Why Asana (ASAN) Shares Are Down Today

Recent Developments Impacting Asana

Asana (NYSE:ASAN), a leading work management software provider, saw its stock price tumble by 7.5% during the afternoon trading session. This decline followed a surge of concerns across the enterprise software industry, triggered by a notable downgrade of Adobe. The downgrade led to a widespread sell-off among high-growth cloud companies with elevated valuations.

An influential Oppenheimer analyst lowered their rating on Adobe, citing that the company's AI offerings have not driven revenue growth as rapidly as anticipated. Meanwhile, Snowflake also faced a setback after Barclays reduced its rating to "Hold," pointing to fierce competition from tech giants like Amazon and Oracle, who are aggressively promoting their own AI data solutions. At the same time, both DocuSign and Asana faced skepticism as investors questioned whether their main markets are becoming increasingly commoditized.

Market reactions can often be exaggerated, and significant price drops may create attractive entry points for quality stocks. Could this be a good moment to consider investing in Asana?

Market Sentiment and Stock Performance

Asana's stock is known for its high volatility, having experienced more than 30 swings greater than 5% over the past year. In this context, the latest drop suggests that investors see the recent news as significant, but not enough to fundamentally alter their view of the company.

Just five days ago, Asana experienced another notable decline, falling 2.7% as investors shifted away from technology stocks to lock in profits after a recent rally. This move was part of a broader trend where high-growth tech companies saw their shares slide, with the Nasdaq suffering the steepest losses among major indices. Reports indicated that many traders were cashing out gains, particularly from the artificial intelligence sector, which had previously enjoyed strong momentum. This shift marked a change in investor priorities, with funds moving out of technology.

Defense sector stocks benefited from this rotation, surging after former President Trump proposed a record $1.5 trillion defense budget for 2027. Major defense contractors rallied, with Northrop Grumman soaring over 10% and Lockheed Martin climbing nearly 8%, helping to offset the tech sector's weakness and keeping the S&P 500 relatively stable. The move toward industrial stocks was further supported by a rebound in oil prices, which helped stabilize the energy market.

Since the start of the year, Asana's share price has dropped 7.1%. Currently trading at $12.05, the stock is down 50.4% from its 52-week high of $24.28 reached in February 2025. For perspective, a $1,000 investment in Asana five years ago would now be valued at just $330.18.

Many industry leaders—such as Microsoft, Alphabet, Coca-Cola, and Monster Beverage—began as lesser-known growth stories that capitalized on major trends. We believe we've found the next big opportunity: a profitable AI semiconductor company that Wall Street has yet to fully recognize.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Pilot AI Taps Waves to Turn Social Intelligence into On-Chain Actionable Metadata

Why tokenized stocks, funds and gold will have a breakout year in 2026

Milk Mocha Enters Stage 11 After 465x Gains! Is It the Best Crypto to Buy Now?

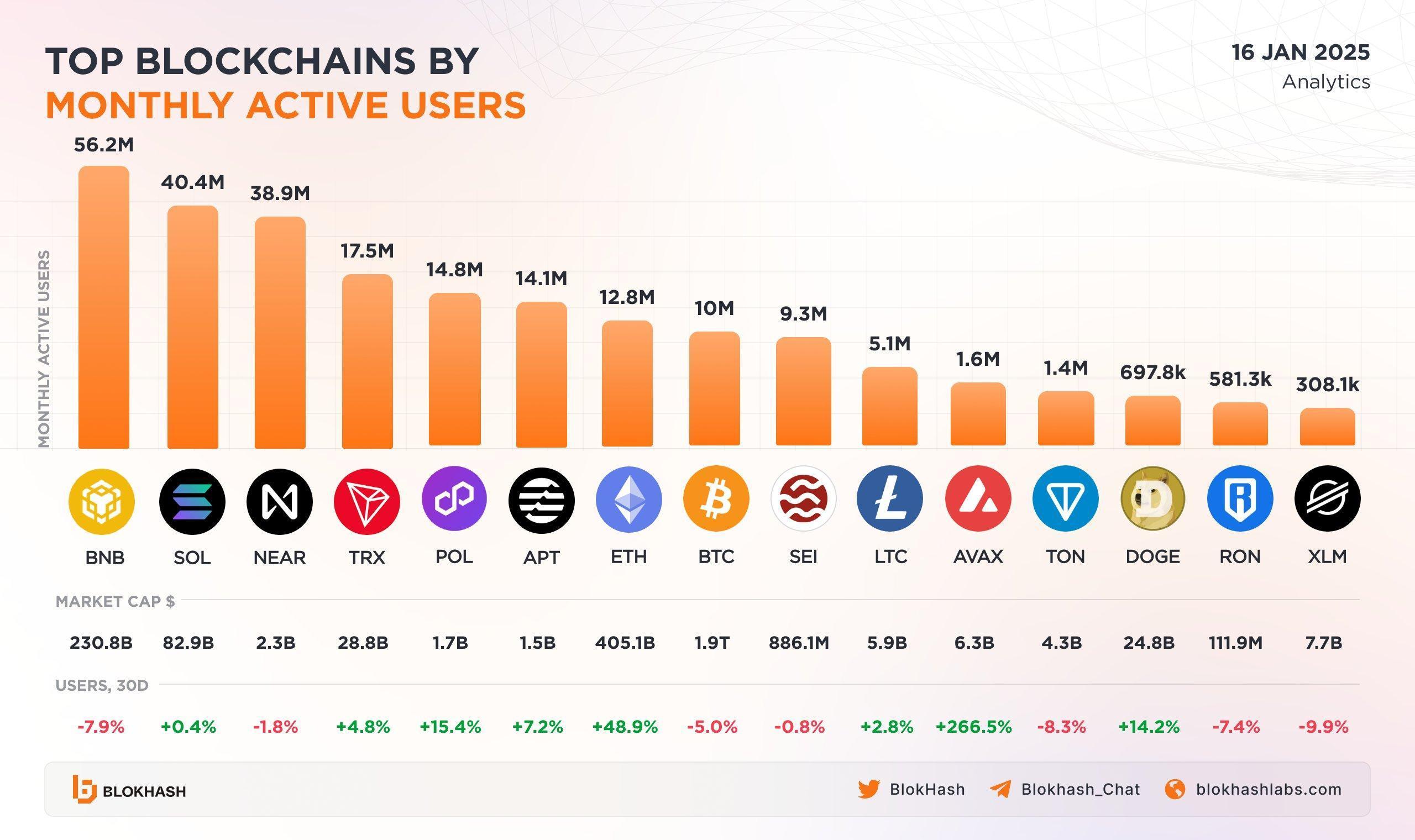

Solana (SOL) Leads Among Top Blockchains by Active Users — Will It Rise Higher?