5 Insightful Analyst Inquiries from Penguin Solutions’s Fourth Quarter Earnings Call

Penguin Solutions Q1 Performance Overview

Penguin Solutions delivered a strong start to the year, with the market responding favorably to its first quarter results. Leadership highlighted solid enterprise demand and noted a trend of AI adoption expanding beyond hyperscale environments. CEO Mark Adams emphasized the company's swift development workshops and customized system design expertise, which have played a key role in attracting new clients, especially in the fields of advanced computing and memory. The management team also credited improved operational efficiency and reduced inventory days for supporting performance, while recognizing persistent challenges in the LED business.

Should You Consider Investing in PENG?

Curious if now is the right moment to invest in Penguin Solutions?

Key Takeaways from Penguin Solutions Q4 CY2025

- Total Revenue: $343.1 million, surpassing analyst forecasts of $339.1 million (flat year-over-year, 1.2% above expectations)

- Adjusted EPS: $0.49, exceeding projections of $0.44 (a 10.6% beat)

- Adjusted EBITDA: $45.24 million, ahead of the $43.21 million estimate (13.2% margin, 4.7% above forecast)

- Management reaffirmed its full-year Adjusted EPS target at $2 (midpoint)

- Operating Margin: 5.7%, consistent with the same period last year

- Inventory Days Outstanding: 78, down from 96 in the previous quarter

- Billings: $262.2 million at quarter’s end, representing a 23.1% increase year-over-year

- Market Cap: $1.02 billion

Analyst Q&A Highlights

While management’s prepared remarks are informative, the unscripted analyst questions often reveal deeper insights and address complex or sensitive topics. Here are the most notable questions from the recent earnings call:

Top 5 Analyst Questions from the Q4 Call

- Brian Chin (Stifel): Inquired about quarter-to-quarter revenue patterns and potential risks in memory supply. CEO Mark Adams pointed out that advanced computing faces timing issues with new customer contracts, while CFO Nate Olmstead identified memory supply as a critical factor for annual growth.

- Brian Chin (Stifel): Asked about progress with channel partners. Adams reported stronger ties with CDW, NVIDIA, and SKT, which are helping to expand the advanced computing pipeline and unlock larger enterprise deals.

- Manmohanpreet Singh (JPMorgan): Sought details on enterprise AI adoption and diversification. Adams observed a shift from hyperscale to broader enterprise AI implementation, with more opportunities and increased planning for future growth.

- Matthew Calitri (Needham & Company LLC): Questioned whether inventory levels signal future shipment trends. Olmstead responded that inventory turnover remains healthy, with the company typically purchasing to fulfill orders and leveraging its balance sheet to secure supply in a tight memory market.

- Madison de Paola (Rosenblatt Securities): Asked about the industry’s move toward optical memory. Adams interpreted recent industry developments as validation of Penguin’s optical memory strategy, reinforcing the company’s direction for future memory solutions.

Upcoming Catalysts to Watch

Looking ahead, analysts will be closely tracking several factors: the pace of enterprise and government AI project bookings and deployments, the company’s ability to source and deliver memory components amid ongoing supply challenges, and efforts to broaden its customer base in advanced computing and memory. Progress in the LED segment and the growth of strategic technology partnerships will also be key indicators to monitor.

Penguin Solutions shares are currently trading at $19.37, down from $21.65 prior to the earnings announcement. Is this a pivotal moment for the stock?

Top Stock Picks for Today

Don’t let your investment strategy rely on outdated trends. The risks associated with overcrowded stocks are increasing every day.

This handpicked selection of High Quality stocks has delivered a remarkable 244% return over the past five years (as of June 30, 2025).

Our list features well-known names like Nvidia (up 1,326% from June 2020 to June 2025) as well as emerging companies such as Tecnoglass, which achieved a 1,754% five-year return.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Jinping wants to curb price wars between China’s tech groups

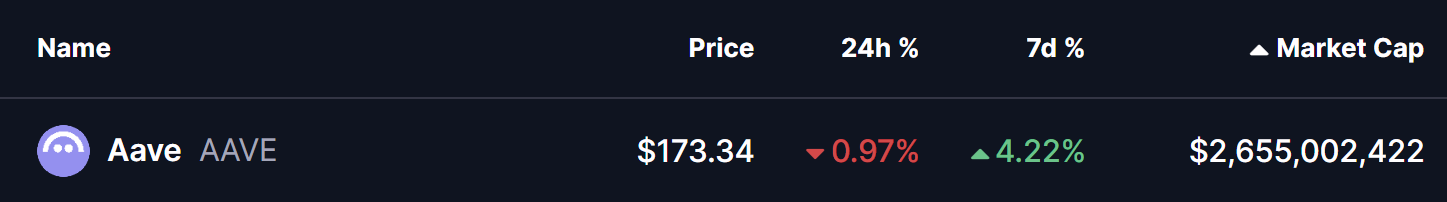

Is Aave (AAVE) Setting Up for a Potential Breakout Next Week? Key Emerging Pattern in Focus

Altcoin XRP Setting Up for the C Wave Push, Ripple’s Native Asset Prepares for Bullish Ascent

Sequoia to join GIC, Coatue in Anthropic investment, FT reports