Bitget UEX Daily Report | Trump Slams Powell, Successor Announcement Imminent; Crypto Legislation Timeline Unveiled, Bitcoin Surges; US CPI Misses Expectations, Rate Cut Hopes Fade (Jan14, 2026)

I. Key Headlines

Federal Reserve Developments

Trump Renews Criticism of Powell, Successor Nomination Forthcoming Trump accused Powell of billions in budget overruns while en route to a Detroit economic speech, questioning incompetence or corruption, and stated the next Fed chair nominee will be revealed in the coming weeks.

- The Justice Department's probe into Powell won't delay the nomination process.

- St. Louis Fed President Musalem views current rates as near neutral, with no immediate need for further easing.

- US December core CPI year-over-year growth fell below Wall Street expectations, hitting a five-year low. Market Impact: These remarks heighten concerns over Fed independence, potentially amplifying short-term market uncertainty, while bolstering the dollar and curbing risk asset enthusiasm.

International Commodities

Trump Cancels Talks with Iranian Officials, Boosting WTI Crude Up Over 3% Intraday Trump announced via social media the cancellation of all dialogues with Iranian officials and urged US citizens to leave Iran immediately.

- Iranian military commanders stated enhanced capabilities in addressing security threats post-US conflict.

- WTI crude peaked at $61.3 per barrel intraday, with gains exceeding 3%.

- Bitcoin briefly surpassed $96,000, Ethereum over $3,300, lifted by the US Senate Agriculture Committee's release of a crypto market structure legislation timeline. Market Impact: Geopolitical tensions elevate energy prices, with potential supply disruption risks sustaining oil support; crypto assets benefit from regulatory clarity, increasing short-term volatility.

Macroeconomic Policies

US December Fiscal Deficit Hits Monthly Record High, 2025 Deficit Narrows to Three-Year Low Driven by record expenditures and welfare adjustments, the US December fiscal deficit reached $145 billion, surging 67% year-over-year.

- Record tariff revenues helped shrink the 2025 fiscal deficit to $1.67 trillion.

- FY2026 first-quarter Treasury interest payments rose 15% YoY, with Medicare, Social Security, and other expenditures up 9%, 11%, and 7% respectively.

- HSBC's annual macro strategy favors China, recommending overweight in A-shares and Hong Kong stocks, with long RMB as a top macro trade. Market Impact: Fiscal expansion burdens debt levels, but tariffs alleviate deficit pressures; China asset recommendations may draw inflows to emerging markets, enhancing regional stability.

II. Market Recap

- Gold: Stable at $4,624, slightly adjusting after two consecutive record highs.

- Silver: Up 3.4% to $88, hitting a historical high.

- Crude Oil: Up 2.8% to $61.15, driven by Iranian tensions.

- DXY: Up 0.33% to 99.17, supported by Fed commentary.

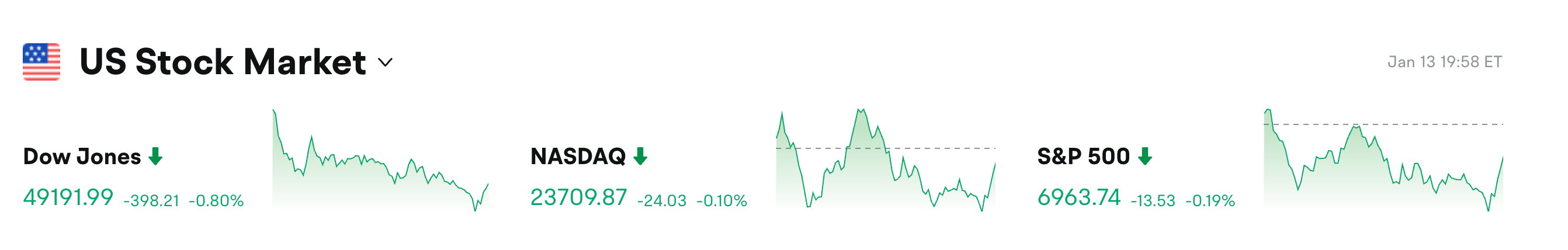

US Stock Indices Performance

- Dow Jones: Down 0.8%, retreating consecutively from historical highs.

- S&P 500: Down 0.2%, led lower by financials.

- Nasdaq: Down 0.1%, with tech sector mixed.

Tech Giants Dynamics

- NVIDIA: +0.47%, benefiting from relaxed chip export policies.

- Apple: +0.31%, boosted by new subscription service launch.

- GOOGL: +1.24%, supported by stable search business.

- Tesla: -0.39%, amid electric vehicle demand scrutiny.

- Microsoft: -1.36%, impacted by data center commitments.

- Amazon: -1.57%, facing intensified e-commerce competition.

- Meta: -1.69%, as glasses capacity expansion fails to offset broader pressures.

