What Proportion of Individuals Attain Financial Independence Before Age 50 and How You Measure Up

Main Insights

-

Achieving financial independence before turning 50 is uncommon, with fewer individuals retiring at that age compared to the early 2000s.

-

The majority of Americans are far from reaching financial freedom—only about 10% claim to have accomplished it, while over half acknowledge they are not close to their goal.

-

Reducing debt and increasing earnings are essential strategies, as reaching financial independence earlier relies on expanding the difference between income and expenses.

Dreaming of financial independence before age 50? You'd be among a select few: Gallup data shows only 1% of Americans in their early 40s are retired, and just 6% in their early 50s have exited the workforce—a significant drop since 2002.

These statistics highlight how rare it is to live without employment income before reaching middle age, even as the FIRE (Financial Independence, Retire Early) movement has gained popularity in recent years.

The underlying causes are both financial and mathematical. According to recent research from Transamerica, the typical household has set aside around $112,000 for retirement, and only 21% have a formal written financial plan.

This amount falls far short of what’s needed to support three or four decades without a paycheck. Meanwhile, the AARP’s 2025 Financial Security Trends Survey reports that roughly 20% of adults have no retirement savings, and 64% are concerned about their financial security in retirement.

Why Few Achieve Financial Independence by 50

Financial independence is generally defined as having enough assets or passive income to cover your living costs without needing to work. Interestingly, most people don’t associate this with extreme wealth. Surveys show Americans often describe financial freedom as being debt-free and living comfortably, rather than being rich. It’s more about stability and peace of mind than luxury.

Yet, even with these modest expectations, few people reach this milestone by midlife. In a 2023 survey, only 8.3% of Generation X (ages 43–58) and 9.3% of Millennials (ages 27–42) said they felt financially independent. Among Baby Boomers, who are at or near retirement age, just 15% reported achieving this status.

Overall, only about one in ten Americans feel they have attained financial freedom on their own terms. The rest rely on regular paychecks or worry about making ends meet. More than half admit they are far from financial independence, and many lack even a basic savings account as a foundation.

Most people simply don’t have the wealth required to retire early. Accumulating a million-dollar nest egg is rare—just 2.5% of Americans have $1 million or more saved for retirement, and only 3.2% of current retirees have reached that mark. Without substantial savings or significant passive income, leaving the workforce at 50 often means drastically reducing your standard of living or risking financial shortfalls later in life.

Strategies to Boost Your Chances of Early Financial Independence

To reach financial freedom early, focus on increasing the gap between your earnings and your spending. On the income side, this might involve advancing in your career, having two earners in the household, or taking on side gigs. The expansion of remote work and the gig economy has made it easier for people of all ages to supplement their income beyond traditional jobs. Every extra dollar earned can be directed toward investments or debt repayment.

On the expense side, examine your biggest costs and look for ways to reduce them. Some people aiming for early retirement downsize to a smaller home or move to areas with a lower cost of living. Others opt for used vehicles or public transportation instead of costly car payments. The objective is to maximize the portion of your income that goes toward saving and investing, rather than spending.

Eliminating debt is crucial. Paying off high-interest obligations can significantly reduce the monthly income you’ll need in retirement. Prioritize paying off credit card balances and car loans first, since the interest paid on these debts could otherwise be working for you through investments.

It’s also important to prepare for unexpected events. Retiring early brings unique challenges, such as covering your own health insurance for many years before Medicare eligibility and ensuring your savings can withstand inflation and market fluctuations over several decades.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Jinping wants to curb price wars between China’s tech groups

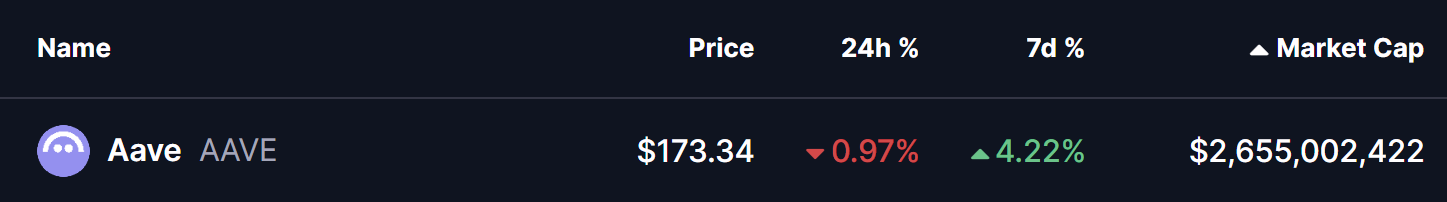

Is Aave (AAVE) Setting Up for a Potential Breakout Next Week? Key Emerging Pattern in Focus

Altcoin XRP Setting Up for the C Wave Push, Ripple’s Native Asset Prepares for Bullish Ascent

Sequoia to join GIC, Coatue in Anthropic investment, FT reports