Research Report|In-Depth Analysis and Market Cap of Fuse Energy (ENERGY)

Bitget2026/01/13 06:41

By:Bitget

I. Project Overview

Fuse Energy is a vertically integrated renewable energy utility platform designed to guide users toward optimized energy consumption through on-chain incentive mechanisms (such as peak shaving and valley filling to balance grid load), enable peer-to-peer energy trading, and reward users based on real behavioral data. The platform has been operating stably for nearly four years and has attracted approximately 200,000 users in the UK.

Unlike traditional energy companies, Fuse Energy simultaneously covers solar and wind power generation, energy retail, end-user installation services, and an embedded smart token incentive system, forming a closed-loop ecosystem from supply to consumption. The project emphasizes sustainable real revenue (with an estimated annual recurring revenue (ARR) of approximately USD 400 million by the end of 2025), rather than relying purely on token trading or speculation. Fuse Energy built its physical and service infrastructure first and issued its token afterward, deeply focusing on the energy vertical and adopting a DePIN (Decentralized Physical Infrastructure Network) model to promote efficient energy collaboration and value transfer.

From a technical architecture perspective, Fuse Energy is built on the Solana blockchain using the SPL standard and adopts a modular design compatible with mainstream ecosystems such as Ethereum. The platform integrates smart contracts with consensus mechanisms (such as Proof of Solution) to support privacy-preserving yet auditable energy transactions, load scheduling, and transparent incentive distribution. Users can connect local energy devices through the app to earn token rewards while participating in grid optimization.

$ENERGY is the platform’s native utility token, serving functions including system governance, revenue sharing, and service redemption. It incentivizes users to balance grid load in exchange for token rewards and supports token burning for services or rewards, forming a deflationary positive feedback loop. Token allocation emphasizes community and ecosystem incentives, with no fixed total supply, and is designed as a non-speculative asset. In 2025, the project completed a USD 70 million financing round at a USD 5 billion valuation, received a SEC no-action letter, launched its mainnet, and plans to expand into European and U.S. markets—demonstrating strong application support through real-world deployment and stable cash flows.

II. Project Highlights

Business Model

Fuse Energy is a pioneer in deeply integrating full-stack renewable energy solutions with blockchain technology. By dynamically binding real energy assets (such as solar and wind power plants, home energy storage, and EV charging stations) with on-chain incentive mechanisms, the platform improves energy coordination efficiency and grid operations. Users who participate in distributed energy resource management receive crypto incentives, effectively accelerating large-scale adoption of renewable energy and real-world Web3 applications.

Innovative Token Incentive and Closed-Loop Economic Model

The platform has built an innovative “token flywheel” economic model based on energy production, end-user retail, service integration, and real-time data. The system automatically identifies optimization windows based on real-time electricity prices and grid load, verifies actual value creation, and distributes $ENERGY tokens precisely. Token holders can participate in governance and revenue sharing, redeem physical products or premium services, or reduce electricity costs through token burning—closely binding tokens to real energy demand and forming a sustainable incentive loop.

Large-Scale Real-World Adoption and Commercialization

Compared with similar projects that remain largely conceptual, Fuse Energy has achieved meaningful user scale, customer conversion, and cash flow growth. Since its founding in 2022, the platform has served approximately 200,000 UK households, generating around USD 400 million in ARR, and covering a wide range of real users and operating distributed energy sites. The project demonstrates clear commercial validation and sustained growth potential. To date, Fuse Energy has raised approximately USD 160 million and reached a valuation of USD 5 billion, with backing from well-known institutions such as Multicoin Capital and Balderton Capital.

Innovative Solutions to Global Energy Challenges

Fuse Energy focuses on addressing global energy challenges driven by AI, EV adoption, and increasing electrification—such as grid congestion, delays, and price volatility. Through its DePIN architecture, the project converts coordinated energy optimization into on-chain incentives, enhancing grid flexibility and stability. This provides sustainable power support for next-generation high-load energy scenarios (e.g., AI computing). Its long-term vision is to promote decentralized access to renewable energy and resilient energy management.

III. Market Capitalization Outlook

Fuse Energy has raised a total of USD 160–168 million across three funding rounds, reaching a latest valuation of USD 5 billion:

Market Cap Expectation Analysis

Baseline Assumptions:

Company valuation: USD 5 billion (post–Series B, December 2025) ARR multiple: 12.5x (USD 5B / USD 400M ARR), within a reasonable range for high-growth SaaS and energy technology companies

Token

FDV Scenarios:

