JPMorgan Chase (NYSE:JPM) Announces Q4 CY2025 Results Meeting Projections

JPMorgan Chase Q4 2025 Earnings Overview

JPMorgan Chase (NYSE: JPM), a major player in global financial services, reported fourth-quarter 2025 results that matched Wall Street’s revenue projections. The company’s sales reached $46.77 billion, reflecting a 6.9% increase compared to the same period last year. Adjusted earnings per share came in at $5.23, surpassing analyst expectations by 7.7%.

Wondering if it’s a good time to invest in JPMorgan Chase?

Highlights from Q4 2025

- Net Interest Income: $25 billion, closely aligning with analyst forecasts and up 7% year-over-year

- Total Revenue: $46.77 billion, slightly exceeding estimates and growing 6.9% from the previous year

- Adjusted EPS: $5.23, beating consensus by 7.7%

- Tangible Book Value per Share: $107.56, up 11.8% year-over-year and marginally above expectations

- Market Cap: $883.3 billion

About JPMorgan Chase

With origins dating back to 1799 and founded by Aaron Burr, JPMorgan Chase has evolved into a global leader in financial services. The company provides a broad range of offerings, including investment banking, consumer and commercial banking, and asset management, serving clients worldwide.

Revenue Trends and Growth Drivers

Banks typically generate income through two main channels: net interest income (the difference between interest earned on loans and interest paid on deposits) and fee-based revenue from services such as credit, wealth management, and trading. Over the past five years, JPMorgan Chase’s revenue has grown at a compound annual rate of 8.6%, which is considered modest for the sector and falls short of industry benchmarks.

JPMorgan Chase Quarterly Revenue

While long-term growth is crucial, recent shifts in interest rates and market conditions can impact financial performance. In the last two years, the company’s annualized revenue growth slowed to 6.9%, trailing its five-year average and indicating a deceleration in demand.

JPMorgan Chase Year-On-Year Revenue Growth

For the latest quarter, JPMorgan Chase’s revenue rose 6.9% year-over-year, aligning with analyst expectations at $46.77 billion.

Over the past five years, net interest income has accounted for just over half (50.2%) of total revenue, highlighting a balanced mix between lending and non-lending sources.

JPMorgan Chase Quarterly Net Interest Income as % of Revenue

Net interest income is often viewed as more stable and reliable than non-interest income, which can be more volatile and less predictable.

Tangible Book Value Per Share (TBVPS)

Bank valuations are heavily influenced by balance sheet strength and the ability to grow book value over time. Tangible book value per share (TBVPS) is a key metric, as it excludes intangible assets and reflects the company’s real net worth per share. Unlike earnings per share, which can be affected by accounting adjustments or mergers, TBVPS offers a clearer picture of underlying value.

JPMorgan Chase has delivered impressive TBVPS growth, averaging 10.5% annually over the past five years. This pace has accelerated recently, with TBVPS climbing 12.5% per year over the last two years, rising from $85.03 to $107.56 per share.

JPMorgan Chase Quarterly Tangible Book Value per Share

Looking ahead, analysts expect TBVPS to increase by 5.6% over the next year, reaching $113.59—a slower pace than recent years.

Summary of Q4 Results

JPMorgan Chase exceeded expectations for adjusted earnings per share and slightly outperformed on tangible book value per share this quarter. The results were generally positive, with the stock price holding steady at $325.21 immediately after the announcement.

Is JPMorgan Chase a compelling buy at its current valuation? While quarterly results are important, long-term fundamentals and valuation play a bigger role in investment decisions.

Industry Perspective

The 1999 book Gorilla Game accurately predicted the rise of tech giants like Microsoft and Apple by focusing on early platform leaders. Today, enterprise software companies integrating generative AI are emerging as the new industry leaders.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP To Repeat Its 2017 Playbook? Analyst Points To 1,250% Rally

Bitmine Buys $65M in ETH Amid Market Momentum

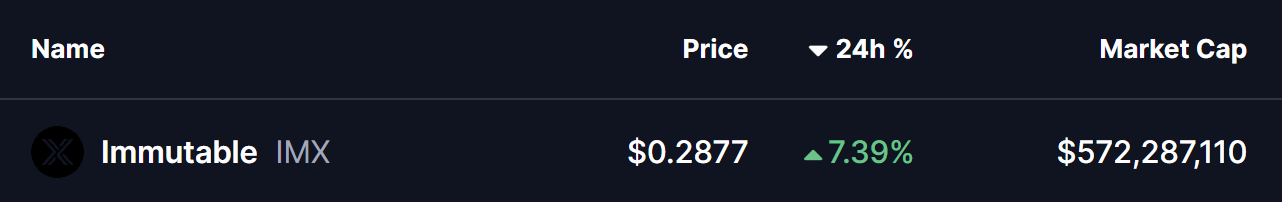

Immutable (IMX) To Rise Higher? This Emerging Bullish Pattern Hints at Upside Move!

XRP Confirms First Golden Cross of 2026, and Bulls Are Already Targeting 13% Upside