Hanging by a Thread, Yen Faces Another Brutal Blow at the Start of the Year

Morning FX

Less than half a month into 2026, the yen is once again testing its limits. USDJPY surged nearly 100 points yesterday and has risen 250 points since the start of the year, approaching 160. It is now just a step away from the 40-year high of 161.70 set in July 2024—despite the Federal Reserve’s ongoing rate cuts.

Chart: Yen depreciates to the 159 level

The driving force behind this round of yen depreciation is Takamichi, who, enjoying overwhelming public support, intends to call an early lower house election to consolidate the majority and push forward policy agendas. The “Takamichi trade” that emerged after Japan's general election in October last year has returned: Japanese stocks are surging, while Japanese bonds and the yen are plummeting.

I. The Death Spiral of Japan's Financial Markets Reappears

Since taking office, Takamichi has maintained ahigh level of public support (with polling approval ratings reaching a historic high of 75%). However, the ruling coalition of the Liberal Democratic Party and Ishin barely holds a majority in the lower house and is even in the minority in the upper house. All policies require absolute parliamentary control to be implemented, so an early election is being called during this honeymoon period with the public.

Chart: Japanese stocks rise, bonds and yen both plunge

The market is not buying it. If the Liberal Democratic Party wins the election, it means an increase in government bond issuance, and in order to pay interest, the Bank of Japan must maintain low rates. Although Japanese stocks benefit from fiscal expansion, increased supply of Japanese government bonds and postponed rate hike expectations directly lead to a collapse in long-term bonds and the yen. Yields on 10-year and 30-year Japanese government bonds have broken through 2.1% and 3.4%, both near historic highs.

II. Where Will the Yen Eventually Depreciate To?

In my opinion, under the negative influences of political upheaval, capital outflows, and a strengthening US dollar rate, the only way to slow the trend is for the Bank of Japan to intervene, likely around the 161-162 range.

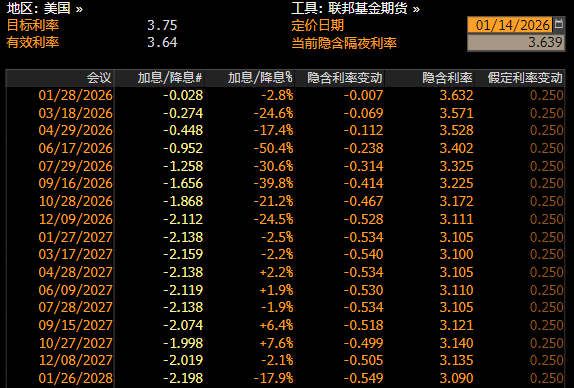

(1) US economic data has remained robust into the new year, continuing the strength of the past two years. An unexpected downturn before the midterm elections is unlikely, and expectations for rate cuts before the June FOMC meeting have nearly vanished.

Chart: Implied rate cut expectations in the interest rate futures market

(2) With NISA account limits reset at the beginning of the year and real interest rates remaining low, USDJPY buying flows will persist; coupled with Takamichi’s one-track approach, the yen will struggle to find buying support.

The Bank of Japan’s intervention threshold may be in the 161-162 range, which is the limit seen in the previous round of yen depreciation. Previously, at the 158 level, the Bank of Japan upgraded its warning to level 4 (out of 5). A 2% depreciation at the start of the year may hit the Bank of Japan’s nerves, and substantial intervention is expected above 160.

III. Summary

(1) The yen suffered a heavy blow at the start of the year, as the early election brought back the “Takamichi trade.” The yen is approaching the 160 intervention threshold, and Japanese government bond yields are reaching new highs. The “extremely steep yield curve” and the “divergence between the yen and the stock market, and interest rate differentials” present a unique landscape.

(2) Strong US data has dashed hopes for a rate cut before June. If the Bank of Japan's hawkish stance does not progress decisively, the yen will likely remain weak until meaningful intervention occurs.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Everyone to get their own AI friend in five years, Microsoft executive says

Bitcoin’s Weekend Journey Sparks New Market Trends