EUR/GBP Price Forecast: Sellers retain control below key SMAs

The Euro (EUR) recovers modestly against the British Pound (GBP) on Tuesday, trimming earlier losses after attracting dip-buying interest near the 0.8650 region. At the time of writing, EUR/GBP trades around 0.8664, holding close to multi-month lows amid a thin economic calendar on both sides of the Channel.

From a technical perspective, EUR/GBP remains within a well-defined downward-sloping channel that has guided price action since November 2025, keeping the broader bias tilted to the downside.

The 21-day Simple Moving Average (SMA) has slipped below the 50-day SMA, and both are trending lower, underscoring persistent selling pressure.

On the upside, the 0.8700 psychological level caps immediate recovery attempts. A sustained break above this zone would shift focus toward the upper boundary of the descending channel, which aligns closely with the 21-day SMA. A clear move beyond this confluence would start to weaken the bearish structure and allow for a deeper corrective bounce.

On the downside, a decisive break below the 0.8650 region would strengthen bearish momentum and increase the risk of a continuation toward the 0.8600 handle, a level last seen in August 2025.

Momentum indicators are showing early signs of stabilization. The Moving Average Convergence Divergence (MACD) remains below the signal line and the zero level, but the flattening histogram points to fading downside momentum.

Meanwhile, the Relative Strength Index (RSI) is hovering near 34 after recovering from oversold territory, suggesting scope for near-term consolidation.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Why tokenized stocks, funds and gold will have a breakout year in 2026

Milk Mocha Enters Stage 11 After 465x Gains! Is It the Best Crypto to Buy Now?

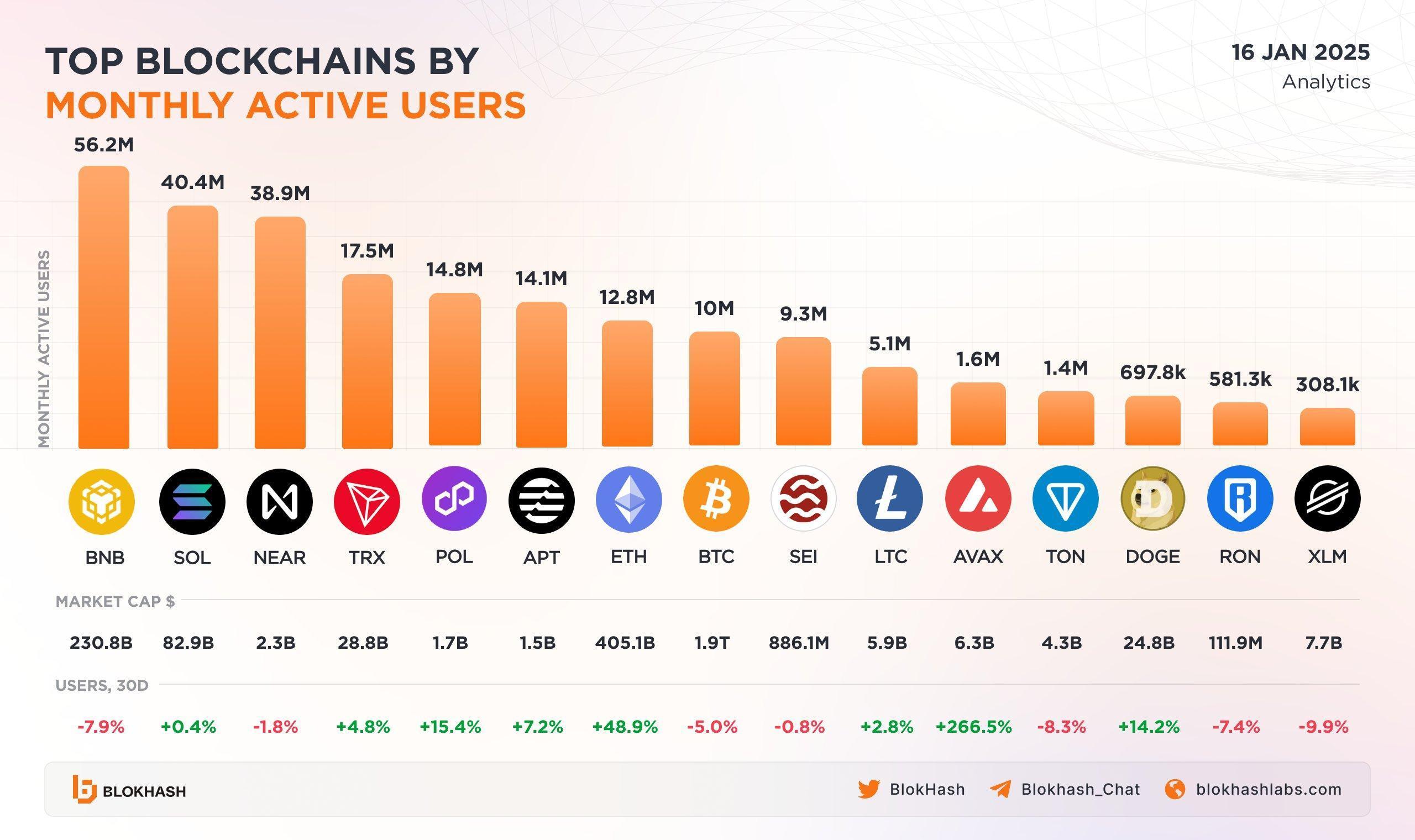

Solana (SOL) Leads Among Top Blockchains by Active Users — Will It Rise Higher?

The Saturday Spread: Leveraging the Markov Principle to Identify Undervalued Prospects (PANW, NTES, DKS)