What Are the Anticipated Results for Home Bancshares (HOMB) in Q4 Earnings

Home Bancshares Set to Announce Earnings: What Investors Should Know

This Wednesday after market close, regional bank Home Bancshares (NYSE:HOMB) is scheduled to release its latest earnings report. Here’s a breakdown of what to expect.

In the previous quarter, Home Bancshares exceeded revenue forecasts by 1.6%, posting $275.5 million in revenue—a 6.3% increase compared to the same period last year. The results were mixed: while the company delivered a strong outperformance on tangible book value per share, its earnings per share only narrowly surpassed analyst projections.

Analyst Expectations for This Quarter

For the upcoming quarter, analysts predict that Home Bancshares will generate $274 million in revenue, representing a 4.5% year-over-year increase. This growth rate is slower than the 8.8% rise recorded in the same quarter last year. Adjusted earnings per share are projected to be $0.60.

Home Bancshares Total Revenue

Over the past month, analysts have largely maintained their forecasts, indicating confidence that the company will maintain its current trajectory. Notably, Home Bancshares has missed Wall Street’s revenue expectations twice in the past two years.

Market Sentiment and Price Targets

As the first among its peer group to report this earnings season, Home Bancshares offers the earliest insight into how bank stocks might perform this quarter. Despite the uncertainty, investor sentiment has remained steady, with the stock price holding flat over the past month. In comparison, Home Bancshares shares have dipped 1.6% during the same period. The average analyst price target stands at $33.13, while the current share price is $28.29.

Looking Beyond Banking: The Next Big Opportunity

Many younger investors may not be familiar with the classic investment strategies outlined in "Gorilla Game: Picking Winners In High Technology," a book published over two decades ago when tech giants like Microsoft and Apple were just beginning to dominate. Applying those same principles today, enterprise software companies harnessing generative AI could become the industry leaders of tomorrow. In this context, we’re excited to share our exclusive free report on a high-growth, profitable enterprise software company that’s capitalizing on automation and poised to benefit from the generative AI trend.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Viral ‘Stranger Things’ AI Videos Raise New Concerns Over Deepfakes

Polygon and Tron Prices Rise But ZKP Solves the Privacy Problem for Big Money & Offers 1000x Potential