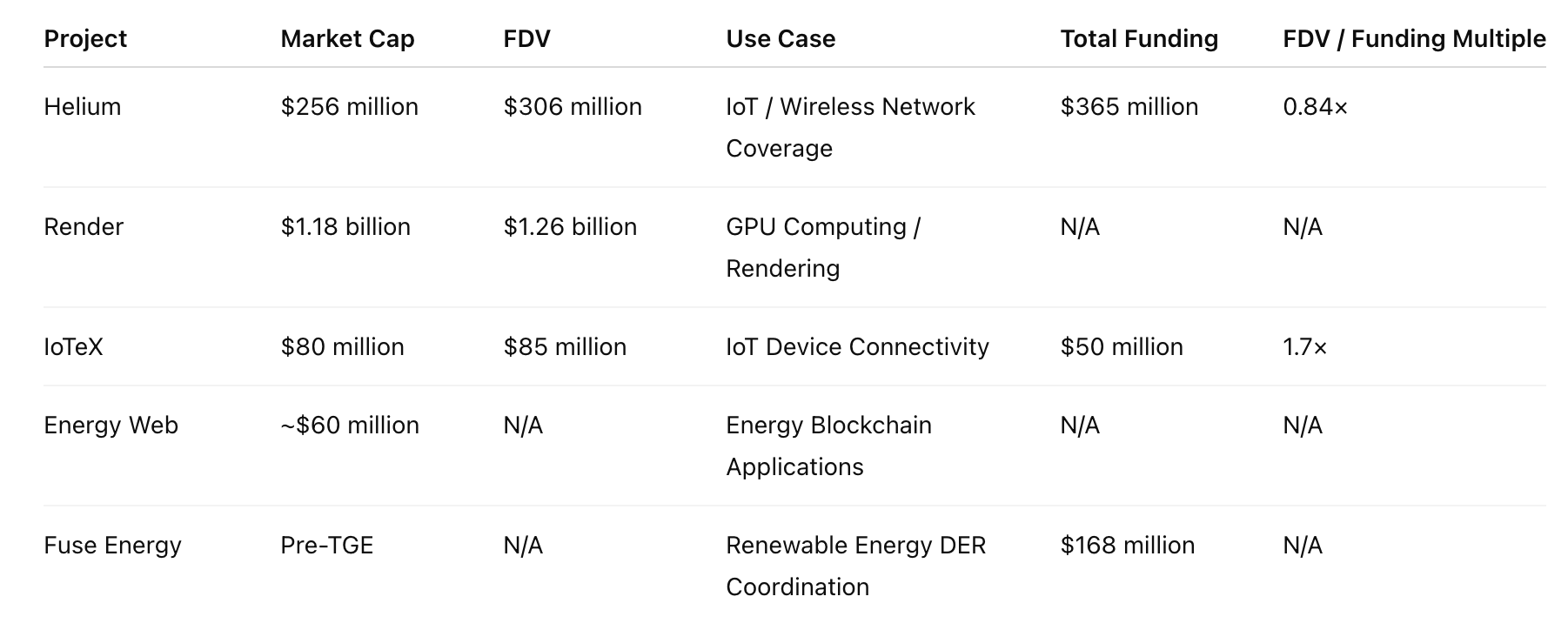

-Conservative scenario (USD 20–40B): Based on Helium’s financing-to-FDV ratio (0.84x), Fuse’s USD 168M funding implies a base FDV of ~USD 140M. However, strong real revenue support could justify a 5–10x premium. Considering potential cooling of the DePIN narrative, FDV may remain below the company valuation.

-Base case (USD 40–50B): Token FDV roughly aligns with company valuation, reflecting USD 400M ARR, regulatory compliance, and integration with the Solana ecosystem. This corresponds to a market cap of approximately USD 1.5–2.0B (assuming 30–40% initial circulating supply).

-Bull case (USD 50–80B): Render’s USD 12.6B FDV in the GPU compute sector shows that vertical DePIN projects can command premium valuations. If the energy DePIN narrative strengthens and the platform expands toward a 1 TW renewable energy target, FDV could exceed company valuation.

Key Variables: TGE timing (not yet announced), initial circulating supply, DePIN market sentiment, and sustainability of ARR growth.

IV. Tokenomics

The total supply of $ENERGY is 10 billion tokens, allocated as follows:

-Network incentives (60.8%): Used for ecosystem incentives and network participant rewards, with a “diminishing early adopter advantage” release mechanism. As the network matures, the release pace gradually slows to reduce long-term inflation pressure.

-Team allocation (13.8%): Subject to a 12-month cliff, followed by four linear releases at months 15 / 18 / 21 / 24, each releasing 20%, aligning team incentives with long-term project goals.

-Investor allocation (25.4%): Also subject to a 12-month cliff, followed by four releases at months 15 / 18 / 21 / 24, each releasing 20%, balancing early investor returns with secondary market sell pressure.

Primary token utilities include:

-Governance and decision-making: Participation in protocol upgrades and partner selection.

-DePIN incentives: Rewards for distributed energy device integration and demand response contributions.

-Grid balancing and smart contract settlement: Optimizing electricity allocation and resource utilization through on-chain contracts.

