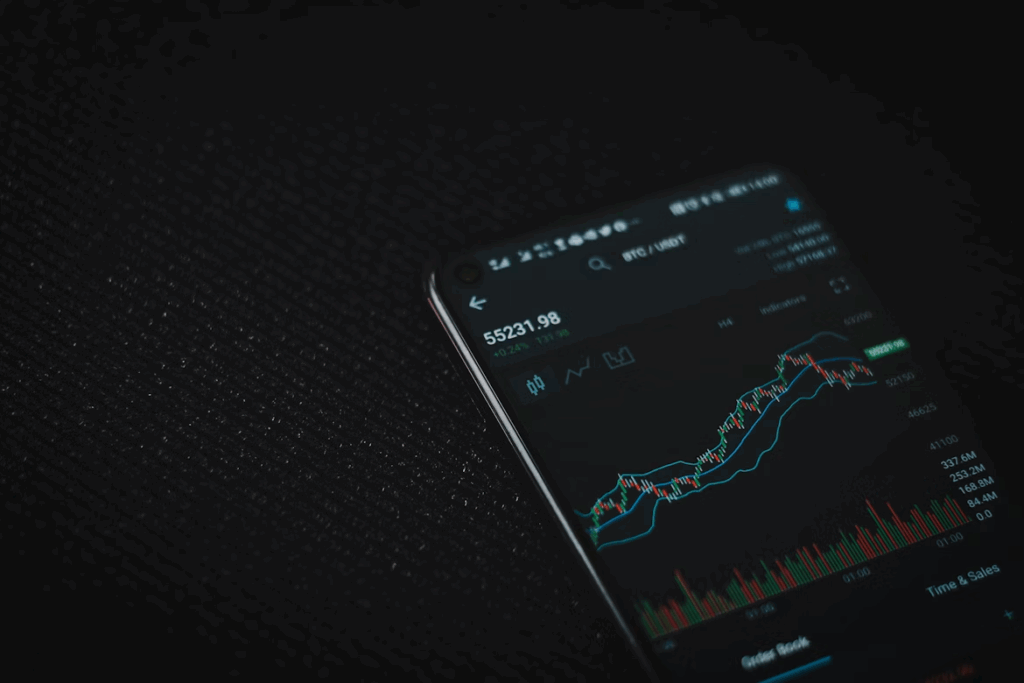

Memecoins are starting 2026 on shaky ground. The PEPE price today continues to slide from its early 2025 highs, with consolidation dragging through December and no clear recovery forming. Meanwhile, the Chainlink price sits near $14, caught between resistance overhead and support below, leaving traders uncertain which direction will break first.

PEPE Price Today Shows Limited Momentum

The PEPE price today sits at $0.00000660, reflecting a challenging period for the memecoin market. After dropping nearly 80% from its Q1 2025 high of $0.00002837, PEPE found support around $0.00000350 in late November.

Current trading shows a modest 1.02% gain, though momentum remains limited with a market cap of $2.77 billion. The PEPE price today continues consolidating after missing the December rally entirely. Analysts suggest potential movement toward $0.0000539 by 2026 if conditions improve, with longer-term projections pointing to $0.0002733 by 2030.

However, what the pepe price today reveals is a coin dependent on broader memecoin sentiment that hasn’t returned yet. Traders searching for the best crypto to buy are weighing PEPE’s uncertain recovery path against this dependency. Trading volume and investor interest remain subdued compared to 2024 levels, leaving many participants waiting for clearer signals.

Chainlink Price Tests Critical Resistance Level

The Chainlink price trades around $13.88, showing mixed signals after recent volatility. LINK tested a high of $14.11 before pulling back, while support held at $13.41 during yesterday’s session.

Trading volume increased 48% to $975 million, indicating renewed activity, though the direction remains uncertain. Technical indicators show the Chainlink price approaching overbought levels with an RSI of 69.67, which could trigger a correction. The $14 resistance level presents a challenge for bulls, while bears watch $13.76 support below.

A break above $14 might push Chainlink price toward $14.12, but a reversal could see levels drop to $13.54. For buyers evaluating the best crypto to buy, Chainlink’s technical setup suggests waiting for confirmation rather than chasing current levels with uncertainty dominating short-term price action.

BlockDAG Tech Powers Real Scalability Solution

What truly sets BlockDAG apart is its innovative architecture. While traditional blockchains process transactions one block at a time, creating bottlenecks and high fees, BlockDAG uses a hybrid architecture that combines blockchain security with DAG scalability. The multi-parent block structure allows blocks to be created and confirmed simultaneously rather than waiting in line. This means BlockDAG can handle 2,000 to 15,000 transactions per second, a speed that rivals Solana and Avalanche while maintaining true decentralization.

The technology uses Proof-of-Engagement for mobile miners through the X1 app and Proof-of-Work for physical miners like the X10, creating multiple pathways for participants to earn rewards without expensive hardware requirements. This isn’t just theory. 3.5 million X1 users and 20,000+ miners sold prove the system works at scale. The platform supports smart contracts, dApps, and future cross-chain compatibility, positioning BlockDAG as infrastructure ready for mass adoption.

Final Thoughts

Across the broader market, established coins face extended uncertainty. The pepe price today remains at $0.00000660, with recovery dependent on sentiment shifts that have not materialized. The Chainlink price holds near $13.88, testing $14 resistance without breakthrough momentum, while technical indicators suggest caution. Both assets stay range-bound with limited catalysts ahead.