Why Latin American markets are outperforming worldwide returns in 2026

Latin American Markets Lead Global Gains in Early 2026

At the outset of 2026, financial assets across Latin America have surged to the forefront of global markets, propelled by a rare convergence of favorable political shifts, robust commodity prices, and renewed international interest in emerging economies.

Stock markets and local currencies throughout the region have significantly outperformed their developed market counterparts, reversing a trend of lagging returns seen in previous years.

This positive momentum stems from a series of closely timed events. A persistent rally in commodity prices—especially in industrial and precious metals—has bolstered the economic prospects of South American nations that rely heavily on exports.

Additionally, while the long-term effects of the recent removal of Venezuela’s Nicolás Maduro by the United States remain uncertain, some investors interpret the development as a step toward reducing the geopolitical risks that have historically weighed on the region.

Further fueling optimism, the announcement of the EU–Mercosur trade pact has reignited hopes for deeper economic ties between Europe and Latin America, despite lingering questions about its full enactment.

Global economic trends have also played a crucial part. Leading financial institutions such as Bank of America and AllianceBernstein report that a softer US dollar in 2026 is enhancing the attractiveness of emerging market investments.

Historically, periods of dollar weakness have coincided with strong performance in emerging markets, as investors seek higher returns abroad.

Countries with significant exposure to metals have been among the biggest winners. Chile and Peru, both major exporters of copper, silver, and gold, have reaped substantial benefits from the ongoing metals boom.

Chile, recognized as the world’s top copper exporter, shipped 14.9 million tonnes of copper in 2024, according to ITC Trade Map statistics.

Latin America Outpaces Global Peers

Data from CountryETFTracker reveals that five Latin American nations now rank among the top ten global equity markets over the past quarter.

Chilean equities have soared 36.6% since mid-October, making them the highest-performing investable stock market worldwide via ETFs. The Chilean peso has also strengthened by over 8% in the last two months, reflecting improved trade conditions and renewed capital inflows.

Argentina has also delivered impressive results, with its stock market climbing 27.45% since October. Investors have responded favorably to President Javier Milei’s liberalization measures, implemented after he assumed office in December 2023.

The International Monetary Fund, in its latest Regional Economic Outlook, praised the Milei government for introducing a bold set of market-driven reforms aimed at boosting productivity, simplifying regulations, and ensuring fiscal responsibility.

The IMF noted that, if these reforms are maintained, Argentina could see significant medium-term benefits, including a more open economy and greater investor trust. However, the austerity measures were initially met with public resistance, sparking protests across the country.

Beyond Chile and Argentina, Peru’s stock market has gained about 27%, with the Peruvian sol reaching its highest value against the US dollar in over five years.

Elsewhere in the region, Colombian equities have risen roughly 16%, while Brazil has rounded out the leaders with a 12.9% increase.

In comparison, the US S&P 500 advanced just 4.8% during the same period, and Germany’s DAX grew by around 5%, highlighting Latin America’s strong relative performance.

EU–Mercosur Pact Marks a New Era for Latin America

After more than twenty years of negotiations, the EU–Mercosur trade agreement is set to be officially signed on January 17 in Paraguay, signaling a pivotal moment in relations between Europe and South America.

For founding Mercosur members—Argentina, Brazil, Paraguay, and Uruguay—the deal marks their first major trade agreement with an external partner, granting preferential access to nearly 450 million consumers in the European Union.

“The approval of the EU–Mercosur trade agreement is a historic achievement, creating the world’s largest free trade zone by population,” noted Ángel Talavera, head of European macro at Oxford Economics.

Together, the EU and Mercosur represent about a quarter of global GDP and encompass approximately 780 million people.

Experts emphasize that the agreement’s impact extends beyond agricultural exports. By reducing tariffs and non-tariff barriers on industrial goods, the pact is expected to benefit manufacturing-heavy economies like Brazil and Argentina, lowering costs, enhancing competitiveness, and strengthening supply chains.

Research from Banco Santander suggests the agreement could reshape trade and investment patterns throughout South America. The EU already contributes nearly €370 billion in foreign direct investment to Mercosur and accounts for over €125 billion in annual trade.

Brazil’s Institute for Applied Economic Research projects that the deal could boost Brazil’s GDP by about 0.5 percentage points and increase investment by 1.5 percentage points each year, reflecting improved export opportunities and greater foreign investment.

Estimates from Real Instituto Elcano and the Bank of Spain indicate that trade between the EU and Latin America could grow by up to 70% over time, while intra-Latin American trade could rise by as much as 40%.

Is Latin America at a Pivotal Moment?

The recent surge in Latin American financial markets appears to be driven by more than just short-term factors.

Higher commodity prices, reduced geopolitical tensions, and a weaker US dollar have all contributed to renewed global investor interest after years of subdued performance.

At the same time, ongoing reforms in countries like Argentina and strengthened trade ties with Europe have improved perceptions of policy stability and long-term growth prospects.

Although challenges persist and the full economic benefits may take time to emerge, Latin America is increasingly being viewed as a standout among emerging markets.

For now, the region’s blend of attractive returns, improving fundamentals, and growing importance in global trade is capturing the attention of investors worldwide.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

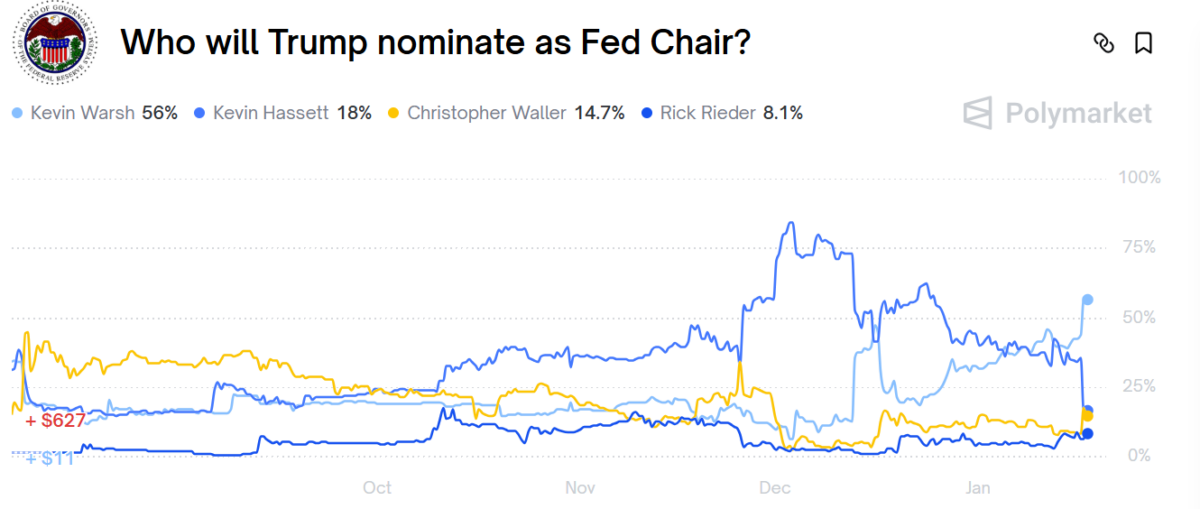

Kevin Hassett odds of replacing Powell at Fed Reserve on Polymarket tank, $11.4 million bets in trouble

A $280 Million Bitcoin Heist Leads to Monero Price Rally

3 Fastest-Growing and Trending Cryptos in 2026 — HBAR, SUI, and ENA