Summary: The Magnificent Seven showed divergence, with Intel surging 7% at the forefront, but most dragged by bank earnings and rate concerns, primarily due to weak investment banking and geopolitical risks.

Sector Movements Observation

Financial Sector Down About 2%

- Representative Stock: JPMorgan, -4.19%.

- Driving Factors: Q4 investment banking fees below expectations, with credit card rate cap proposals sparking economic worries.

Energy Sector Up 1.5%

- Representative Stock: Chevron, +2%.

- Driving Factors: Oil price surge from Iranian tensions.

Biotech Sector Up About 3%

- Representative Stock: Moderna, +17%.

- Driving Factors: 2025 revenue outlook exceeding guidance, positive product development updates.

III. In-Depth Stock Analysis

1. NVIDIA - US Eases H200 Chip Export Restrictions to China

Event Overview: The US Federal Register indicates relaxed controls on NVIDIA's H200 AI chip exports to China, following Trump's social media statement allowing sales subject to Commerce Department approval, security reviews, and fees. This aims to balance tech exports with national security. Market Interpretation: Institutional views suggest this alleviates supply chain disruption fears, though ongoing reviews may add transaction uncertainty; Wall Street analysts anticipate short-term support for NVIDIA's Asian market share. Investment Insights: Policy easing favors stock rebound, but monitor escalating US-China trade friction risks.

2. Meta - Plans to Double AI Smart Glasses Capacity to 20 Million Units

Event Overview: Meta is discussing with EssilorLuxottica to boost Ray-Ban Meta AI glasses annual capacity to 20 million units, potentially up to 30 million, to capitalize on growing demand and outpace competitors. Current production is nearing the original 10 million target, with final decisions pending. Market Interpretation: Analysts see strong potential in hardware expansion for revenue contribution, but warn of supply chain bottlenecks and market saturation risks. Investment Insights: Strengthens Meta's metaverse positioning; track demand validation and production execution.

3. Apple - Launches ¥380/Year Creative App Subscription Bundle

Event Overview: Apple Creator Studio integrates Final Cut Pro, Logic Pro, and more apps, adding AI features like Keynote, at ¥38/month or ¥380/year, with education discounts. The service launches January 28, supporting family sharing. Market Interpretation: Institutions view it as an ecosystem expansion strategy, expected to enhance subscription revenue stability, but user conversion rates remain key. Investment Insights: Bolsters services growth engine; long-term positive, though short-term hinges on market feedback.

4. JPMorgan - Q4 Revenue Up 7% But Investment Banking Falls Short of Guidance

Event Overview: Q4 investment banking fees declined 5% YoY, well below the company's low-single-digit growth expectation, despite strong trading and interest income, resulting in mixed overall performance and a stock drop. Market Interpretation: Analysts attribute it to deal delays and economic uncertainty, but remain optimistic on long-term recovery. Investment Insights: Short-term pressure evident; await clearer economic policies before positioning.

5. Moderna - 2025 Revenue Outlook Exceeds November Guidance Midpoint

Event Overview: The company stated 2025 revenue will surpass prior guidance midpoint, with updates on seasonal flu vaccines and other products. This drove a 17% stock surge, making it a top S&P 500 performer. Market Interpretation: Wall Street is bullish on vaccine demand recovery, seeing updates as solidifying biotech leadership. Investment Insights: Capitalize on medical innovation opportunities, but monitor regulatory and competitive dynamics.

IV. Today's Market Calendar

Data Release Schedule

| 08:30ET | US | PPI (M-o-M) | ⭐⭐⭐ |

| 08:30ET | US | Current Account Balance | ⭐⭐⭐⭐ |

| 10:00ET | US | Existing Home Sales | ⭐⭐⭐ |

| 07:00ET | US | MBA Mortgage Applications | ⭐⭐ |

Key Events Preview

- Bank Earnings: Time - Citigroup and Wells Fargo release Q4 results, focus on consumer spending and investment banking outlook.

Bitget Research Institute Views:

Over the past 24 hours, the three major US stock indices retreated, with the Dow Jones falling 0.8% dragged by JPMorgan's earnings report; gold held steady above $4,600, while silver hit a record high of $88; crude oil was supported by tensions in Iran; the US dollar index remained near 99.22. Overall, we believe that Fed independence and geopolitical events will continue to drive safe-haven demand, favoring precious metals and energy in the short term.

Disclaimer: The above content is compiled by AI search and manually verified for publication only, not intended as any investment advice.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin’s Fixed Supply Keeps Edge Over Gold, Says Cathie Wood

XRP Feels Dead at $2, Past Cycles Say That Feeling Doesn’t Last

Musk seeks up to $134 billion from OpenAI, Microsoft in 'wrongful gains'

Bitcoin Surges; Short-Term Traders React Swiftly