Morgan Stanley highlights three overlooked indicators suggesting the stock market is heading into a fresh phase of growth

New Wave of Stock Market Growth Expected in 2026

- Morgan Stanley anticipates a renewed phase of market expansion, projecting higher stock values by 2026.

- The bank highlights subtle indicators of economic momentum, such as the surge in copper prices.

- Strategists at Morgan Stanley predict the S&P 500 will climb by 13% in 2026, making it one of the most optimistic forecasts among major financial institutions.

According to recent analysis, the US stock market is poised for another significant period of expansion.

Despite the impressive gains seen over the past three years, several indicators suggest that the market is entering a fresh growth phase marked by robust asset and economic growth, according to Andrew Sheets, Morgan Stanley’s global head of fixed income research.

“It’s been an eventful beginning, but our main message remains unchanged,” Sheets commented on the bank’s market outlook podcast. “At this point, we still see strong evidence supporting our belief that this market cycle has more room to run before it cools off.”

Morgan Stanley stands out with one of the most bullish stock market projections for 2026, expecting the S&P 500 to rise by 13%. This outlook is based on expectations of solid earnings growth and a continued pattern of “rolling recovery” in the economy, a shift from their earlier view of a “rolling recession,” where downturns affected different sectors at different times.

Sheets identified three key signals suggesting that both earnings and economic growth could surpass current investor expectations. Here’s what Morgan Stanley is monitoring:

1. Copper Prices Reach New Highs

The price of copper has experienced a notable rally in recent months, which Sheets interprets as a positive signal for the economic outlook in the coming year.

In 2025, copper prices jumped approximately 44%, marking their strongest annual performance since the financial crisis.

Copper is widely regarded as an economic indicator because its demand is closely linked to industrial and manufacturing activity. The recent price surge is attributed to supply-demand imbalances and increased expectations for copper use in data centers.

2. Korean Equities Outperform

While US stocks posted strong gains in 2025, South Korean equities outshone global markets, signaling further optimism for worldwide economic growth, according to Sheets. The Korea Composite Stock Price Index soared by 75% last year, far exceeding the S&P 500’s 17% increase.

Korean stocks are known for their cyclical nature and are often seen as a barometer for global economic sentiment. Sheets also pointed out that small-cap stocks in Korea, which are particularly sensitive to economic changes, have been outperforming their larger counterparts.

3. Financial Sector Shows Strength

Financial stocks in both the US and Europe have enjoyed significant gains, representing another area of the market that typically benefits from economic expansion, Sheets observed.

In the US, the financial sector was among the top performers last year, with S&P 500 financial stocks rising 14% over the previous twelve months, based on data from State Street Investment Management.

“We’re seeing different assets in various regions all sending a similar message — that global cyclical activity is improving and has been on an upward trend for some time,” Sheets remarked.

“Of course, any single indicator can be misleading. But when several indicators align, it’s something investors should pay close attention to,” he added.

Wall Street’s Optimism for the Year Ahead

Most analysts on Wall Street are forecasting another strong year for equities, driven by factors such as anticipated interest rate reductions, healthy corporate profits, and continued US economic strength. Major banks including Morgan Stanley, RBC, and Deutsche Bank expect the S&P 500 to deliver gains of at least 10% in the coming year, surpassing its historical average.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Why tokenized stocks, funds and gold will have a breakout year in 2026

Milk Mocha Enters Stage 11 After 465x Gains! Is It the Best Crypto to Buy Now?

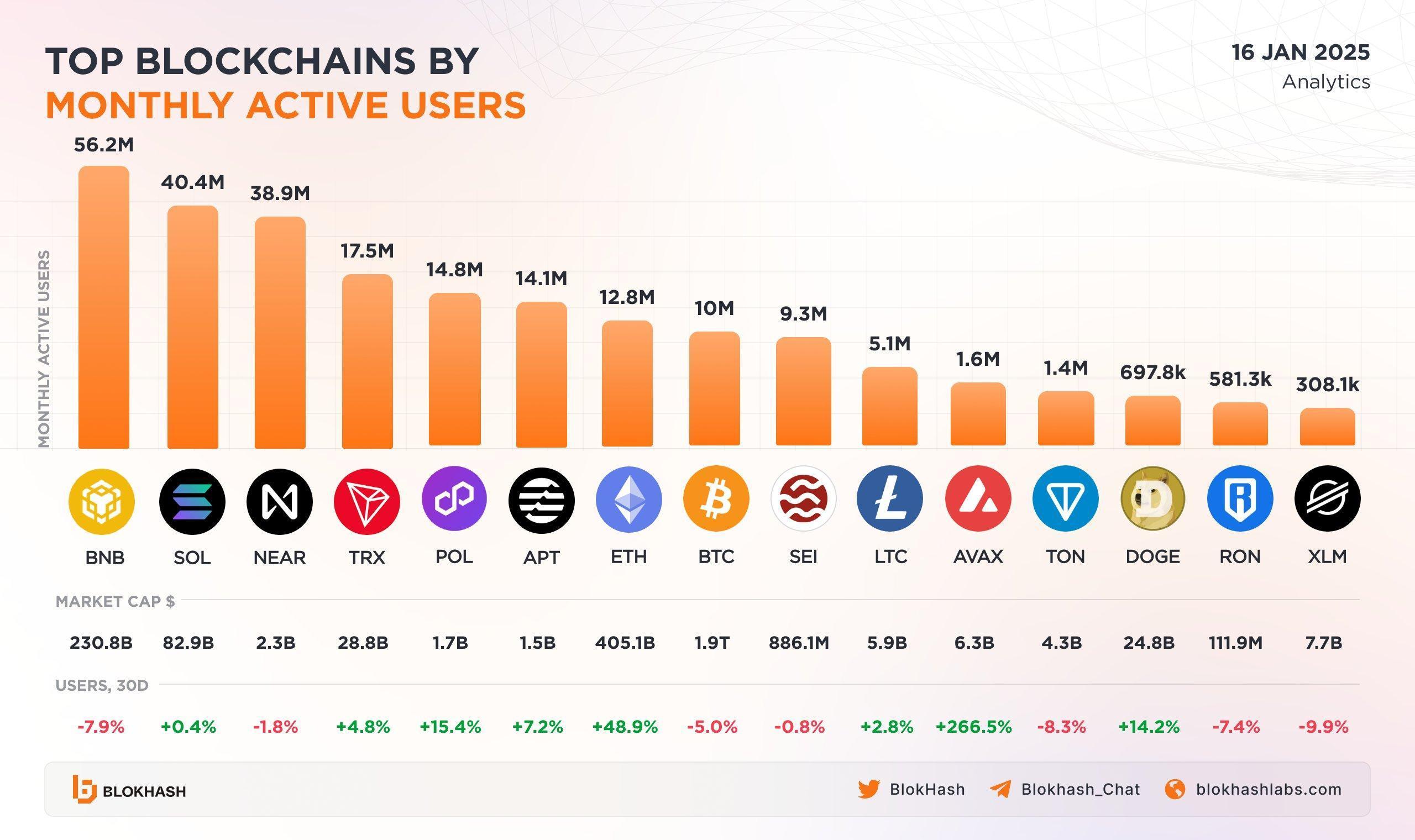

Solana (SOL) Leads Among Top Blockchains by Active Users — Will It Rise Higher?

The Saturday Spread: Leveraging the Markov Principle to Identify Undervalued Prospects (PANW, NTES, DKS)