Bernstein Favors This Under-the-Radar Semiconductor Stock for 2026

Bernstein's Top Semiconductor Picks for 2026

Bernstein has released its latest recommendations for leading chip stocks looking ahead to 2026, and the results are largely as expected. Nvidia (NVDA) and Broadcom (AVGO) remain at the forefront, thanks to their critical roles in the global semiconductor industry. Bernstein analysts maintain that both companies are attractively valued, especially as investment in artificial intelligence continues to surge. Notably, Bernstein gives Nvidia the edge over Advanced Micro Devices (AMD), even as AMD's strengths in inference have fueled ongoing debates between the two rivals. Bernstein expresses strong confidence in Nvidia’s future product lineup and does not see the company lagging behind AMD in the AI inference space.

Other semiconductor stocks, such as Micron (MU) and Applied Materials (AMAT), have seen their valuations climb sharply, raising concerns about potential overvaluation. Despite this, Bernstein remains optimistic about these names, giving particular attention to Applied Materials. The firm rates AMAT as “Outperform,” even as the stock trades near its highest point in the past year.

Latest Headlines from Barchart

Overview of Applied Materials

Applied Materials stands as the world’s largest provider of equipment and services for the production of semiconductor chips and advanced displays. The company partners with all major chip manufacturers globally and is headquartered in Santa Clara, California.

Over the past year, AMAT shares have soared by 80%, quadrupling the gains of the S&P 500 Index ($SPX) and outpacing the iShares Semiconductor ETF (SOXX), which returned 52% in the same timeframe. Bernstein anticipates that this strong performance could persist through 2026.

Compared to its historical averages, AMAT is currently trading at a premium. Its forward price-to-earnings (P/E) ratio stands at 33.24, which is 67% above its five-year average. The price-to-sales (P/S) ratio is also elevated relative to past valuations. When compared to peers, the forward P/E is three times higher than Micron’s, despite both companies benefiting from robust demand for high-bandwidth memory. However, their P/S ratios are similar.

This higher earnings multiple is considered justified due to AMAT’s more consistent profitability. Both AMAT and Micron are projected to grow earnings by about 23% in 2027, but AMAT is expected to maintain around 8% growth through 2029, while Micron’s earnings are forecasted to decline by 49% that year. This outlook positions AMAT as a more attractive long-term investment, which is reflected in its valuation.

Dividend Yield and Valuation Considerations

AMAT’s current dividend yield is 0.58%, which, while respectable for a semiconductor firm, is below its five-year average of 0.81%. This represents a 28.5% decrease from historical levels, largely due to the stock’s recent rally. However, in the current market environment, dividend yield is less of a focus for investors evaluating the stock’s value.

Applied Materials Surpasses Earnings Expectations

On November 13, 2025, Applied Materials reported fourth-quarter earnings per share of $2.38, beating analyst estimates of $2.06. Revenue reached $8.8 billion, exceeding Wall Street’s consensus by $130 million. This marks the sixth consecutive year of growth for the company, and management expects this momentum to continue into 2026. The ongoing expansion of AI and rising demand for semiconductor manufacturing are expected to keep the company busy, with management noting that customers have already signaled the need for increased production in the second half of 2026.

Like its industry peers, AMAT faces challenges related to geopolitical tensions and export controls. China now represents a smaller share of revenue, and many analysts are discounting its impact. The primary challenge ahead will be how effectively the company manages the ramp-up of AI-related equipment, as this will influence its ability to capitalize on the significant AI investments planned for the year.

Analyst Opinions on AMAT

While Applied Materials may not be the most high-profile AI stock, it enjoys broad coverage among Wall Street analysts. Currently, 35 analysts cover the stock, with 19 rating it as a “Strong Buy.” The recent surge in share price may prompt some to reassess their outlooks, but overall sentiment remains positive for AMAT shareholders.

Just recently, Bernstein increased its price target for AMAT from $260 to $325, even as the stock approaches that level. Over the past month, several analysts have raised their targets, reflecting expectations that the company will benefit from increased spending on memory chips. The highest price target now stands at $425, suggesting a potential 38% upside from current levels.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

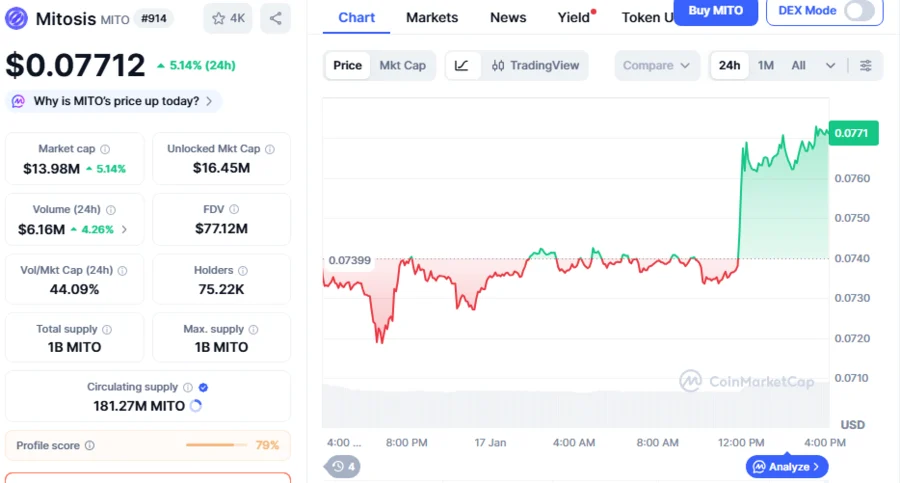

Mitosis Price Flashes a Massive Breakout Hope; Cup-And-Handle Pattern Signals MITO Targeting 50% Rally To $0.115305 Level

Recent financial moves by Trump spark renewed worries about possible conflicts of interest

Why Quant (QNT) Price Is Rising Today: Can It Hit $100 This Weekend?

XRP Price Prediction January 2026: Onchain Signals Elevating XRP Rally Odds