Mizuho Identifies This Under-the-Radar Semiconductor Stock as a Leading Pick for 2026

Semiconductor Sector Outlook for 2026

Following a remarkable surge of over 40% in the PHLX Semiconductor Index ($SOX) during 2025, the semiconductor industry's prospects for 2026 are evolving. Mizuho’s latest report, "Semiconductors & Automotive Technologies," notes that while the most accessible gains may have already been realized, there are still promising investment opportunities—especially for those willing to look beyond the most prominent industry giants.

Mizuho continues to favor established leaders like Nvidia (NVDA) and Broadcom (AVGO), but also highlights Lumentum (LITE) as a lesser-known contender poised to benefit from similar industry trends. With capital expenditures by hyperscale companies projected to climb 32% year-over-year to $540 billion in 2026, investments are increasingly flowing into areas such as optical interconnects, photonics, and high-speed data transfer—core domains for Lumentum.

Latest Headlines from Barchart

Overview of Lumentum

Based in San Jose, California, Lumentum specializes in optical and photonics technologies. The company delivers essential components for data center interconnects, long-distance networking, and cloud connectivity—areas that are becoming increasingly vital as artificial intelligence workloads expand. With a market value near $24 billion, Lumentum occupies a significant yet often underappreciated position compared to more widely recognized semiconductor companies.

LITE shares have demonstrated notable volatility and strength, recently trading around $350 within a broader range of $46 to $400. This fluctuation reflects both the cyclical nature of the optical sector and shifting perspectives on the costs associated with AI infrastructure. While the S&P 500 ($SPX) may have limited upside, market sentiment toward Lumentum could shift rapidly if network capacity becomes constrained.

Traditional valuation metrics show Lumentum trading at elevated levels, with a forward price-to-earnings ratio of 89 and a price-to-sales ratio of 15. While these figures suggest a premium, investors are increasingly focused on whether the growth potential of optics—now fueled by AI advancements—could justify a reevaluation of the sector, rather than simply expecting multiples to contract as AI adoption becomes mainstream.

Lumentum Surpasses Earnings Expectations Amid AI Growth

Lumentum’s financial results for the first quarter of fiscal 2026 reinforced the bullish case for LITE stock. The company reported revenue of $533.8 million, marking a robust 58% year-over-year increase, and delivered non-GAAP earnings of $1.10 per share—well above analyst forecasts. Non-GAAP operating margins also improved significantly, rising to 18.7% from just 3% in the same quarter of the previous year.

Company leadership emphasized that this performance is not a one-off event. Lumentum is experiencing strong momentum across data center, interconnect, and long-haul network markets, and is projecting a 20% sequential revenue increase for the next quarter. Innovations such as optical circuit switches and co-packaged optics, though still in early stages, are already shaping customer strategies.

Looking ahead, Lumentum anticipates second-quarter fiscal 2026 revenue between $630 million and $670 million, with non-GAAP earnings per share expected to range from $1.30 to $1.50. This guidance underscores management’s confidence in both market demand and the company’s ability to execute. The upcoming earnings report will be closely monitored as investors assess the durability of this AI-driven growth phase.

Analyst Outlook for LITE

Analysts are increasingly optimistic about Lumentum, viewing the company less as a cyclical supplier of optical components and more as a critical player in the infrastructure supporting AI hardware. This shift in perception also changes how valuation risk is considered.

LITE currently holds a consensus rating of “Moderate Buy.” The average price target stands at $281.28, with projections ranging from a low of $140 to a high of $470. At the average target, there is roughly 21% downside from current levels. However, bullish analysts argue that if the adoption of AI-powered optics accelerates, Lumentum’s future could be very bright.

In summary, Mizuho’s endorsement highlights a broader trend: as AI investment continues to grow in 2026, companies like Lumentum—often operating behind the scenes—could see significant benefits. For investors willing to embrace some risk, LITE’s role in AI networking makes it a stock to watch closely.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

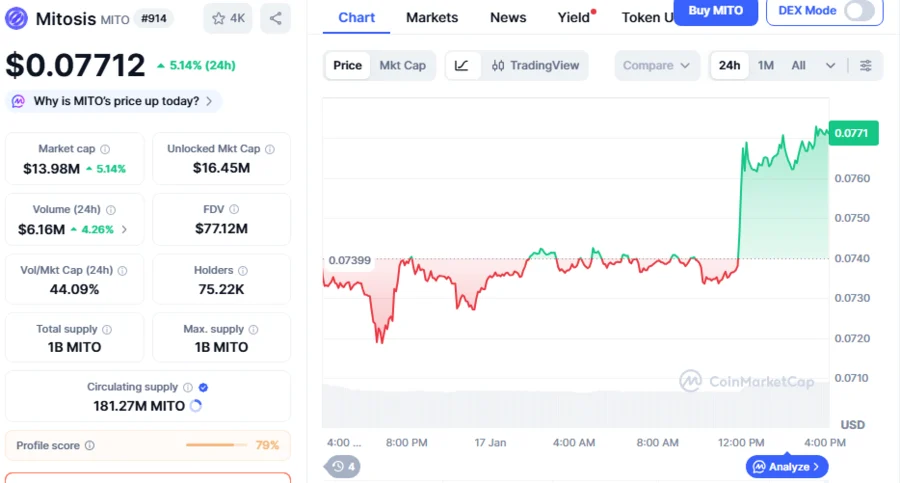

Mitosis Price Flashes a Massive Breakout Hope; Cup-And-Handle Pattern Signals MITO Targeting 50% Rally To $0.115305 Level

Recent financial moves by Trump spark renewed worries about possible conflicts of interest

Why Quant (QNT) Price Is Rising Today: Can It Hit $100 This Weekend?

XRP Price Prediction January 2026: Onchain Signals Elevating XRP Rally Odds