Bitcoin Surpasses $93,000 as US Inflation Remains Unchanged

Bitcoin Surges Past $93,000 Amid Renewed Market Activity

Bitcoin has surpassed the $93,000 mark for the first time in almost a week, posting a gain of over 2% in the last 24 hours.

Earlier today, new data from the U.S. revealed that consumer prices increased by 0.3% in December. Over the past year, inflation has reached 2.7%, maintaining the same pace as the previous month, according to the Bureau of Labor Statistics.

At the time of this report, Bitcoin was trading at $93,406, based on figures from CoinGecko. Trading activity has seen a notable uptick, with daily volume jumping 20% to $88.9 billion, as reported by CoinGlass, an on-chain analytics provider.

On Myriad, a prediction market platform operated by Decrypt’s parent company Dastan, optimism is running high. Participants now estimate an 80% chance that Bitcoin will break through to $100,000, rather than dropping back to $69,000. This prediction market has been active since late November.

Trading Volume Returns, But Investor Sentiment Remains Cautious

Although Bitcoin’s trading volume has rebounded, analysts at Glassnode caution that this doesn’t necessarily indicate expectations of a major rally. In a recent report, they noted that while liquidity is beginning to recover, spot CVD (cumulative volume delta) has weakened, suggesting that sellers are currently more dominant and that the market is adopting a more defensive stance.

Cumulative volume delta (CVD) is a metric that tracks whether buyers or sellers are exerting more pressure over time. When buyers are in control, CVD rises; when sellers dominate, it declines.

Despite the increase in trading activity, overall trader sentiment has not seen a corresponding boost. For instance, the Crypto Fear & Greed Index has only slightly improved from last month’s Extreme Fear level and still registers as Fear as of Tuesday.

Investors Eye U.S. Supreme Court Decision on Tariffs

Analysts at QCP Capital, a Singapore-based digital asset management firm, pointed out that following the latest Consumer Price Index release, market participants are now watching for the U.S. Supreme Court’s ruling on former President Donald Trump’s tariff policies.

The court is set to determine whether these trade measures are lawful, with a decision possibly coming as early as Wednesday. Historically, announcements regarding Trump’s tariffs have triggered significant volatility in both equity and cryptocurrency markets.

Regardless of the outcome, QCP analysts believe the decision could have a notable effect on cross-asset strategies and overall risk appetite in the markets.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

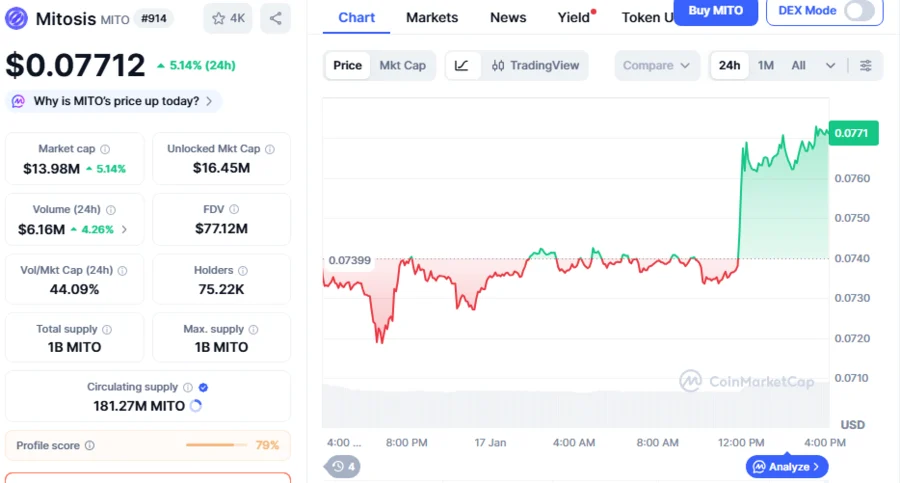

Mitosis Price Flashes a Massive Breakout Hope; Cup-And-Handle Pattern Signals MITO Targeting 50% Rally To $0.115305 Level

Recent financial moves by Trump spark renewed worries about possible conflicts of interest

Why Quant (QNT) Price Is Rising Today: Can It Hit $100 This Weekend?

XRP Price Prediction January 2026: Onchain Signals Elevating XRP Rally Odds