EUR/CHF trims gains as ECB officials signal caution, focus shifts to Eurozone data

The Euro (EUR) trims part of its gains against the Swiss Franc (CHF) on Wednesday as traders digest remarks from key European Central Bank (ECB) officials amid a thin economic calendar on both sides. At the time of writing, EUR/CHF trades around 0.9330, pulling back from an intraday peak near 0.9350, its highest level since December 17.

ECB Vice-President Luis de Guindos, speaking at Spain Investors Day in Madrid, flagged elevated geopolitical tensions as a key downside risk to the growth outlook, noting that the high level of uncertainty may not be fully reflected in market pricing.

Guindos said inflation is currently around the ECB’s target and domestic demand has supported activity, but warned that global trade disruptions and broader financial stability risks continue to cloud the outlook.

Mārtiņš Kazāks, Governor of the Bank of Latvia and a member of the ECB’s Governing Council, said risks to the outlook remain on both sides and warned that uncertainty is still high, including the risk of non-linear shocks. He added that the ECB is delivering on its inflation mandate and that the central bank remains in a good place.

Overall, ECB officials continue to signal a steady and cautious policy approach, with little indication that the central bank is in a rush to raise interest rates.

ECB Governing Council member and Banque de France Governor François Villeroy de Galhau warned that France could enter a “danger zone” in the eyes of international investors if its budget deficit were to exceed 5% of GDP next year.

Figures released on Tuesday showed that France’s central government budget deficit narrowed to about EUR 155.4 billion in the first 11 months of 2025, from EUR 172.5 billion a year earlier.

Attention now turns to inflation data from France and Spain, alongside Eurozone Industrial Production and Trade Balance figures due on Thursday.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Trump Postpones Effort to Garnish Student Borrowers’ Wages as Part of Affordability Initiative

Stakely Taps FastLane to Advance Liquid Staking with $shMON on Monad

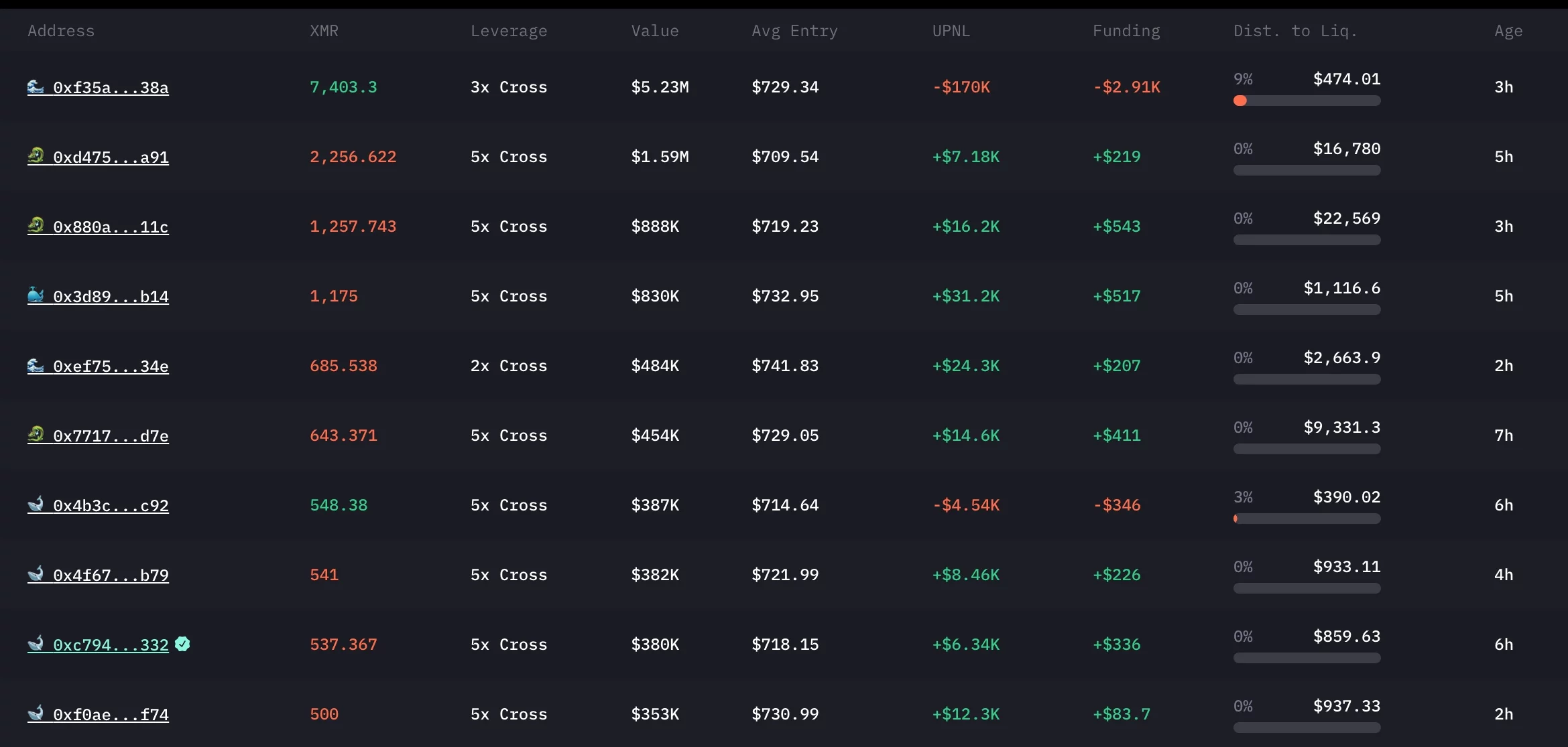

XMR price pumps as a rare pattern points to Monero hitting $1,000