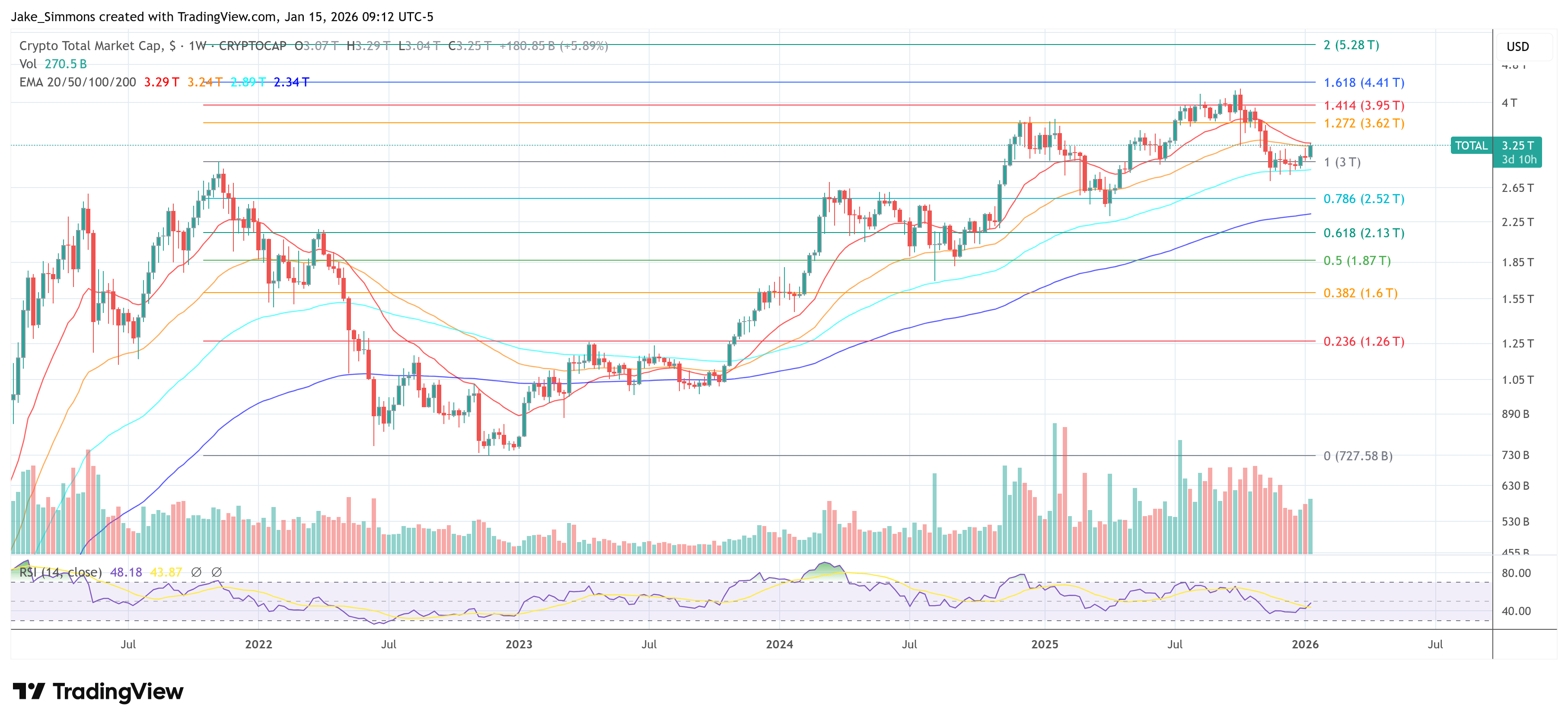

Keyrock Flags 12 Crypto Charts You Need To Watch This Year

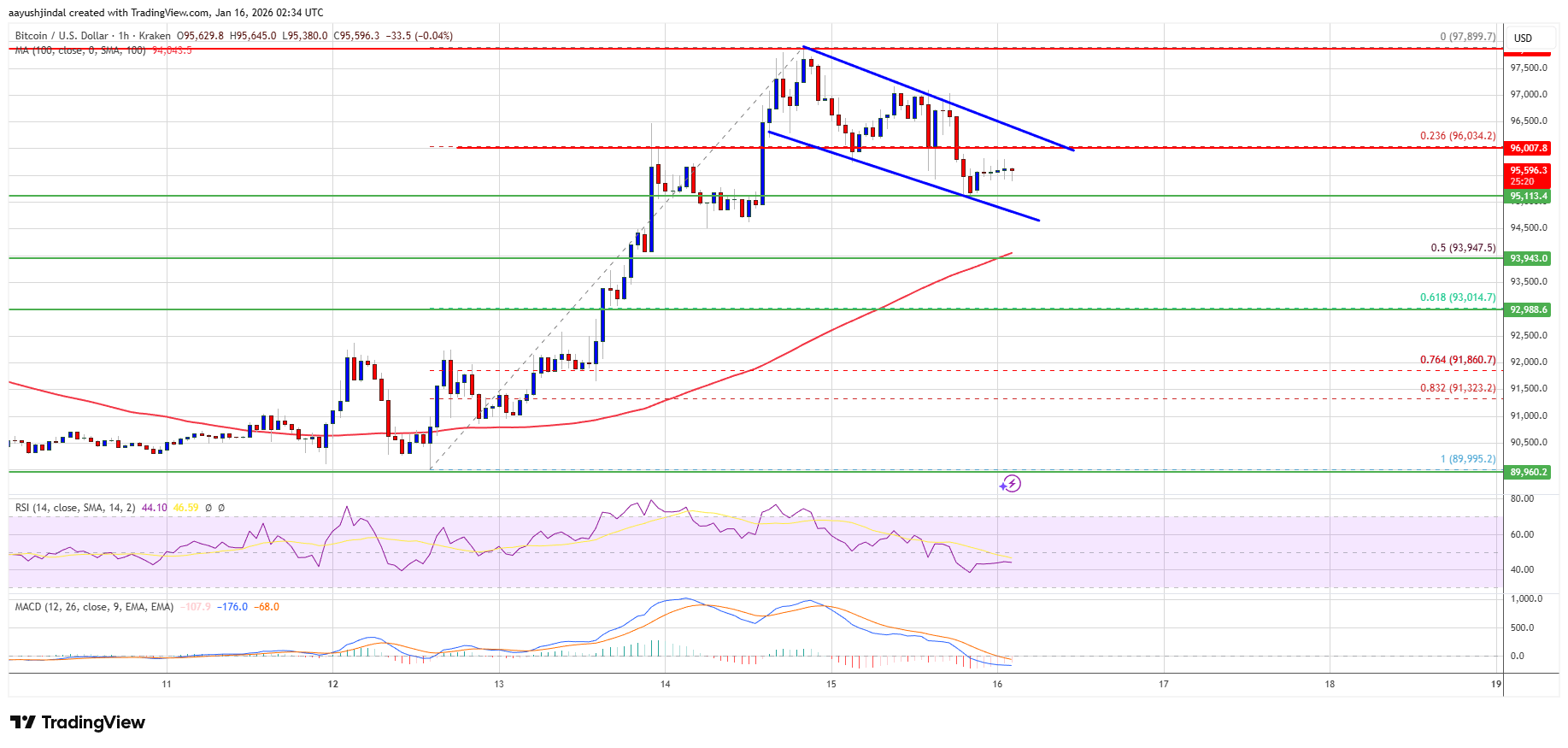

Bitcoin Price Blinks After the Run, Market Watches the Reaction