Crypto YouTuber and daily markets commentator Zach Humphries says a little‑noticed section of a draft U.S. bill could, if passed as written, push XRP into the same regulatory bucket as Bitcoin and Ethereum — and effectively remove it from the SEC’s crosshairs going forward.

In a new video, Humphries walks through language shared by Fox Business alum Eleanor Terrett, highlighting a provision in the so‑called “Clarity Act” discussion draft that ties token status to ETF listings as of January 1, 2026.

Draft Bill Language: ETF Status As a Legal Shield

According to the section Humphries reads out, a “network token” would not be considered a security if, on January 1, 2026, units of that token are the “principal asset” of an exchange‑traded product listed on a national securities exchange and properly registered.

Sponsored

“Anything that has an ETF product out there today” would fall into this non‑security classification, he says, assuming the draft survives largely intact. He names Bitcoin, Ethereum, XRP, Solana, HBAR, Dogecoin, Litecoin, Chainlink and others as likely candidates.

Humphries stresses this would directly undercut the core premise of the SEC’s historic lawsuit against Ripple — that XRP is an unregistered security — at least on a go‑forward basis, and not just for Ripple itself but for “every exchange and fund manager interacting with XRP.”

He notes the bill remains a discussion draft and may change, but sees the current language as “huge for XRP” if it passes.

XRP’s Price Action, Flows & “Smart Money” Mood

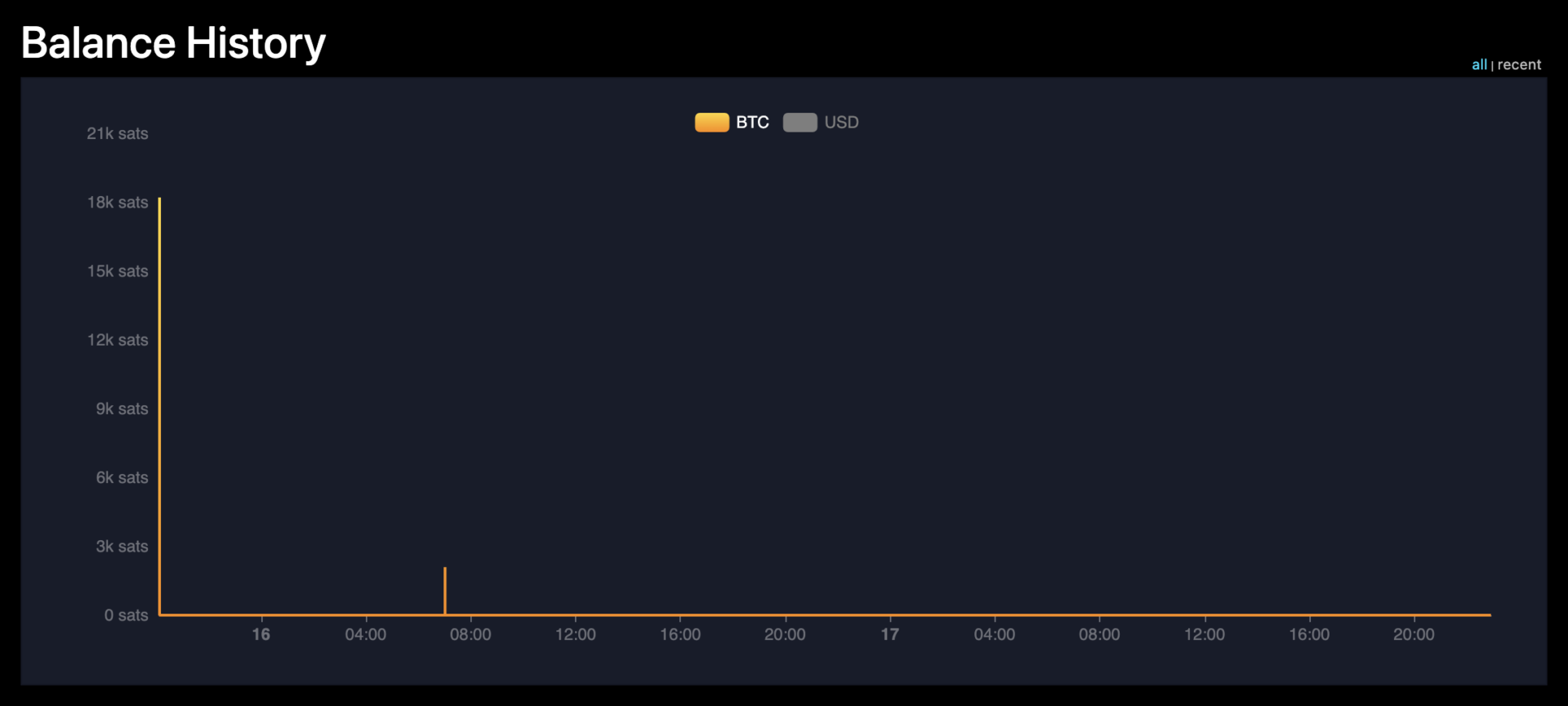

While parsing the policy angle, Humphries spends equal time on the chart. Since the turn of 2026, XRP has run from roughly $1.80 at the end of 2025 to a wick high around $2.41 before cooling to about $2.15 at recording time.

On the daily chart, he points to a clean 25% move in the first days of the year.

For a token he puts at roughly a $130 billion market cap, that kind of move “takes a lot,” and he interprets it as “smart money buying the dip heavily under two dollars.”

He adds that U.S.-listed XRP products from Bitwise, Franklin and Grayscale have seen net inflows as of January 12, with combined assets “nearing $1.5 billion,” even as he says Bitcoin and Ethereum products have faced outflows. That rotation, if sustained, would be notable.

Alongside XRP, Humphries flags broader market strength: Bitcoin near $95,000, Ethereum around $3,300, plus sharp gains in privacy coins like Dash, Monero and Zcash, and renewed activity in meme names such as Pepe, Bonk, Pudgy and SPX.

Why This Matters

If the draft Clarity Act provision survives and is enacted, top tokens with U.S. ETFs as of January 1, 2026 could gain a very powerful legal argument against future SEC securities claims. For XRP, still shadowed by its enforcement history, that would be a structural shift rather than just another rally narrative.

Until then, the trade is mostly about positioning: whether the recent 25% move and ETF inflows are a front‑run of regulatory clarity, or just another crowded bet in an over‑heated alt cycle.

People Also Ask:

No. Humphries repeatedly frames it as a discussion draft that may or may not pass, and possibly with altered language.

No. The video focuses on a potential future statute and the implications of the draft language, not a final legal status.

He specifically mentions Bitcoin, Ethereum, XRP, Solana, HBAR, Dogecoin, Litecoin, Chainlink & other assets with ETF products.