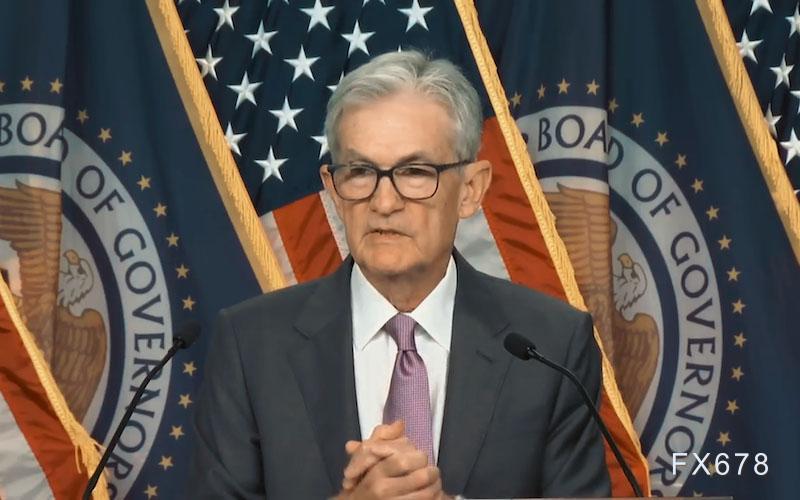

Powell Under Investigation Triggers "Institutional Panic," Multiple Officials Condemn, Gold Becomes Safe Haven Amidst Market Turmoil

FX678 January 13 News—— On Monday (January 12), the U.S. Department of Justice launched a criminal investigation into Federal Reserve Chairman Jerome Powell. Powell publicly denounced the move as an "unprecedented" attempt to exert political influence over the Fed's interest rate decisions.

On Monday (January 12), the U.S. Department of Justice launched a criminal investigation into Federal Reserve Chairman Jerome Powell. Powell publicly denounced the move as an "unprecedented" attempt to exert political influence over the Fed's interest rate decisions.

According to sources familiar with the matter, the investigation was initiated by Washington District Attorney Jeanine Pirro, an ally of U.S. President Donald Trump. The Federal Reserve confirmed receipt of the subpoena. A source noted that prior to issuing the subpoena, neither Attorney General Pam Bondi nor Deputy Attorney General Todd Blanche were informed of the decision.

The escalation of the situation has triggered strong opposition from former Fed leadership and key Republican senators, raising concerns about the independence of the Federal Reserve. The market response was an increase in U.S. Treasury yields, as investors weighed the risks of potential political interference with the Fed.

Official Reason and Powell's Accusation

In a public statement, Pirro said the Department of Justice acted after the Fed ignored a request to discuss cost overruns on the renovation of its two historic headquarters buildings. Pirro wrote on the social media platform X: "This office's decision is based on facts, and nothing else."

However, Powell described the investigation as a direct attack on the Federal Reserve's autonomy. While stating his respect for the rule of law, he argued that the investigation was not genuinely about his congressional testimony regarding the renovation project.

Powell declared: "These are pretexts. The threat of criminal charges is because the Federal Reserve sets interest rates based on our assessment of what best serves the public, not in accordance with the president's preferences." He added that this "unprecedented action should be seen as part of a broader context of government threats and ongoing pressure."

President Trump claimed he was unaware of the Department of Justice's actions, but added that Powell "certainly hasn't done well at the Fed, nor at building construction."

Bipartisan Backlash and Institutional Warnings

This move sparked swift condemnation from the political and economic establishment, uniting both Powell's critics and allies in opposition to the government's actions.

Warnings from Former Fed Chairs

Former Fed Chairs Janet Yellen, Ben Bernanke, and Alan Greenspan joined other former economic officials in a joint statement. They warned that the investigation mirrored tactics used in unstable economies. They wrote: "This is how emerging markets run monetary policy when institutions are weak, with extremely negative consequences for inflation and economic performance."

The principle of Fed independence is a cornerstone of modern economic policy, designed to insulate monetary policy decisions from short-term political pressures to ensure long-term price stability.

Republican Senators Condemn the Investigation

Several key Republicans on the Senate Banking Committee (which oversees the Federal Reserve) publicly criticized the investigation.

Senator Thom Tillis called the move a "huge mistake" and threatened to oppose any Trump Fed nominee, including Powell's successor, until the issue is resolved.

Senators Kevin Cramer and Lisa Murkowski expressed similar concerns, with Murkowski stating: "If the Federal Reserve loses its independence, both our market stability and the overall economy will be affected."

Senator Cynthia Lummis, usually a sharp critic of Powell, said the use of criminal statutes appeared "very difficult" and that she saw no criminal intent.

Senator John Kennedy bluntly stated: "We simply don't need this, just like we don't need a hole in our head."

It was reported that Treasury Secretary Scott Besant told President Trump that the investigation has "created a mess" and could harm financial markets.

How Markets Interpret the Fed’s Crisis

Financial market reactions have been mixed but telling. Long-term U.S. Treasury yields have risen, indicating investor concerns that reduced Fed independence could lead to higher inflation. Persistently rising borrowing costs could undermine government efforts to address economic affordability issues.

Meanwhile, as investors sought safe-haven assets, gold prices hit a record high of $4,630.08 per ounce (UTC+8) on Monday, and hovered around $4,595 during Asian trading on Tuesday (UTC+8), remaining at relatively high levels. However, major stock indices closed at record highs, led by technology and retail sectors. The event is expected to provide lasting support for gold prices.

(Spot gold daily chart, source: Easy FX678)

Krishna Guha of Evercore ISI pointed out that markets are "taking significant comfort" from the strong political backlash against attacks on Fed independence, seeing it as a counterbalance to government pressure.

What’s Next for Powell and the Fed?

This confrontation marks a new and more turbulent chapter in the ongoing friction between the White House and the Federal Reserve. Until now, Powell has avoided direct public clashes with the administration.

The emergence of this criminal investigation comes as the Supreme Court is scheduled to hear arguments in two weeks regarding the administration's attempt to dismiss another Fed official, Governor Lisa Cook.

Powell was nominated by Trump at the end of 2017, and his term as chairman will end in May 2026. However, he can remain as a member of the Fed Board until 2028. Some analysts believe that this latest round of pressure increases the likelihood that he will choose to stay on as a sign of resistance.

11:12 (UTC+8), spot gold is quoted at $4,597 per ounce.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

VIPBitget VIP Weekly Research Insights

Bitcoin’s Resurgence: US Demand Shifts Market Sentiment

India Crypto Industry Pushes Tax Reform Ahead of Feb Budget