Altcoin Daily, one of YouTube’s largest crypto news channels, argues that Bitcoin’s recent technical breakdown—not its fundamentals—is what’s keeping major institutional capital on the sidelines, despite what the host calls “the best setup for crypto we’ve ever had.”

The episode leans on an older interview clip with billionaire macro trader Stanley Druckenmiller to explain why: big money won’t touch even a strong fundamental story if the chart has turned against it.

“If the Bitcoin Price Chart Stinks, I Won’t Do It”

In the resurfaced Stanley Druckenmiller clip, the veteran investor & multi-millionaire describes his process: roughly 75–80% of the ideas are driven by fundamentals, then “verified by the chart.”

Sponsored

He reviews hundreds of daily, weekly, and monthly charts every evening and says that if he likes a thesis but the technicals look bad, he stays out. With “6,000 girls out there,” as his former boss crudely put it, there are always “20 or 30” assets that are both fundamentally and technically attractive. Institutions, Altcoin Daily suggests, will apply the same logic to Bitcoin.

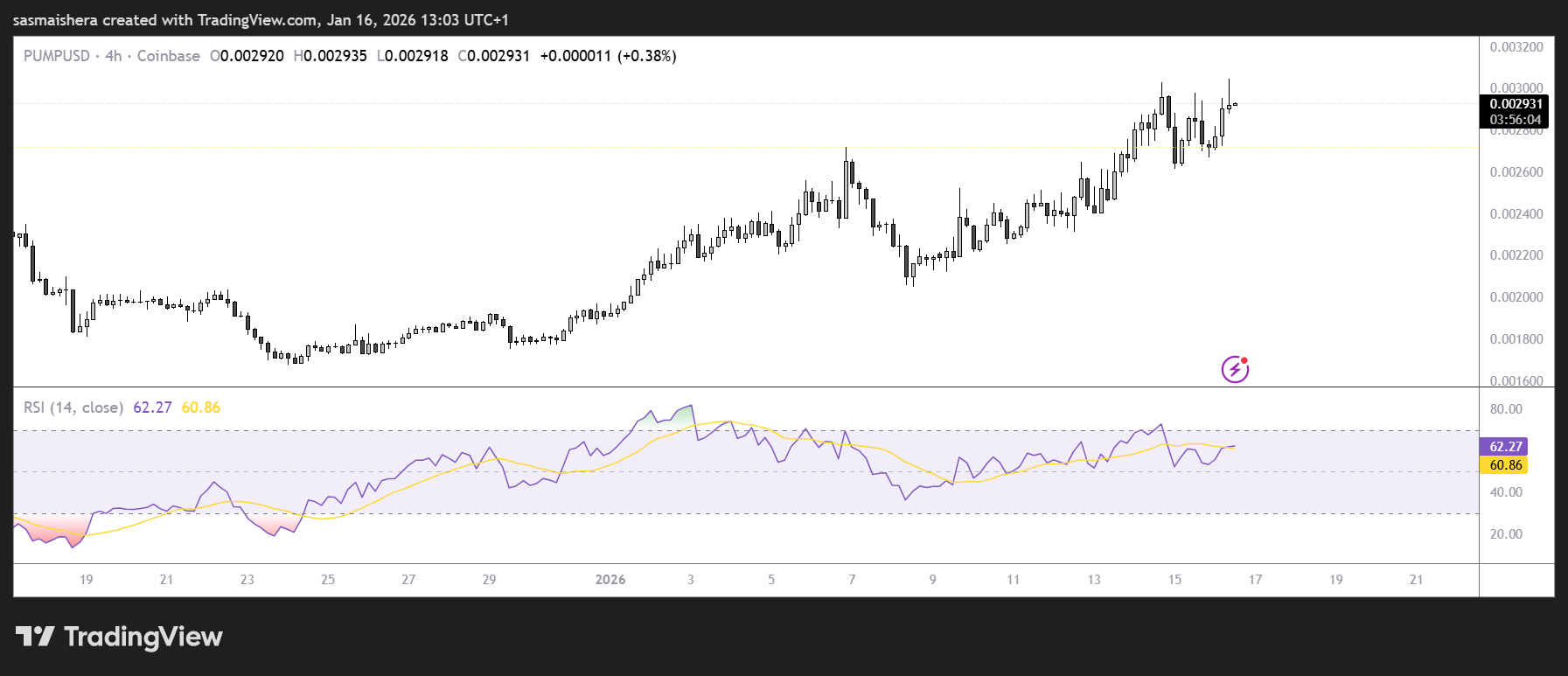

The host argues that Bitcoin’s recent break below its 50‑week moving average—followed by confirmation—has historically signaled the start of a new bear market, with prior cycles only bottoming near the 200‑week moving average. That level currently sits around $57,000–$58,000, according to the video.

October 10’s “Mini Black Swan” Deciphered

To explain how the chart got “broken,” the channel turns to a recent interview with BitMEX co‑founder Arthur Hayes, who walks through what he says happened on October 10 on Binance and other venues.

Hayes claims an attacker exploited how Binance marked margin positions collateralized with certain stablecoins. By pushing prices on a less-liquid internal market, they allegedly triggered outsized liquidations relative to the capital deployed.

The sequence, as described:

- Mark price distortion on specific stablecoins

- Forced liquidations on cross‑collateral margin positions

- Market makers pulling liquidity and “de-risking”

- An API issue that left some traders unable to see or manage positions

- Cascading liquidations across altcoins and leveraged DeFi strategies

Hayes also says many over-leveraged traders, some market-making firms, and several DeFi lending protocols suffered “catastrophic failures” or went out of business, leading to a sharp, liquidity-driven crash rather than a shift in long‑term fundamentals.

Bullish Bitcoin Thesis, Bearish Price Chart

Altcoin Daily frames this as a temporary but serious speed bump for institutional adoption. On one hand, the host highlights macro tailwinds: ongoing money printing into 2026, expectations of friendlier U.S. legislation, and a broader tokenization push—even mentioning the SEC’s role in bringing traditional assets on-chain.

On the other hand, he stresses that institutions now see a chart that historically precedes deeper downside. If they can find “20 or 30” other assets that are both fundamentally strong, as well as technically intact, they may wait for either a time-based reset or a full capitulation move closer to the 200‑week moving average.

For traders who understand the October 10 mechanics and view it as an exogenous shock rather than a structural failure of Bitcoin itself, the channel presents this divergence—bullish fundamentals, damaged technicals—as an opportunity to build or increase positions while “big money” hesitates.

People Also Ask

No. It notes that historically a confirmed break below the 50‑week moving average has preceded bear markets, and suggests institutions will treat that signal cautiously.

He’s skeptical of conspiracy theories and instead focuses on how published margin and pricing rules were exploited, plus system issues that compounded the move.

The host cites the 200‑week moving average around $57,000–$58,000 as the level where past bear markets have often found a bottom.

The video is broadly optimistic on regulation and tokenization, arguing that clearer rules and on‑chain traditional assets strengthen the long‑term crypto thesis.