Kaspa (KAS) is trading just under $0.05 as of January 12, 2026, showing a clearly bullish short-term setup with technical analysts eyeing a potential retest of the $0.2076 all-time high. With a market cap near $1.27 to $1.29 billion and most 2026 forecasts clustering in the $0.06 to $0.10 band, Kaspa represents a high-beta, execution-risk Proof-of-Work bet rather than a mature Layer 1 play.

But while Kaspa holders watch for the next technical breakout, a new project is creating explosive momentum that’s pulling speculative capital away from PoW coins and established Layer 1s alike.

Current Kaspa Price Position and Technical Setup

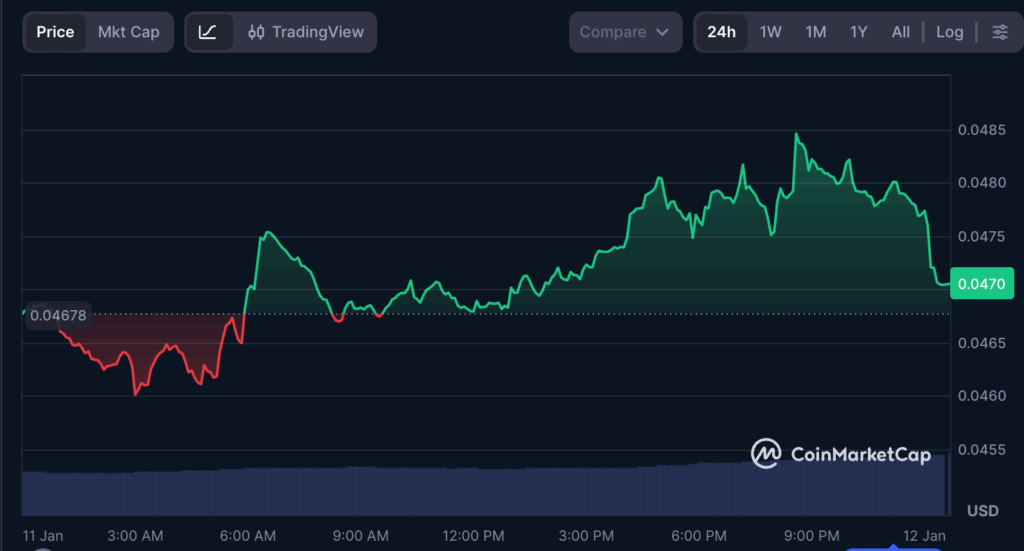

Kaspa’s current price action sits around $0.047 to $0.048 with daily candles showing a bullish engulfing pattern on the weekly chart after a two-week correction. Technicians treat this as a signal that the prior uptrend may resume, potentially retesting the all-time high near $0.2076.

Key metrics defining Kaspa’s position:

Network strength accelerating: Kaspa uses the KHeavyHash PoW algorithm, with the current network hashrate around 210 EH/s and difficulty near 49P, both very elevated versus early-cycle levels, indicating strong miner participation and growing security.

Short-term momentum building: Over the last week, KAS logged roughly 3 green days out of 7 with about 1% volatility, indicating gentle recovery rather than explosive action. Sentiment registers as 70% bullish, though the Fear & Greed Index sits at 29 (Fear), a mix that often sets up favorable asymmetric entries when broader markets are cautious.

Mining economics remain viable: With prices near $0.046 to $0.048 and a 55 KAS block reward, miners are still incentivized, though profitability is tightly linked to electricity and hardware efficiency as difficulty rises.

Kaspa Price Targets Point to Moderate Upside

Analyst forecasts for Kaspa present moderate upside scenarios rather than parabolic moves:

Short-term (30 days): Quantitative models project a slow grind higher from $0.0487 on January 12 to about $0.0563 by January 28, implying roughly 17% upside if the path holds.

2026 range: Technical-analysis-based forecasts put KAS in a $0.067 to $0.1516 range with an average around $0.104, effectively a 40 to 200% upside band from today, depending on where within the range price realizes.

Conservative scenario: Another multi-year model expects the average 2026 price to be near $0.048 with a wide range between $0.027 and $0.065, underscoring how scenario-dependent returns will be on macro risk appetite and Kaspa adoption.

Longer-term (2030+): Long-horizon projections place Kaspa around $0.12 to $0.13 by 2031, about 2x from current levels but far from Solana-style multi-hundred-billion valuations.

Potential Catalysts for Kaspa Price Growth

Several catalysts could trigger Kaspa’s breakout from current consolidation:

All-time high retest: Technical setup suggests potential run toward $0.2076 ATH if bullish engulfing pattern confirms and broader market cooperates.

Hashrate expansion: Rising network security and miner participation could attract institutional mining operations and increase confidence in the chain’s long-term viability.

DeFi integration: Unlike Solana or Cardano, Kaspa has limited DeFi stack integration. Meaningful ecosystem development could expand use cases beyond pure PoW security.

Macro liquidity improvement: As a high-beta PoW asset, Kaspa would benefit disproportionately from risk-on crypto market conditions, though the lack of ETF flows limits institutional demand channels.