Global markets generally advance prior to the release of US wholesale price data

Global Markets Show Gains Amid Ongoing Uncertainties

World stock markets largely advanced on Wednesday, following a modest retreat from record highs on Wall Street. Investors remained cautious due to ongoing uncertainties in several regions, including developments in Iran.

European Indices Edge Up

- France’s CAC 40 climbed 0.5% to reach 8,392.24 in early trading.

- Germany’s DAX inched up 0.1%, standing at 25,453.63.

- The UK’s FTSE 100 rose by 0.3% to 10,163.11.

Meanwhile, futures for both the Dow Jones Industrial Average and the S&P 500 slipped by 0.2%.

Asian Markets React to Political Developments

Japan’s Nikkei 225 soared 1.5% to close at 54,341.23, fueled by speculation that Prime Minister Sanae Takaichi may soon call for general elections. On Tuesday, Takaichi met with South Korean President Lee Jae Myung, and both leaders pledged to cooperate on economic and security matters. South Korea’s Kospi index advanced 0.7% to 4,723.10.

Chinese markets experienced volatility, with Hong Kong’s Hang Seng gaining 0.6% to 26,999.81, while the Shanghai Composite fell by 0.3% to 4,126.09.

China’s trade surplus jumped 20% year-over-year in 2025, reaching a record $1.2 trillion, despite increased tariffs on imports imposed by U.S. President Donald Trump.

- Australia’s S&P/ASX 200 edged up 0.1% to 8,820.60.

- Taiwan’s Taiex rose 0.8%.

- India’s Sensex declined by 0.5%.

Policy Moves and Economic Data

President Donald Trump announced a 25% tariff on imports from countries conducting business with Iran, as activist reports indicated the death toll from recent protests in Iran had surpassed 2,500 as of Wednesday.

A closely watched inflation report aligned with economists’ forecasts, reinforcing expectations that the Federal Reserve will lower its key interest rate at least twice in 2026 to support employment. Later in the day, wholesale inflation data is expected from the government.

Wall Street and Commodities Update

On Tuesday, the S&P 500 slipped 0.2% after reaching a record high the previous day. The Dow Jones dropped 0.8% from its peak, and the Nasdaq composite eased by 0.1%.

Early Wednesday, U.S. benchmark crude oil fell 57 cents to $60.87 per barrel, while Brent crude, the international benchmark, declined 58 cents to $64.89 per barrel.

Currency Movements

- The U.S. dollar weakened slightly to 158.78 yen from 159.13 yen.

- The euro edged up to $1.1649 from $1.1645.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

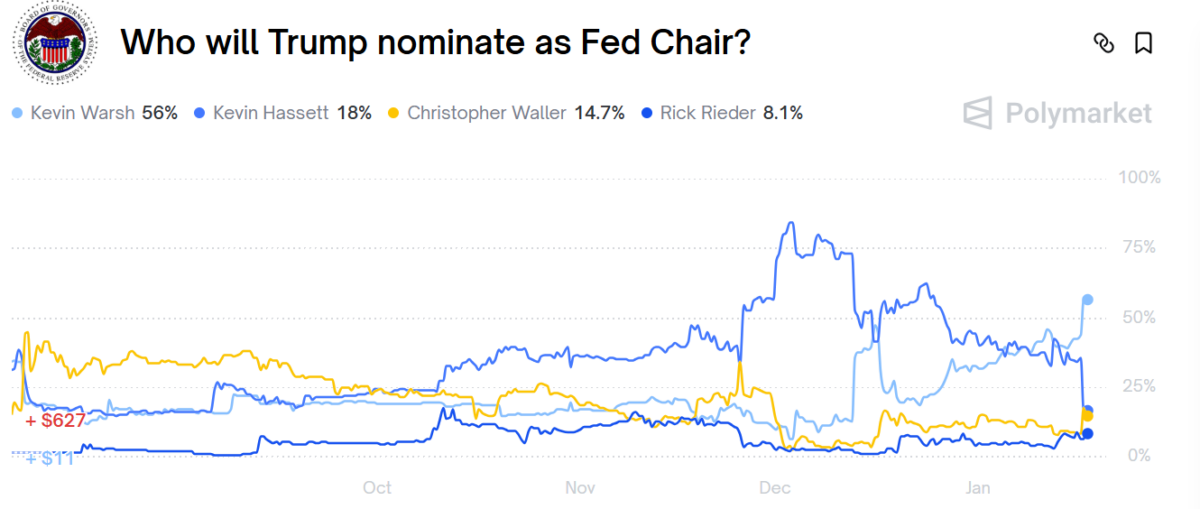

Kevin Hassett odds of replacing Powell at Fed Reserve on Polymarket tank, $11.4 million bets in trouble

A $280 Million Bitcoin Heist Leads to Monero Price Rally