CME to Adjust Margin Requirements for Precious Metals Amid Price Volatility

CME Group Updates Margin Calculation for Precious Metals Futures

CME Group has announced a revision to its margin-setting process for gold, silver, platinum, and palladium futures contracts, following recent sharp price increases and heightened market volatility.

According to a statement from CME, margins will now be determined as a percentage of the notional value of the contracts, replacing the previous method that used a fixed dollar amount.

This change will be implemented at the close of trading on Tuesday. CME explained that the adjustment follows a standard review of market conditions to maintain sufficient collateral levels.

Precious metals have experienced a remarkable upswing in recent months, with significant gains and volatility extending into the current year. On Monday, both gold and silver reached new highs, with silver climbing roughly 20% since the start of 2026.

Christopher Wong, a strategist at Oversea-Chinese Banking Corp., noted that the revised margin system could temporarily put downward pressure on precious metals prices. He added that using a percentage-based margin is more responsive to market needs and reduces the frequency of adjustments. However, should volatility exceed historical norms or unexpected events occur, the percentage could still be raised.

Last year, CME made several changes to margin requirements for precious metals as prices surged, trading volumes increased, and volatility intensified.

Clearinghouses such as CME require brokers to post daily margin deposits to safeguard against potential losses on client positions.

According to CME’s website, these margin requirements are designed to ensure that clearing members can fulfill their obligations to both their clients and the clearinghouse itself.

The rally in metals has been fueled by various factors, including concerns about a weakening US dollar, expectations of further interest rate cuts in the US, and the Federal Reserve’s autonomy.

Silver has also attracted attention amid speculation that it could be targeted by new US import tariffs.

©2026 Bloomberg L.P.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Zero Knowledge Proof Secures AI and Enables Safe Decentralized Marketplaces for Monetizing Sensitive Data

Altcoin Market Sets Up for a Possible $1T Rotation — 5 Tokens Positioned for a 60% Breakout This Month

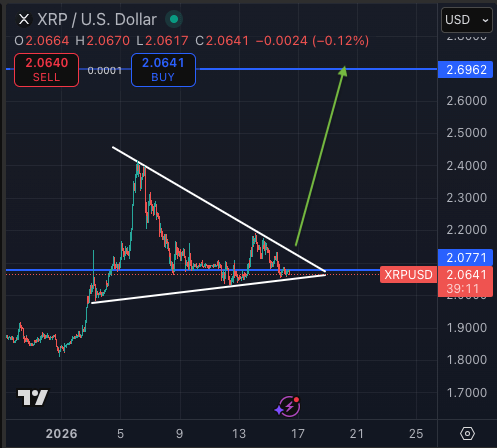

XRP Breakout Possible Before The Weekend, Expert Says

Crypto Market Review: Fake Bitcoin (BTC) Breakthrough; Shiba Inu (SHIB): Third Time's a Charm; XRP: 3 Price Waves