Why UBS believes Trump's proposal to limit credit card interest rates at 10% might have unintended negative consequences

Trump's Proposal for Credit Card Interest Cap Shakes Financial Markets

-

Donald Trump's suggestion of a 10% ceiling on credit card interest rates triggered a sharp decline in financial sector stocks on Monday.

-

UBS warned that the proposed measure could lead to unintended negative outcomes.

-

According to UBS, instead of making credit cards more affordable, many issuers would likely restrict access to credit.

UBS cautioned that President Trump's plan to limit credit card interest rates could have significant and unforeseen repercussions.

Trump announced on Truth Social last Friday that he supports a temporary, one-year cap of 10% on credit card interest rates, arguing that the industry has been exploiting consumers.

This announcement led to a notable drop in the share prices of major financial institutions on Monday, including Capital One, Synchrony Financial, JPMorgan, and Citigroup.

While investors worried about the potential impact on lenders' profits, UBS analysts argued that the proposal could ultimately harm everyday Americans, despite its aim to lower borrowing costs.

Erika Najarian, an analyst at UBS, suggested that the proposed interest rate cap could have the opposite effect, reducing consumer spending and limiting lending to certain groups of borrowers.

Najarian explained that credit card companies would probably respond by tightening credit access for some consumers, rather than simply lowering rates.

She emphasized, "A 10% cap on credit card rates would most likely restrict credit for those who rely on it the most—particularly middle- and lower-income households."

The UBS analyst team noted that, although the chances of this proposal becoming law are slim, both consumers and investors would feel the impact of reduced credit availability.

They referenced Boston Fed data from May 2025, which showed household credit card spending by income bracket: under $39,000—about $26 billion; $59,000 to $83,000—roughly $37 billion; over $121,000—$175 billion. This means that at least 26% of credit card spending could be at significant risk, potentially causing a substantial economic effect.

UBS analysts also pointed out that consumer spending typically makes up around 70% of the US GDP. Credit card transactions represent nearly half of Visa's payment volume and more than half of Mastercard's. A reduction in credit access, as predicted by UBS, could seriously threaten US economic growth.

Erika Najarian is not alone in her concerns. Billionaire investor Bill Ackman also criticized Trump's plan, calling it a "mistake" and warning that millions of credit cards could be cancelled as a result.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP To Repeat Its 2017 Playbook? Analyst Points To 1,250% Rally

Bitmine Buys $65M in ETH Amid Market Momentum

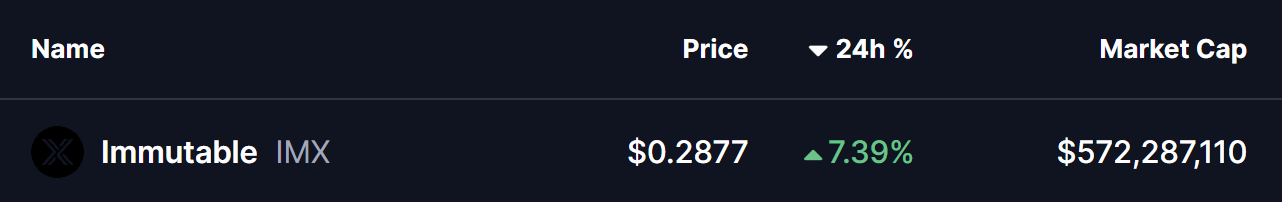

Immutable (IMX) To Rise Higher? This Emerging Bullish Pattern Hints at Upside Move!

XRP Confirms First Golden Cross of 2026, and Bulls Are Already Targeting 13% Upside