'Sell America' returns: The latest major developments as Trump sparks new waves of market volatility

Market Turbulence Returns Amid Trump Headlines

-

Monday saw renewed selling of US assets as investors processed a wave of recent news involving former President Trump.

-

Major stock indices experienced sharp swings, initially dropping before recovering as concerns about the Federal Reserve's independence took center stage.

-

Financial stocks, particularly credit card issuers, came under pressure following Trump's suggestion to impose a 10% cap on credit card interest rates.

Investor sentiment shifted notably at the start of the week, with the "sell America" trend making a comeback.

Market participants responded to several weekend developments, including a proposal to limit credit card interest rates and the Justice Department's criminal investigation into Fed Chair Jerome Powell.

Stocks fluctuated throughout the day as investors digested these headlines. After a steep decline at the open, the Dow Jones rebounded into positive territory, erasing a loss of more than 400 points.

US Market Snapshot (as of 2 p.m. ET Monday)

-

S&P 500: 6,977.09, up 0.16%

-

Dow Jones Industrial Average: 49,522.66, up 18 points (0.04%)

-

Nasdaq Composite: 23,760.625, up 0.4%

The Justice Department's investigation is linked to Powell's testimony last year regarding costly renovations at the Federal Reserve's offices—a project Trump has criticized.

Trump, who has reportedly chosen a successor to replace Powell when his term ends in May, told NBC he was unaware of the investigation, adding, "I don't know anything about it, but he's certainly not very good at the Fed, and he's not very good at building buildings."

The White House did not immediately comment on the situation.

Markets often react unpredictably when there are signs of political interference with the Fed. Trump has repeatedly urged the central bank to lower interest rates, both during his presidency and since. Investors worry that premature rate cuts could reignite inflation, forcing the Fed to tighten policy again later.

Such rapid market responses are not new. Paul Hickey, co-founder of Bespoke Investment Group, noted, "All these moves suggest a possible return of the 'sell America' trade," referencing the broad sell-off in US assets in 2025 amid concerns over tariffs and economic health.

David Morrison, senior market analyst at Trade Nation, observed, "Investors rushed to cut their exposure to US assets," highlighting worries about the Fed's independence and Powell's strong response in a video statement released Sunday.

Key Market Moves on Monday

Bond Yields Tick Higher

Treasury yields were mixed after rising across the board earlier in the session. The 10-year US Treasury and other long-term yields remained slightly elevated by afternoon.

John Canavan, lead analyst at Oxford Economics, commented, "Treasury yields are higher, and the curve is steeper amid fresh attacks on the Federal Reserve's independence."

Historically, yields have spiked when the president has intervened in Fed affairs or threatened Powell's position. Last April, yields surged after Trump suggested he could dismiss the Fed chair, though he later moderated his stance following heavy selling in the Treasury market.

Gold Hits New Highs

Gold—a traditional safe haven and inflation hedge—jumped 2% to surpass $4,600 for the first time on Monday, setting a new record.

The metal has climbed 4% since the start of the year and just achieved its strongest annual performance since 1979, a period marked by surging US inflation.

David Morrison of Trade Nation noted that demand for safe-haven assets remains "strong," especially as investors monitor ongoing geopolitical tensions involving the US, Venezuela, and Greenland.

Other metals that often move in tandem with gold, such as silver and copper, also advanced.

-

Silver: +5%

-

Copper: +2%

US Dollar Weakens

The US Dollar Index, which tracks the greenback against major foreign currencies, fell as much as 0.4% on Monday before recovering some ground. This decline suggests investors may be reducing their exposure to dollar-denominated assets amid concerns about the Fed's independence.

Morrison commented, "The investigation into Mr Powell has raised concerns about the Fed's autonomy, an unfavourable backdrop for the greenback."

Enrique Diaz-Alvarez, chief economist at Ebury, added, "The broader fear is that the move could continue to erode Fed autonomy, which may raise long-term inflation expectations and be bearish for the greenback."