-Fee payments and revenue sharing: Supporting energy payments and platform revenue distribution.

-Other uses: Acting as on-chain fuel or liquidity incentives, and participating in task rewards and community airdrops.

V. Team and Financing Information

Alan Chang, Co-Founder & CEO, Imperial College London graduate, former Chief Revenue Officer and Senior Vice President at Revolut, where he oversaw USD 1.7 billion in funding and growth to a USD 45 billion valuation.

Alan Chang, with first-class honors from University College London, former Head of Strategy at Revolut and investor at Mosaic, brings combined expertise in fintech and energy innovation, supporting the integration of blockchain with renewable energy.

Fuse Energy has raised approximately USD 160–168 million across three funding rounds and achieved a USD 5 billion valuation post–Series B.

-Seed round (September 7, 2022): USD 78 million, led by Balderton Capital and Lakestar, with participation from Ribbit Capital, Accel, BoxGroup, Creandum, and Lowercarbon Capital.

-Strategic / Series A rounds (September 2024 & July 2025): USD 10–12 million, led by Multicoin Capital, with strategic participation from Solana founder Anatoly Yakovenko.

-Series B (December 18, 2025): USD 70 million at a USD 5 billion valuation, co-led by Balderton Capital and Lowercarbon Capital. Proceeds will be used to accelerate global expansion and vertically integrate renewable energy operations, with a focus on the U.S. and high-demand European markets.

VI. Potential Risks

Fundamental Risks

The energy sector is highly regulated, and deep integration between blockchain systems and physical grid infrastructure may face complex legal, compliance, and engineering challenges. Changes in regulatory environments could directly impact token issuance, operational compliance, and business expansion.

The project’s ability to sustain large-scale user adoption, continuously optimize user experience, and ensure blockchain system availability and security will be critical to maintaining long-term incentive effectiveness. Failure to achieve widespread adoption or match the reliability of traditional energy networks could weaken token circulation and real value support.

Token Sell-Pressure Risk

Phase 1: Early circulation and incentive release (TGE–12 months)

Early circulation is primarily driven by network incentives (60.8%). Due to the “diminishing early adopter advantage” mechanism, release rates are relatively faster at the beginning to onboard nodes, users, and ecosystem participants. Sell pressure is expected to be fragmented, small in size, and continuous, driven mainly by participant monetization behavior rather than one-off shocks.

Phase 2: Concentrated unlock window (12–24 months)

After the 12-month cliff, team (13.8%) and investor (25.4%) tokens will unlock in four tranches at months 15 / 18 / 21 / 24. This period represents the core sell-pressure risk window, with clearly defined unlock sizes and predictable timing. Given low entry costs for early investors, insufficient market liquidity or fundamental support could lead to notable volatility and pre-/post-unlock price speculation.

Phase 3: Mid-to-late inflation absorption (post–24 months)

Once major team and investor allocations are fully released, structural sell pressure should decline significantly. Supply dynamics will shift toward long-term network incentive emissions. If network usage, real revenue, and token utility form a positive feedback loop, inflation may be absorbed by demand; otherwise, ongoing incentive releases could translate into slow but persistent price pressure.

Overall Assessment:

$ENERGY’s sell-pressure risk exhibits a “mid-term heavy, early and late relatively manageable” structure. Close attention should be paid to the 12–24 month unlock window and whether real ecosystem demand growth can absorb supply. Broader market cycles, early post-listing volatility, and potential shakeouts should also be considered.

VII. Official Links

Website:

https://www.fuseenergy.com

Disclaimer: This report is generated by AI and does not constitute any investment advice.

0

0

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

PoolX: Earn new token airdrops

Lock your assets and earn 10%+ APR

Lock now!

You may also like

Why Molson Coors (TAP) Stock Is Dropping Today

101 finance•2026/01/16 21:36

Why Shares of Sirius XM (SIRI) Are Falling Today

101 finance•2026/01/16 21:36

Why Shares of PNC Financial Services Group (PNC) Are Rising Today

101 finance•2026/01/16 21:36

Why Trimble (TRMB) Stock Is Dropping Sharply Today

101 finance•2026/01/16 21:36

Trending news

MoreCrypto prices

MoreBitcoin

BTC

$95,477.23

-0.04%

Ethereum

ETH

$3,292.95

-0.21%

Tether USDt

USDT

$0.9995

-0.02%

BNB

BNB

$934.96

+0.60%

XRP

XRP

$2.08

+0.24%

Solana

SOL

$145.09

+2.14%

USDC

USDC

$0.9997

-0.00%

TRON

TRX

$0.3102

-0.25%

Dogecoin

DOGE

$0.1379

-1.29%

Cardano

ADA

$0.3967

+1.13%

How to buy BTC

Bitget lists BTC – Buy or sell BTC quickly on Bitget!

Trade now

Become a trader now?A welcome pack worth 6200 USDT for new users!

Sign up now