Apple Makes a Big Move! META Recruits Former Trump Official and Goldman Sachs Executive for AI Infrastructure!

Influenced by news that the Department of Justice has launched an investigation into Federal Reserve Chairman Powell, risk-off sentiment quickly surged in early trading, with the dollar, U.S. Treasuries, and U.S. stocks all declining in tandem. The market began to revisit the frequently mentioned issue—is the Federal Reserve's independence being eroded?

However, Wall Street's cooling-off period arrived sooner than expected. As trading progressed, institutional investors began to realize that this was more of "political noise," and risk assets soon recovered their lost ground.

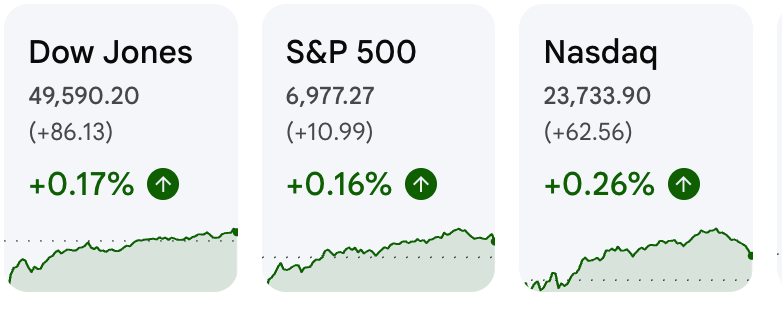

By the close, the S&P had a V-shaped reversal, erasing losses late in the session and closing at a record high, up 0.16%; the Dow rose 0.17%, also hitting a new closing record; and the Nasdaq gained 0.26%.

The Federal Reserve's Resolve Under Political Pressure

According to the investigation directions disclosed by the Department of Justice, the focus is on Powell’s previous congressional testimony and related spending details. But Powell’s subsequent public statement pointed directly to the explicit political intent behind the investigation, namely to pressure the Fed to shift toward quantitative easing through judicial means.

The market’s interpretation of this event is becoming more rational:

On the one hand, the "end-of-term" defensive attribute played a key role. Powell’s term as Chairman will end in May this year. Applying political pressure to a chairman about to step down is unlikely to truly alter the Federal Reserve’s established monetary policy path; this window of independence reassures the market.

On the other hand, the balancing effect of a remaining board member cannot be underestimated. Although his chairmanship is ending, Powell’s term as a Federal Reserve Governor can be extended until January 2028. The prediction market is now highly focused on a possibility: after stepping down as chairman, Powell will remain as a board member, using his professional influence to counterbalance political interference within the board.

Lastly, there is the backlash effect of the confirmation process. Such a high-profile judicial investigation could trigger backlash during congressional confirmation of a new chairman. Several heavyweight senators have already stated that until the investigation is thoroughly clarified, they may block any new chairman’s nomination and confirmation. This complex game makes investors judge that the event is highly likely to "start with a bang and end quietly."

Earnings Season Begins: Fundamentals Remain the Core of Pricing

With key inflation data due this week, Wall Street’s pricing focus is shifting toward corporate profitability. Goldman Sachs traders noted in their latest briefing that despite political news frequently dominating headlines, overall market turnover and activity levels have actually remained relatively calm ahead of the official start of earnings season.

The Goldman Sachs research team expects that, supported by robust nominal GDP growth and the recent trend in the dollar exchange rate, revenue growth for S&P 500 constituents is likely to exceed 6%.

While the outlook for revenue expansion is optimistic, margin expansion is expected to be relatively modest due to ongoing cost pressures. Currently, the market’s main focus remains on capital expenditures by major cloud service providers on AI infrastructure, which is considered the underlying pillar supporting current U.S. stock valuation logic.

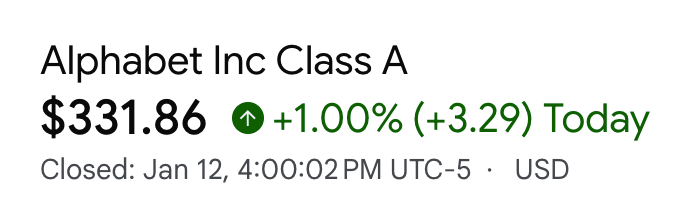

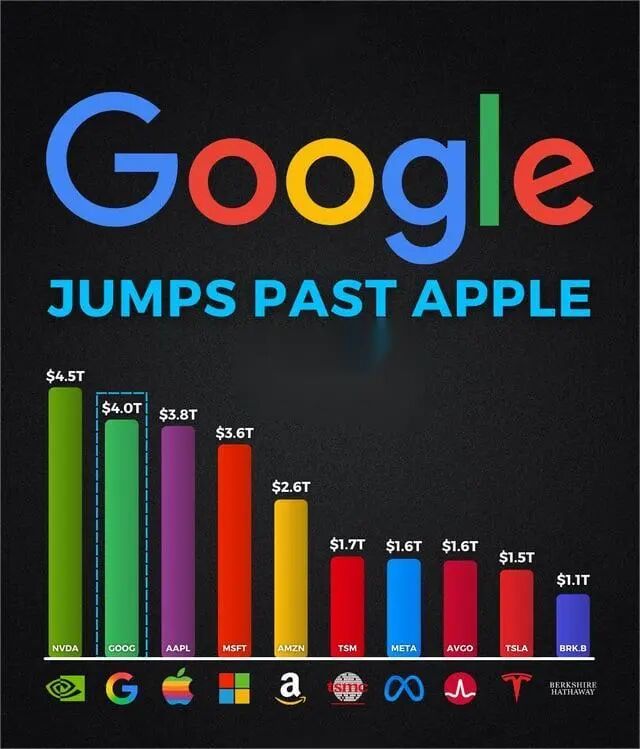

Google’s market cap surpasses $4 trillion

Google closed up by 1%, with its market capitalization breaking through the $4 trillion mark in one fell swoop.