Credit Card Lenders Slide

The financial sector was rattled after Trump called for a one-year cap on credit card interest rates at 10% via a post on Truth Social.

Trump wrote, "Please be informed that we will no longer let the American Public be 'ripped off' by Credit Card Companies that are charging Interest Rates of 20 to 30%, and even more, which festered unimpeded during the Sleepy Joe Biden Administration. AFFORDABILITY!"

Shares of major credit card issuers and lenders dropped in response:

-

Capital One: -9%

-

Citigroup: -4%

-

American Express: -4%

-

JPMorgan: -2%

-

Visa: -2%

-

Mastercard: -2%

Morrison added, "Trump's proposal to cap credit card rates at 10% for a year added another layer of uncertainty, particularly for banks."

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Chevron Gives Green Light to Expand Leviathan Gas Project in the Eastern Mediterranean

Bitcoin Momentum Recovery: The Critical Juncture That Could Spark a Dramatic Rally

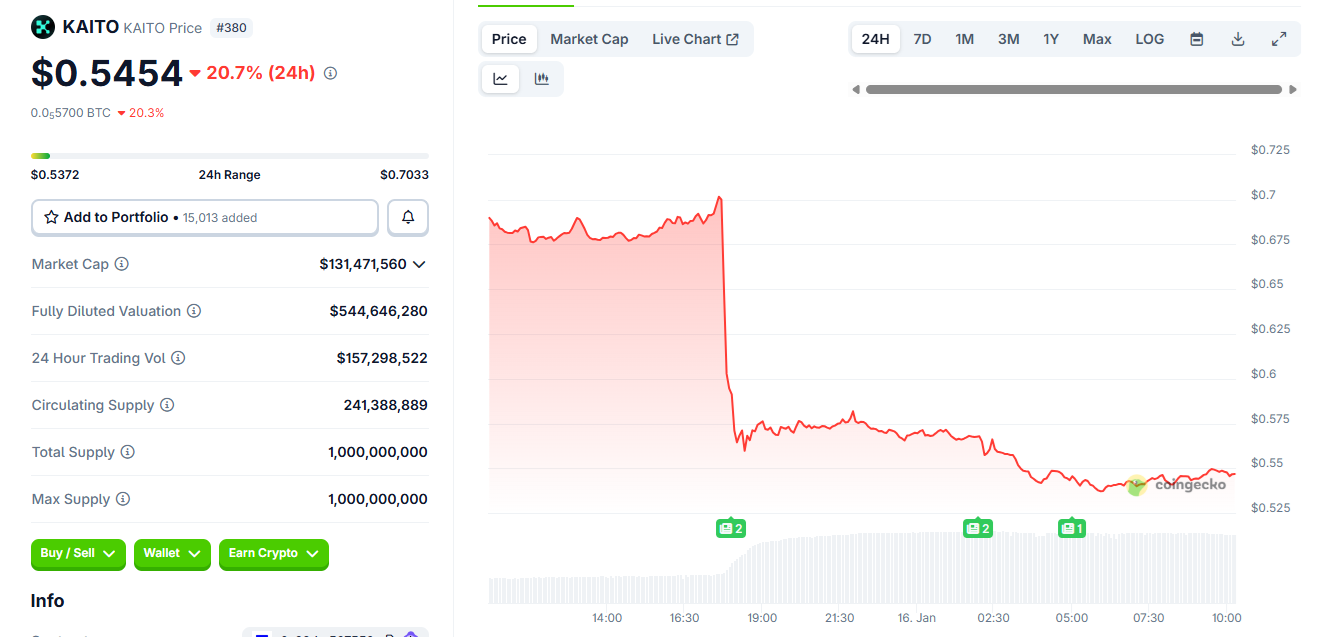

Kaito retires Yaps as token falls near all-time lows

The US Treasury market is experiencing a level of stagnation that is approaching record highs