JPMorgan Sees Decline in Investment-Banking Revenue Due to Lower Debt Underwriting

JPMorgan Chase Reports Unexpected Drop in Investment Banking Fees

Photographer: Michael Nagle/Bloomberg

JPMorgan Chase & Co. saw its investment banking fees decline in the final quarter, falling short of its own projections from the previous month.

The largest bank in the United States earned $2.35 billion from its investment banking division during the last quarter of 2025, representing a 5% decrease compared to the same period the previous year. In December, the company had anticipated a modest increase in this area.

Top Stories from Bloomberg

The decline in investment banking was mainly due to a 2% drop in debt underwriting fees, which came as a surprise since analysts had predicted a 19% increase.

JPMorgan is the first major bank to release its quarterly results this week, with other large institutions such as Bank of America, Wells Fargo, Citigroup, Goldman Sachs, and Morgan Stanley scheduled to report in the following days. Collectively, these banks are on track to achieve their second-highest annual profits, aided by policy changes under President Donald Trump.

"The U.S. economy has shown continued strength," said CEO Jamie Dimon. "Although the labor market has cooled somewhat, there are no signs of significant deterioration. Consumers are still spending, and most businesses remain in good shape."

Dimon also noted that these positive trends may continue for an extended period.

WATCH: JPMorgan Chase & Co.’s investment banking fees unexpectedly declined in the fourth quarter, though the bank’s overall performance largely surpassed analyst expectations. Dani Burger reports. Source: Bloomberg

JPMorgan reported a net income of $57 billion for 2025, falling short of its record-breaking profit from 2024, which remains the highest ever recorded by a U.S. bank.

Trading revenue for the fourth quarter reached $8.24 billion, surpassing even the most optimistic analyst forecasts, with both equity and fixed-income trading outperforming expectations.

During the first nine months of the previous year, major banks expanded their lending portfolios at the fastest rate since the financial crisis, resulting in higher net interest income. JPMorgan’s loan balances increased by 4% in the last quarter compared to the previous one, and net interest income rose 7% year-over-year. The bank projects it will generate approximately $103 billion in net interest income in 2026.

Additionally, JPMorgan reaffirmed its expectation to spend around $105 billion this year. Marianne Lake, head of the consumer and community banking division, indicated at a recent industry event that this figure is higher than analysts had anticipated, attributing the increase primarily to expenses related to growth and higher business volumes.

Most Popular from Bloomberg Businessweek

©2026 Bloomberg L.P.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Future Contracts Tap into Altcoin Potential at CME Group

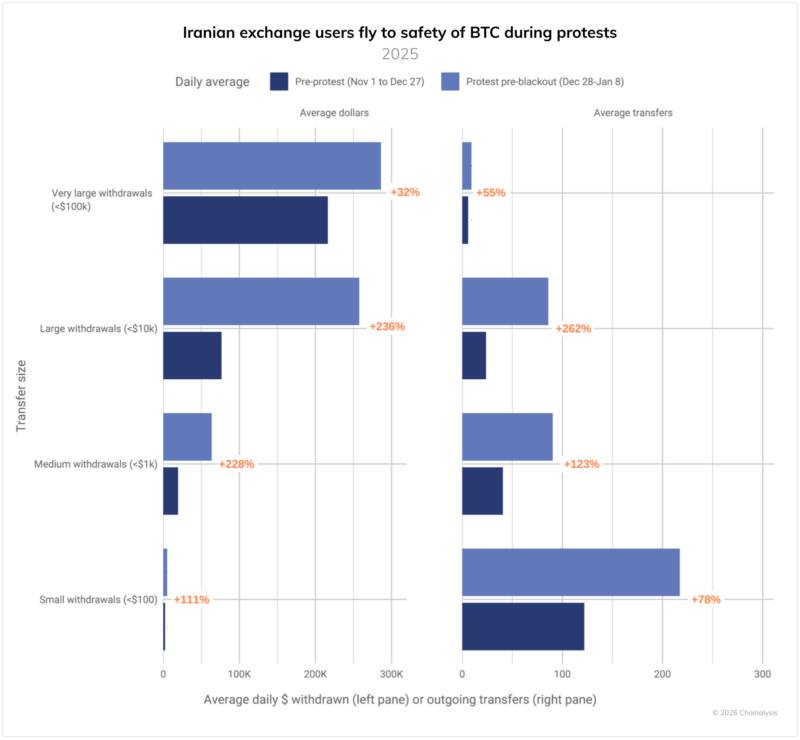

$7.8 Billion and Growing: What Iran’s Crypto Data Reveals About Crisis

Why is Sweetgreen's business struggling?