According to U.S. Stock Investment Network, Apple has officially announced a partnership with Google to support Apple’s AI features, including a major upgrade to Siri later this year. Both tech giants confirmed the news on Monday.

Google wrote on its official blog, "Apple has reached a multi-year cooperation agreement with Google, under which the next generation of Apple Foundation Models will be based on Google’s Gemini models and cloud technology." "These models will support future Apple Intelligence features, including the more personalized Siri to be released later this year."

There were earlier reports that Apple was in preliminary talks with Google to use a customized Gemini model to power the new version of Siri.

Analysis by the U.S. Stock Investment Network believes this is not just a simple technology outsourcing, but rather a reshuffling of the power structure in the AI sector:

-

Google has established its dominance in "underlying infrastructure": When the world’s top hardware ecosystem chooses Gemini as its foundation, Google’s AI large model has in fact become the industry standard.

-

Leap from search to commercial closed loop: Google’s AI shopping integration solution announced simultaneously with Walmart is also significant. By introducing a new Universal Commerce Protocol, users can now complete the entire process "from discovery to checkout" within the Google interface. This end-to-end Gemini-powered experience is attempting to break the barriers of traditional e-commerce, upgrading Google from a mere traffic portal to a transaction hub.

In fact, our foresight on Google was evident early on. Back in June’s "U.S. Stock Investment Network Must-Buy Stocks" article, we at U.S. Stock Investment Network already recommended Google, with the bottom-fishing price at $169, and so far, the return has almost doubled!

Additionally, in our in-depth article on November 15, 2025, "U.S. Stocks: This Company Will Surpass Nvidia’s $5 Trillion Market Cap," we also presciently laid out Google’s vertical integration advantages in the AI era: from self-developed TPU chips (hardware computing power), the powerful Google Cloud platform (infrastructure), to the groundbreaking Gemini model (software algorithm), and the disruptive reconstruction of AI search.

Now that Google’s market cap has officially reached the $4 trillion mark, the stock price is fulfilling our earlier predictions one by one.

Being able to "position" in such a market in advance relies on the U.S. Stock Investment Network’s deep research into the industry’s underlying logic and long-term persistence.

Meta’s Grand Strategy

While tech giants are fiercely competing on large models and algorithms, META’s CEO Mark Zuckerberg has already set his sights on the physical endpoint of the AI race—power and infrastructure.

On January 12, Eastern Time, the company released a series of major signals in management restructuring and infrastructure investment, not only appointing executives with deep Washington backgrounds but also officially unveiling an internal organization aimed at managing hundreds of billions of dollars in spending.

“Wall Street + Washington” Executives Join

To clear obstacles for its massive AI infrastructure project, META has brought back one of Wall Street’s most powerful female executives—Dina Powell McCormick. As a former senior partner at Goldman Sachs, she was deeply involved in sovereign investment business and served as Deputy National Security Advisor during Trump’s first term.

The strategic intent behind this appointment is clear—what Zuckerberg needs is not only technical talent, but also a “diplomat” able to move between global sovereign wealth funds and governments. He stated on social media that McCormick will focus on cooperation with governments and sovereign entities, raising external financing for the company’s infrastructure investments.

Trump himself openly praised the appointment on Truth Social as an "excellent choice." As the AI competition enters its second half, energy approvals, land use, and cross-border capital flows are becoming new battlegrounds. By bringing in professionals with strong political backgrounds, META clearly aims to gain a head start in resource acquisition.

Coinciding with the executive appointment is a major internal organizational adjustment. Zuckerberg announced the establishment of a new organization called "Meta Compute", with Santosh Janardhan and Daniel Gross directly reporting to him.

The new organization’s task is to oversee the company’s infrastructure construction, which could total up to $600 billion over the next few years. Zuckerberg’s ambition is no longer limited to software iteration alone, but to build data center clusters on the scale of tens or even hundreds of gigawatts (GW). The company’s planned data center in Louisiana alone is as large as 5GW, with a physical footprint close to that of Manhattan.

To power these "electricity guzzlers," META has recently become one of the world’s largest nuclear power buyers, signing agreements with energy companies like VST and OKLO. This vertical integration from chip design, software stack to energy supply is the underlying logic behind its pursuit of "superintelligence."

The Strategic Balance Behind Layoffs

It’s worth noting, according to U.S. Stock Investment Network, META plans to lay off about 10% of its metaverse business Reality Labs’ staff in the near future.

By "lightening the load" on non-core or slow-progress metaverse divisions, Zuckerberg is freeing up more profit space and management focus to bet fully on AI infrastructure as the core engine. This strategic contrast reveals the company’s current direction of resource integration:

-

Business-side loss cutting: Continuously reducing redundant expenses at Reality Labs, improving efficiency, and alleviating Wall Street’s concern over the company’s overall profit margin.

-

Infrastructure-side increase: Saturating funds into data center and nuclear energy construction to ensure absolute computing power and energy reserves on the road to "superintelligence."

META is undergoing a dramatic "evolution." It is actively shedding the burdens left by old narratives and devoting itself wholeheartedly to a physical infrastructure AI war.

Although META’s stock price has been sluggish recently, hitting its lowest closing point in over a month since December 3rd, this short-term price pain is essentially a "capacity contraction" for long-term certainty pricing.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Why Meteora (MET) Is Rising Today?

Sui Blockchain Explains Major Outage, Claims Funds Were Safe

Revolut chairman Gilbert holds Swiss residence in Zug

Use of Stablecoins on Visa Direct Money Transfer Platform Expanded