If gold is repriced as currency again: its value would not be $5,000, but $184,000

As gold prices rapidly approach the once unimaginable level of $5,000 per ounce, VanEck’s fixed income analysts point out that if gold were to back all circulating money, its real price would be several orders of magnitude higher—putting the currencies of some of the world’s most developed economies at the greatest risk, while countries like Russia and Kazakhstan could easily adopt a gold standard as soon as tomorrow.

“What is the ‘real’ price of gold?” VanEck’s emerging markets debt team asked in a recent analysis. “Not the price you see on the screen today, but the price if gold once again became the global reserve standard.” Central banks are buying gold at a record pace, and questions about how long the dollar’s dominance can last hang over the market.

Given that gold has recently surged in price due to its reserve asset attributes, analysts believe this question is long overdue.

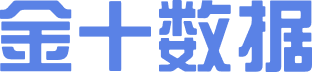

The proportion of the US dollar in global reserves is declining

The proportion of the US dollar in global reserves is declining Analysts say this situation raises a fundamental question: If gold had to back the world’s money supply, what would the gold price be?

“For most of modern financial history, this wasn’t a hypothetical question,” they noted. “Under the classic gold standard, paper money was simply a claim check for physical gold in the vault. This link was fully severed in 1971, and the world moved to a ‘fiat’ currency system, where money is backed only by government decree.”

VanEck’s analysts are raising this question now not because they believe the gold standard will return tomorrow, but because it serves as what they call the ultimate solvency test. “By calculating what price gold would need to reach to back today’s money supply, we can see how much paper money has been printed relative to the hard asset that once backed everything.”

To find this implicit “reserve price” for gold, they used a relatively simple calculation: dividing monetary liabilities by known official gold reserves.

The analysts used two specific definitions of money in their calculations, since “‘money’ is a concept that keeps expanding during crises.”

First, they calculated M0, the monetary base. “This is cash in circulation plus bank reserves,” they said. “In a typical bank run, this is the money people are demanding.”

The second category is M2, or broad money. “This includes savings deposits and money market funds,” the analysts wrote. “In modern financial crises, such as in 2008 or 2020, this is the broader liquidity the entire system seeks to protect.”

When they calculated the implicit price of gold based on the monetary liabilities of the world’s major central banks (weighted by their share of daily FX trading volume), the resulting valuations were astonishing.

“If gold had to back M0 (the monetary base), the trading price would need to reach $39,210 per ounce,” the analysts said. “If gold had to back M2 (broad money), the trading price would need to reach $184,211 per ounce. These numbers represent the price needed to ‘cover’ outstanding monetary liabilities in a scenario where gold once again becomes the primary reserve asset.”

VanEck analysts warn that although these two numbers represent global averages, they do not reflect the enormous differences between countries. “The ratio of money printed to gold reserves reveals which countries are over-leveraged and which are safe,” they said.

The most leveraged countries include some of the world’s most developed economies, such as the UK and Japan, which have printed massive amounts of money relative to their official gold holdings. “In a reset scenario, their currencies would be under the most pressure,” they wrote. “For example, Japan’s implied gold price for M2 is about $301,000 per ounce, while for the UK it’s about $428,000 per ounce.”

VanEck’s baseline group includes the US and the Eurozone. “The implied price for M2 in the US is about $85,000 per ounce, while for the Eurozone it’s about $53,000,” the analysts noted.

The third group—solvent countries—includes emerging economies with substantial gold reserves relative to their M0 and M1 money supply. “Emerging markets like Russia and Kazakhstan arguably have enough gold to back their money supply at much lower valuations,” they said. “This highlights a shift where some emerging markets are becoming more fiscally defensible than developed countries.”

VanEck wrote that these calculations are far from theoretical in 2026, as the world has clearly entered an era of fiscal dominance.

“Developed markets are struggling with high government debt, forcing central banks to ‘print’ more money to maintain system liquidity,” they said. “As the pile of paper money grows infinitely, in theory, the value of finite-asset gold must rise accordingly to keep up.”

The emerging markets debt team cautiously noted that they do not expect the dollar to “suddenly lose its reserve currency status.” Instead, they foresee a gradual evolution, “towards a multipolar world where the dollar shares this role with gold and fiscally disciplined emerging market bonds.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Faces Challenges: Market Trends and Investor Insights

Senate Judiciary flags DeFi oversight ‘gaps’ in U.S. crypto bill

Morph Integrates RedStone Oracle for Real-Time, Secure Pricing for On-Chain Payments

SwissBorg Hooks Base for Killer Crypto Swaps – Kriptoworld.com